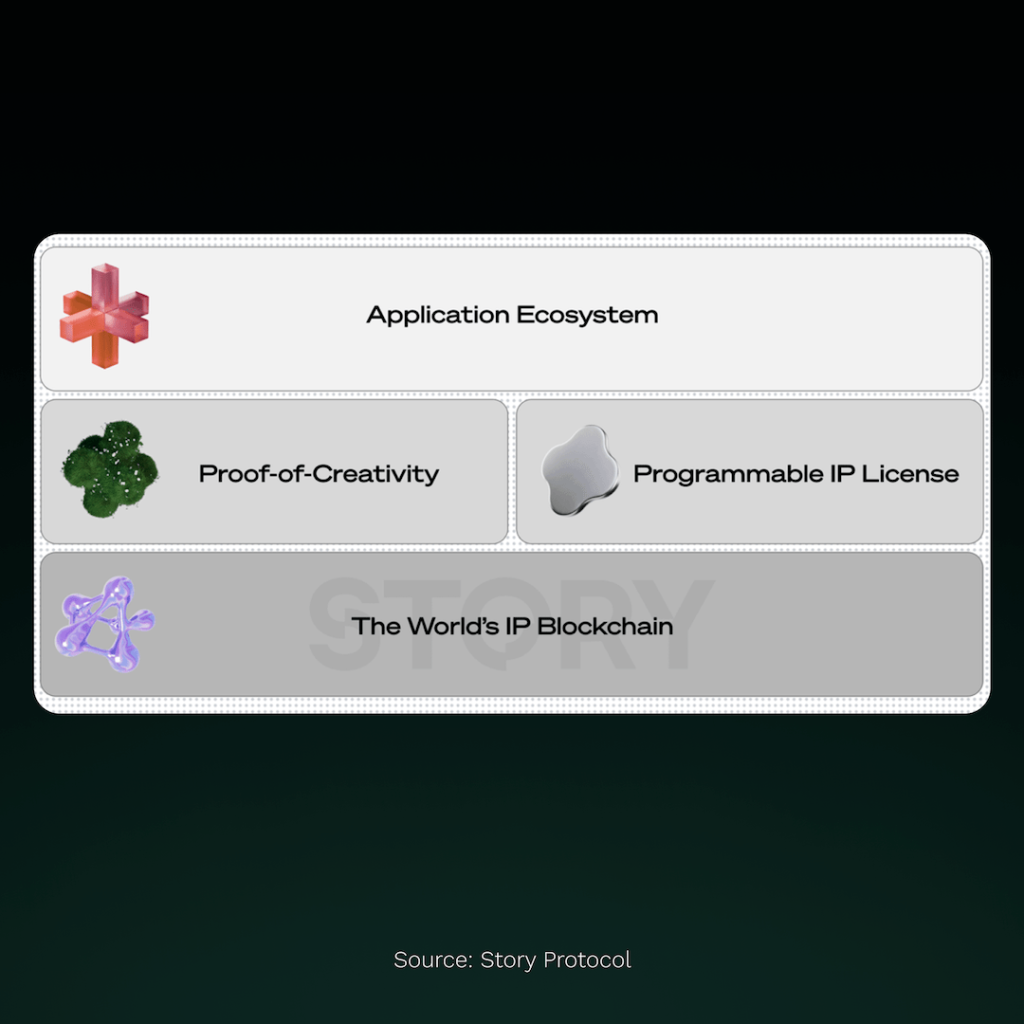

Let’s look at some examples from the IP space.

Table of Contents

- The Trillion Dollar Opportunity

- Understanding the Benefits

- Tangible vs Intangible Assets

- Current State of Tokenization

- Infrastructure

- Government Securities

- Private Credit

- Stablecoins

- Commodities

- Real Estate

- Intellectual Property

- Luxury Collectibles

- Carbon Credits

- Honorable Mentions

- The Future of Tokenized Assets

- 2030 Market Size Predictions

- Capitalizing on The Great Tokenization

- Tren Finance & RWA Tokenization

The Great Tokenization: Everything You Need to Know About Real World Asset Tokenization

As blockchain technology matures and expands its reach, we are rapidly witnessing the tokenization of real world assets, or as we like to call it: “The Great Tokenization” – a transformation of hundreds of trillions of dollars worth of asset ownership, trading and value creation.

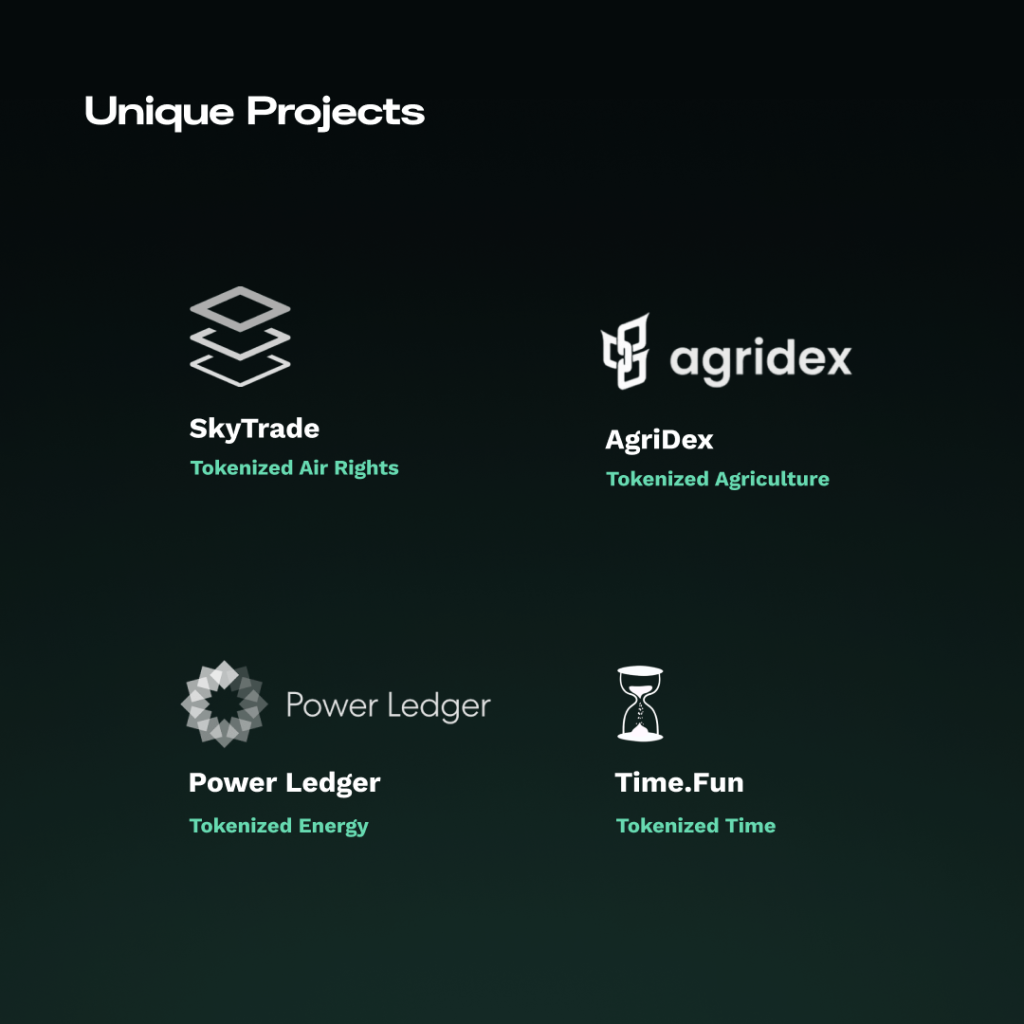

Imagine owning a slice of the air above Manhattan, and trading it like a stock. Picture yourself investing in a Picasso masterpiece for just $50, or buying a government bond with the tap of your smartphone, or purchasing 30 minutes of your favorite crypto personality’s time (which is tradable, and can go up or down in value). These aren’t wild futuristic ideas – they are a few of the interesting things happening right now.

The tokenization of real-world assets is unlocking markets previously inaccessible to most investors. Real estate ownership is being fractionalized, allowing investors to purchase shares in properties all over the globe for less than the cost of a nice dinner. Government securities, traditionally the domain of large institutional investors, are finding their way onto the blockchain, making these investments accessible to a broader audience. Tokenized energy, time, airspace, IP, mortages, car leases, carbon credits. you name it, if it’s an asset, tangible or intangible, someone is working to tokenizing it right now.

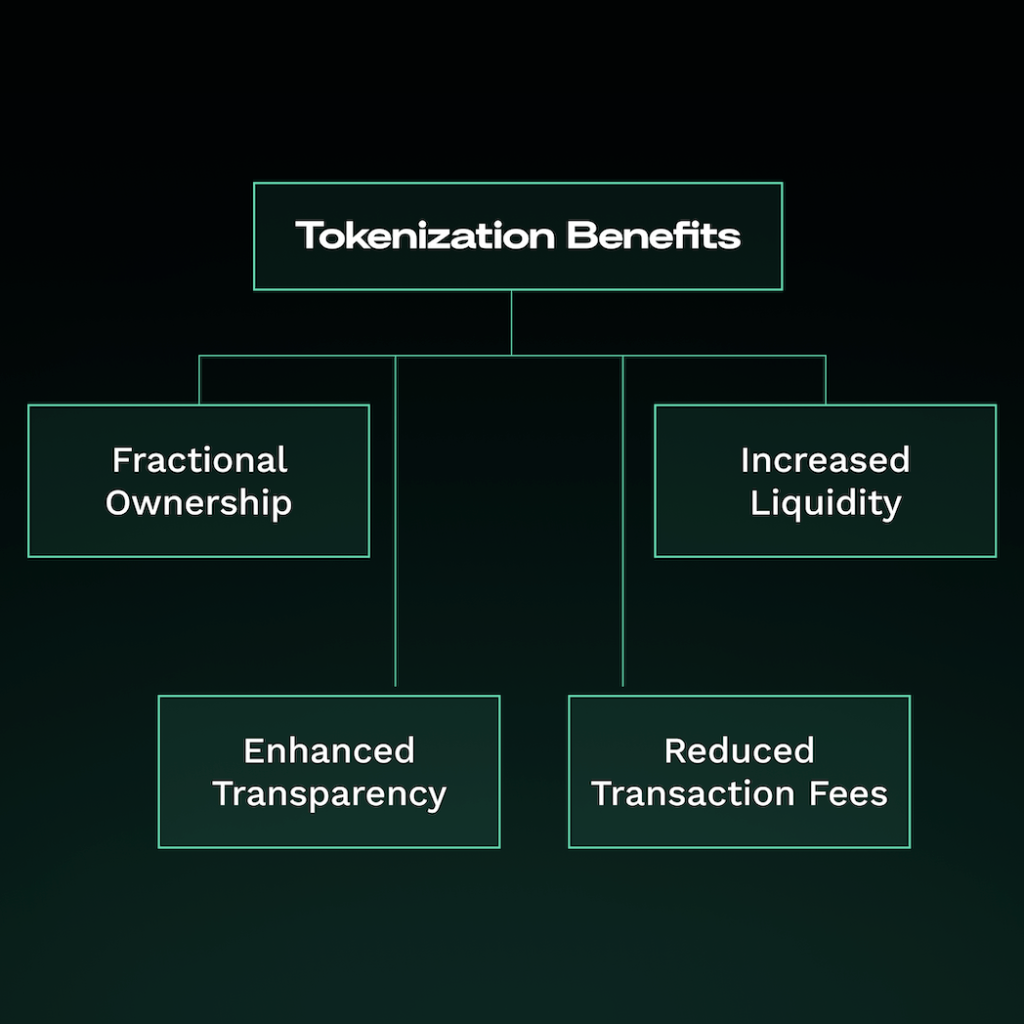

If you’re new to this idea: at its core, tokenization the process of converting rights to an asset – whether physical or digital, tangible or intangible – into a digital token on a blockchain. This seemingly simple concept is unleashing a world of possibilities, because of its four key benefits:

- Increased liquidity

- Fractional ownership

- Enhanced transparency

- Reduced transaction fees

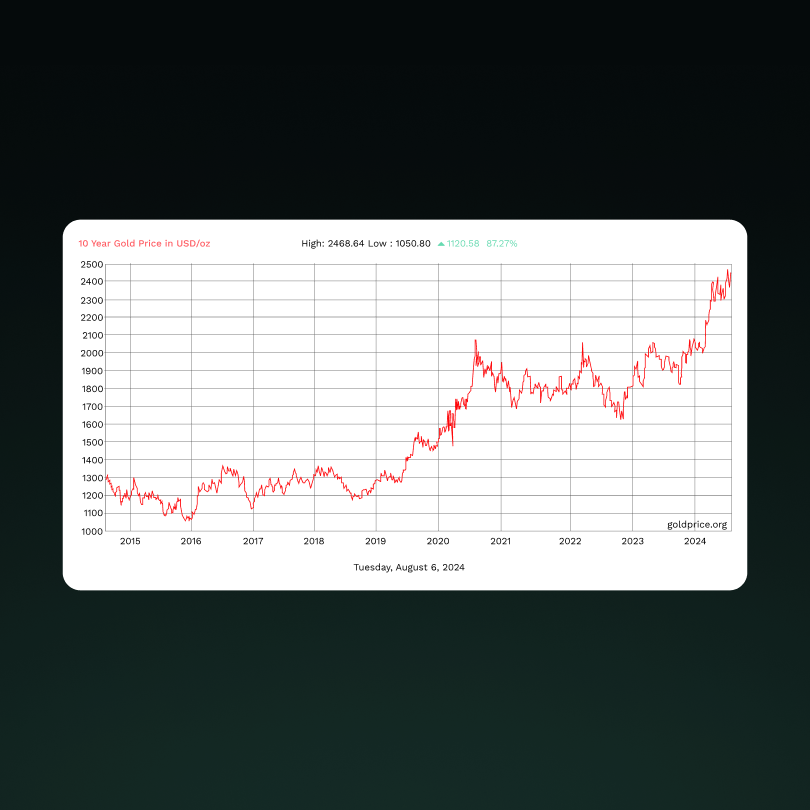

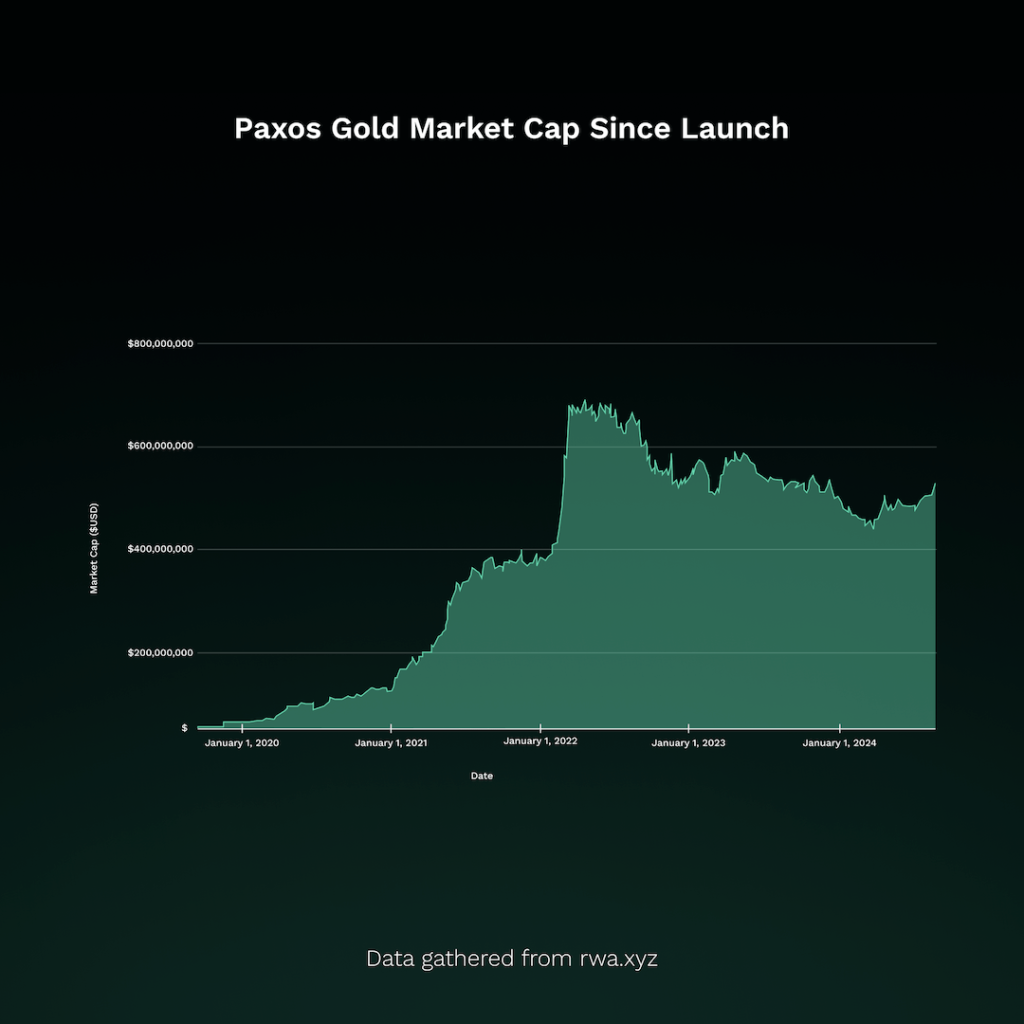

The implications are vast and varied. In the world of scientific research, intellectual property rights are being tokenized, revolutionizing how biomedical studies are funded. The fine spirits market is experiencing a renaissance of authenticity and accessibility. Even precious metals like gold are being digitized, allowing investors to own and trade fractions of gold bars without ever touching the physical asset.

From real estate to rare whisky, from carbon credits to future earnings, the potential for tokenization appears boundless. It’s not only changing the way we invest but also reshaping our very concept of ownership and value.

In this report, we’ll dive into the world of tokenization and its far-reaching implications. We’ll explore unique projects, examine the technologies driving this revolution, and peek into the future of asset ownership and trading. Let’s explore how The Great Tokenization is redefining the global financial landscape in ways we’ve never seen before.

Part 1

The Great Tokenization: Trillion Dollar Opportunity

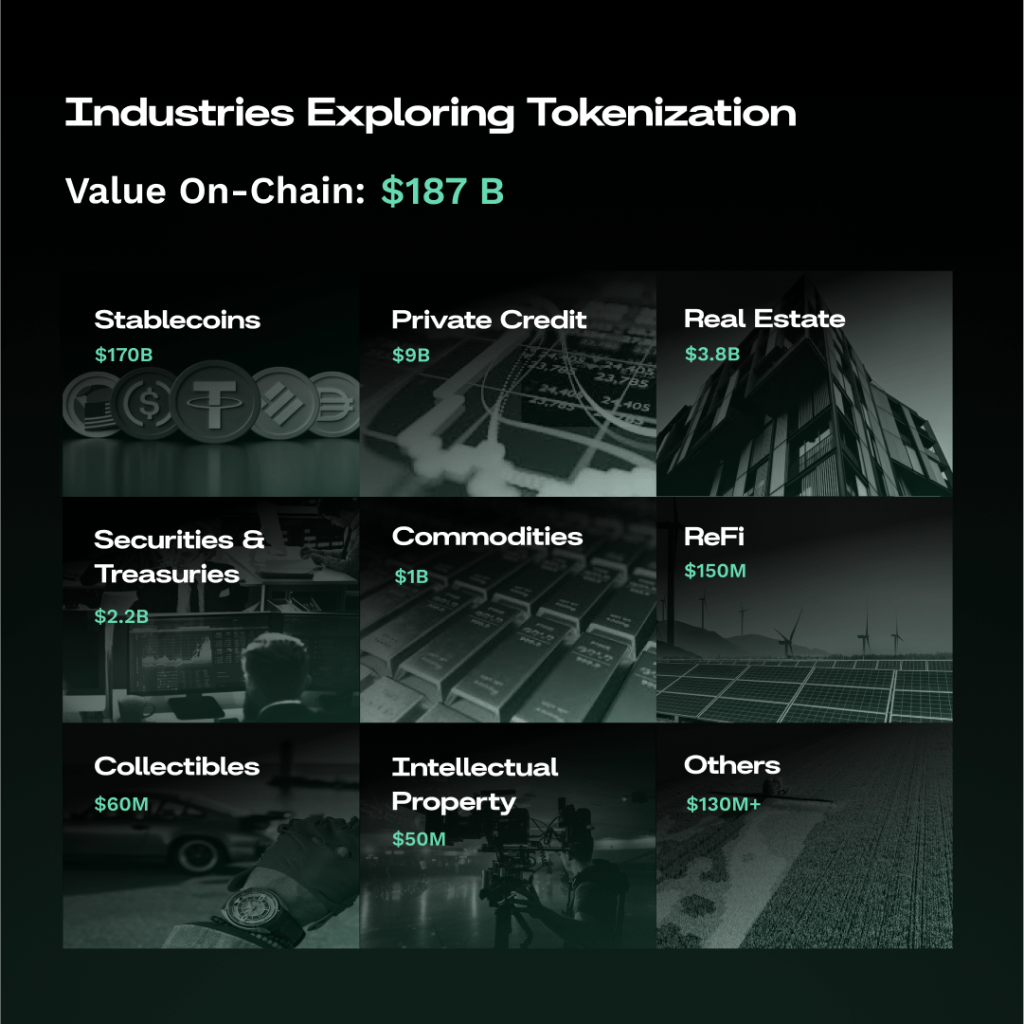

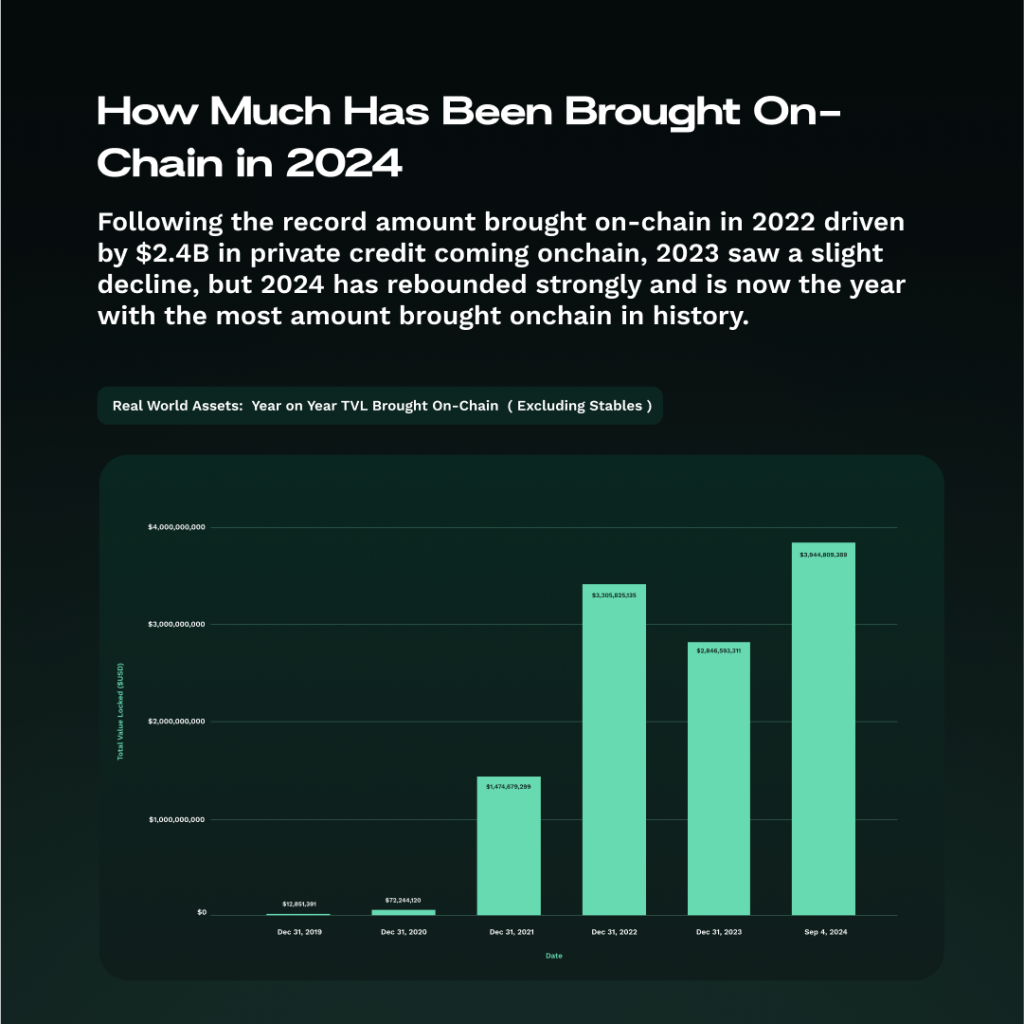

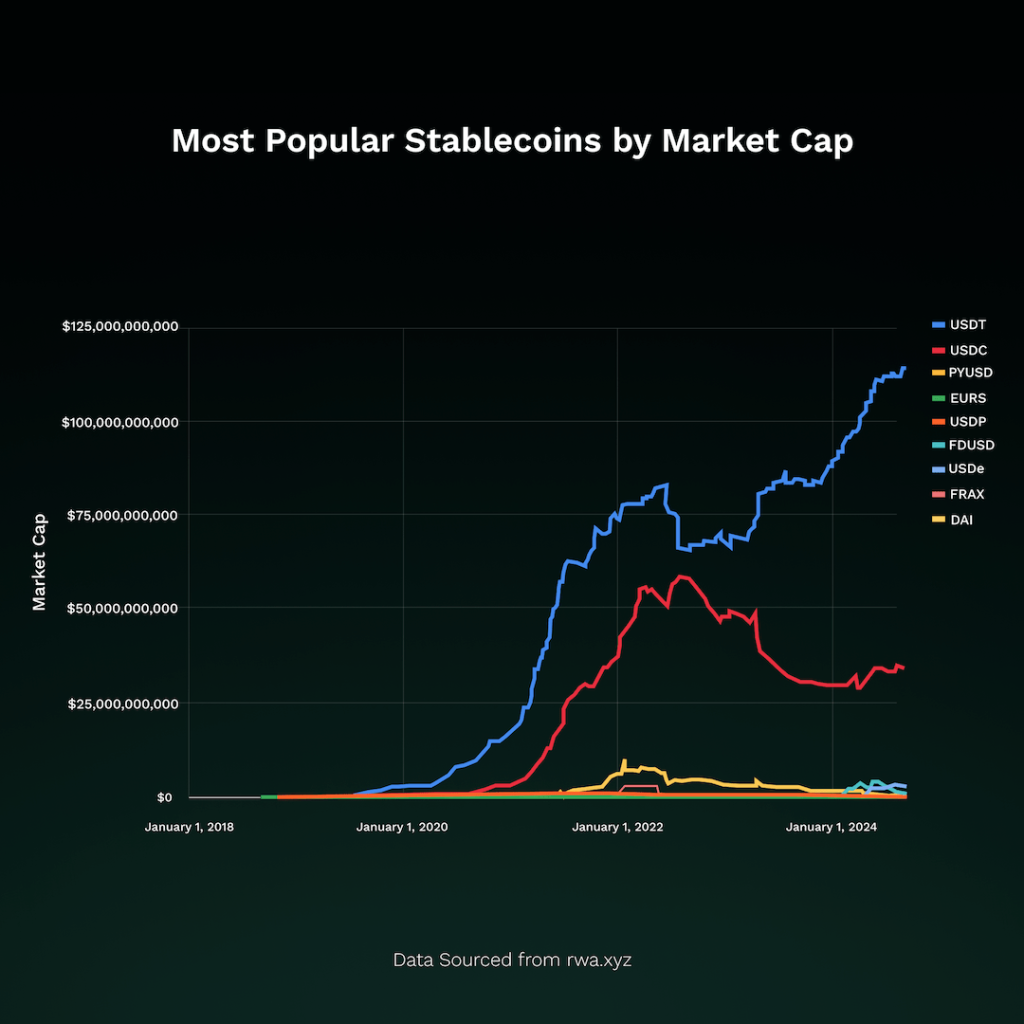

Hundreds of trillions of dollars worth of assets could potentially be tokenized. At the time of writing, roughly $185bn (including stablecoins) has been tokenized according to RWA.xyz — naturally people are wondering: what’s this all about, and how can one capitalize on the great tokenization?

Why Blockchain? The Foundation of Tokenization

Crypto sometimes has a reputation of being a solution looking for a problem. When it comes to the tokenization of assets, the benefits are clear. It’s a better solution than the existing one. Why is blockchain so crucial to this transformation? Traditional asset management has long been plagued by significant problems that frustrate investors, issuers, and regulators alike. Lack of transparency in private markets leads to mispricing and increased risk. Illiquidity in high-value assets like real estate or fine art ties up capital for extended periods. High barriers to entry exclude small investors from diversification opportunities. Inefficient processes involving multiple intermediaries result in slow, costly, and error-prone transactions. Limited trading hours prevent quick reactions to global events, while opaque markets leave room for fraud and manipulation.

Blockchains offer solutions to these long-standing issues. It brings a level of transparency and security previously unattainable, recording all transactions on a public ledger that’s immutable and accessible to all participants. This openness builds trust but also significantly reduces the potential for fraud, addressing the opacity that has long characterized many asset markets.

Perhaps the most revolutionary aspect of blockchain-based assets is their enhanced tradability. The technology enables round-the-clock trading, breaking free from the constraints of time zones and reducing reliance on intermediaries. This continuous market activity breathes new life into traditionally illiquid assets. Imagine being able to trade a fraction of a real estate property as easily as you would a stock – that’s the power of tokenization.

But the benefits don’t stop at transparency and tradability. Blockchain’s programmability, through smart contracts, opens up a world of possibilities for asset management and governance. Dividend distributions, voting rights, and other complex processes can be automated, increasing efficiency and creating new avenues for investor participation. This addresses the cumbersome nature of managing corporate actions in traditional systems.

These features combine to democratize investment opportunities in unprecedented ways. High-value assets that were once the exclusive domain of wealthy investors can now be divided into smaller, more accessible units. This fractional ownership model is expanding access to a diverse range of assets, from fine art to commercial real estate, allowing a broader spectrum of investors to build diversified portfolios and breaking down the high barriers to entry that have long excluded small investors.

Understanding The Benefits

Tokenization works by creating a digital representation of an asset on a blockchain. This could be anything from a piece of real estate to a work of art, or even intangible assets like intellectual property rights. Each token represents a share of ownership of the underlying asset, allowing for more granular and flexible ownership structures.

Tokenization Benefits - The Four Pillars

- Fractional Ownership: By dividing assets into smaller, more affordable units, tokenization democratizes access to investments that were previously out of reach for many. For example, instead of needing millions to invest in prime real estate, investors can purchase tokens representing a small fraction of the property.

- Enhanced Transparency: Blockchain technology provides an immutable record of all transactions. This increased transparency can reduce fraud, enhance trust, and simplify auditing processes.

- Reduced Transaction Fees: By streamlining processes and removing intermediaries, tokenization can significantly reduce the costs associated with asset transfers and management.

- Increased Liquidity: Tokenization can turn traditionally illiquid assets into easily tradeable digital tokens, potentially creating new, more liquid markets for a wide range of assets.

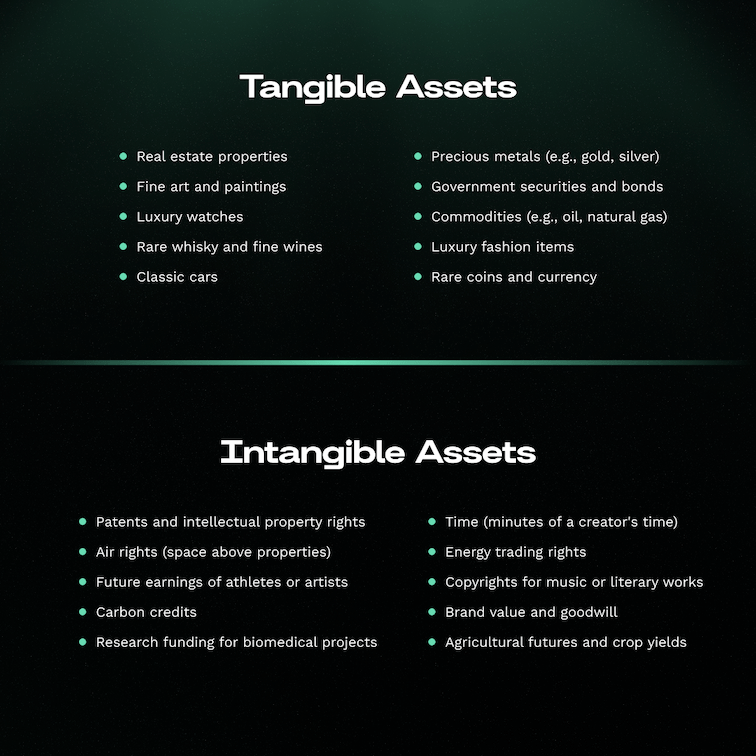

Tangible vs Intangible Assets

One of the really interesting aspects is the tokenization of intangible assets. These are assets that historically have not been easy to turn into liquid, tradable items. Through tokenization however, things such as a claim on a person’s time or intellectual property become liquid assets that owners can easily buy and sell.

Tangible Assets: Physical assets with a real, measurable value.

Intangible Assets: Non-physical assets that still hold value.

While tokenization of tangible assets like real estate and fine art is groundbreaking in its own right, what truly excites us, as mentioned above, is the potential for bringing intangible assets on-chain. These are assets we never before considered as having proper value exchange mechanisms. Intellectual property rights, future earnings, carbon credits, and even personal time are now being tokenized, creating entirely new markets and ways of perceiving value.

Imagine trading the future earnings of an up-and-coming artist, investing in the patent for a groundbreaking medical discovery, or buying a share in the carbon offset potential of a rainforest. These intangible assets, once difficult to quantify and trade, are now becoming accessible and liquid through tokenization.

As we move further into the era of The Great Tokenization, we can expect to see an increasing number of both tangible and intangible assets being tokenized. This shift promises to create more efficient and liquid markets across a wide range of industries, blurring the lines between physical and digital asset ownership.

Part 2

The Current State of Tokenization

The reason we wanted to write this report in the first place was that, through our own research, we came to the conclusion that there is a lot more activity in the RWA tokenization space than we think most people realize. It’s exciting, and we wanted to bring more attention to the movement overall, as well as individual projects.

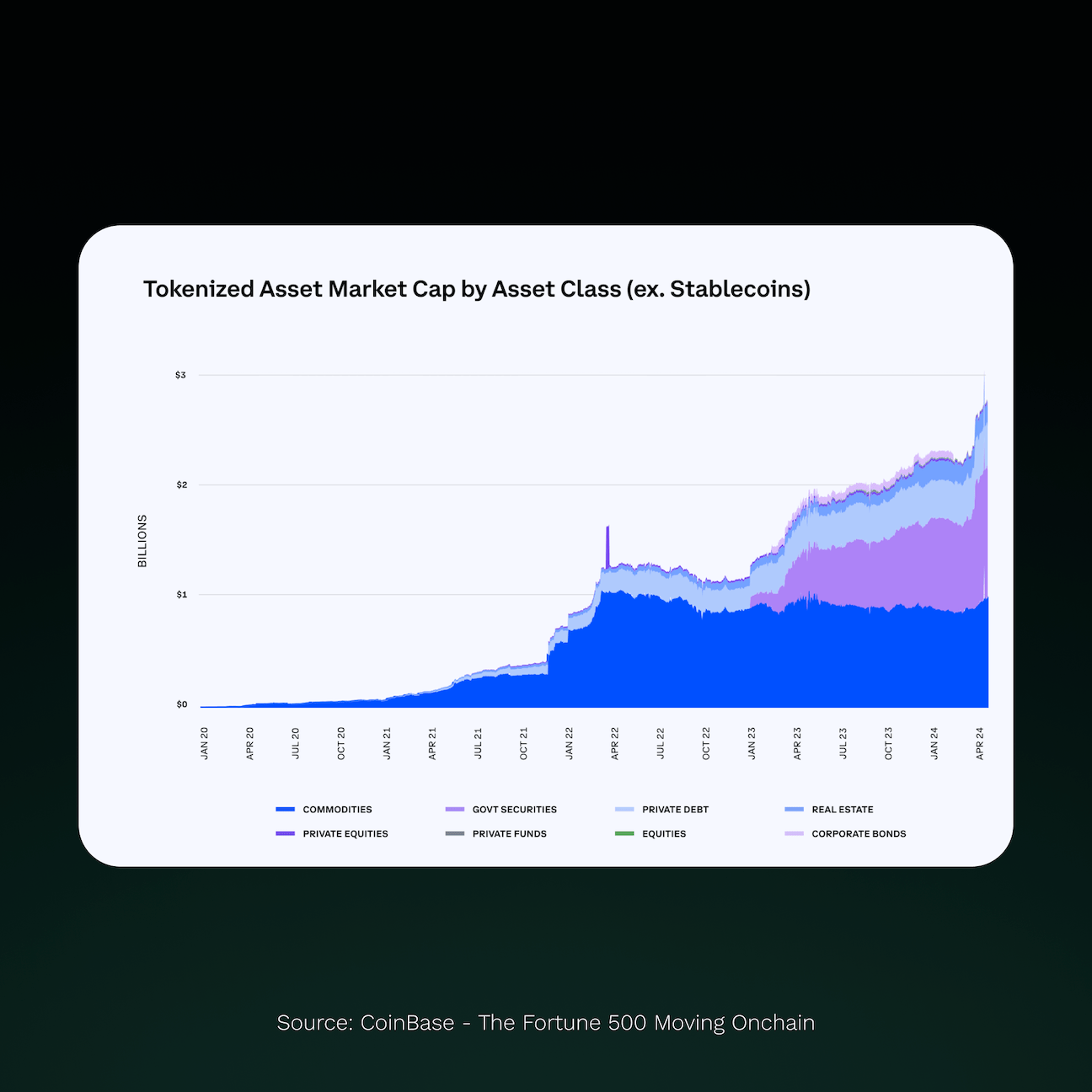

Recent projections paint a picture of explosive growth in the tokenization market. Estimates suggest that by 2030, tokenized assets could reach a market size of anywhere from $2 trillion to $10.9 trillion, depending on whose predictions you believe to be more accurate. Real estate, debt instruments, and investment funds are expected to lead this charge, emerging as the top three tokenized asset classes.

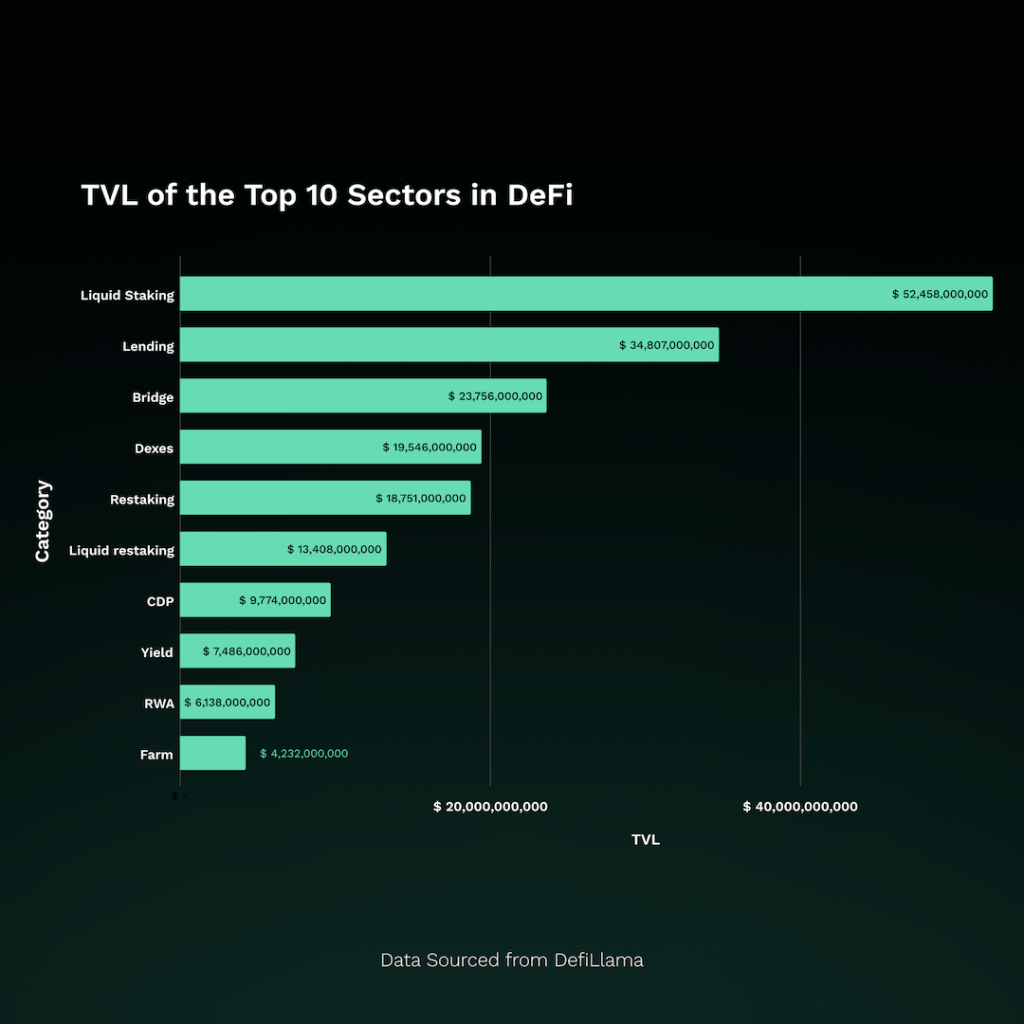

The impact of tokenization is already being felt in the DeFi sector. As of 2024, Real World Assets have carved out a significant niche, representing the 9th largest sector in DeFi with a Total Value Locked of $6.13 billion. This figure is a testament to the growing confidence in tokenized assets and their ability to bridge the gap between traditional finance and DeFi.

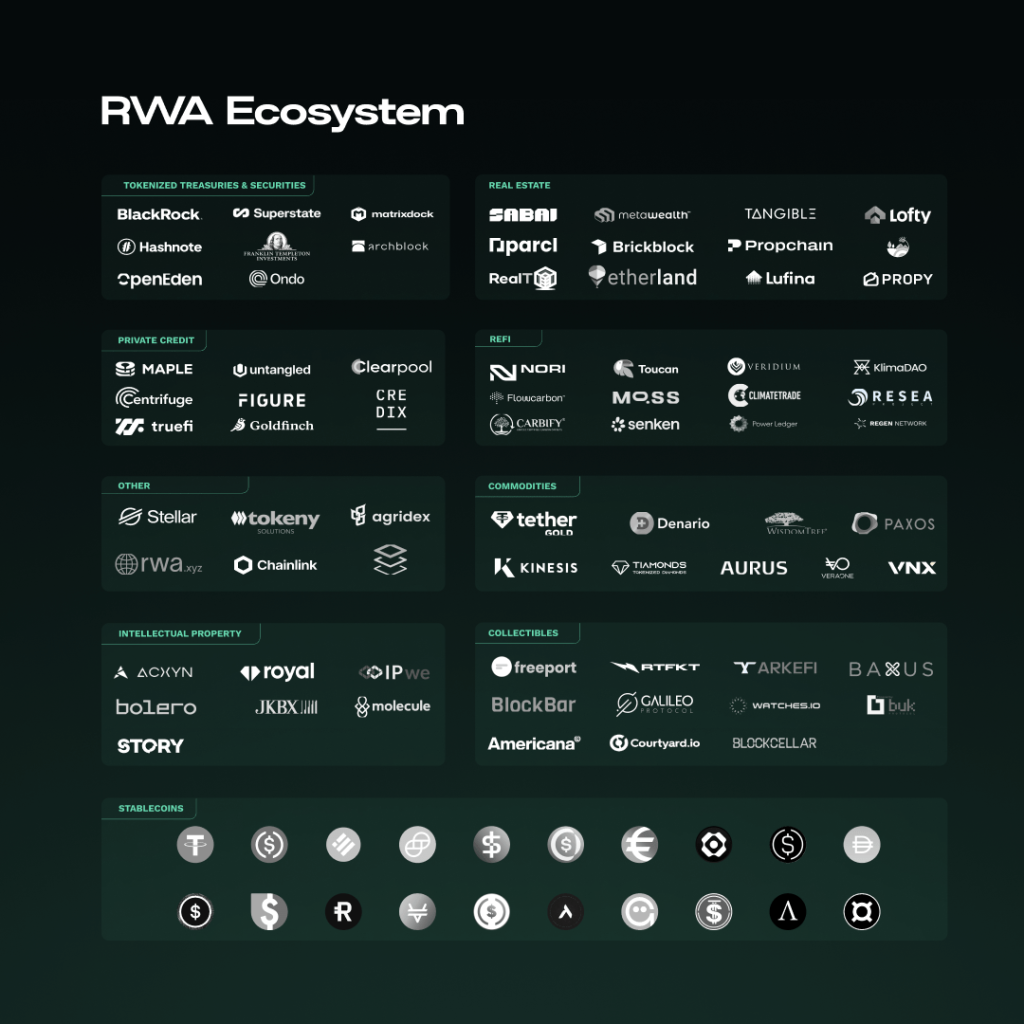

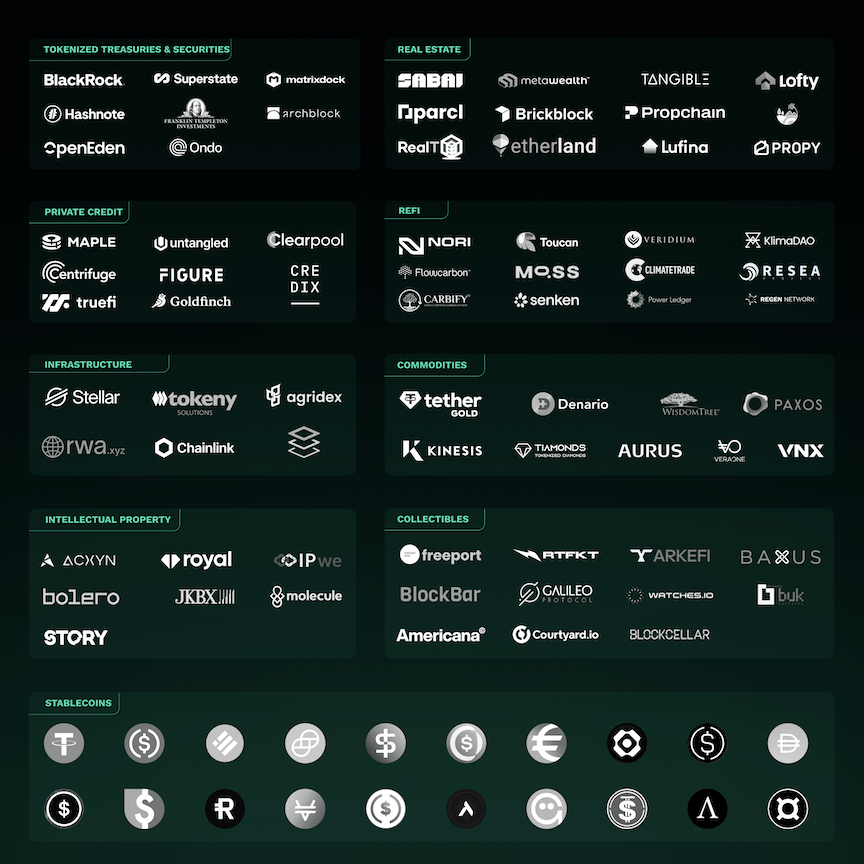

Ecosystem Overview

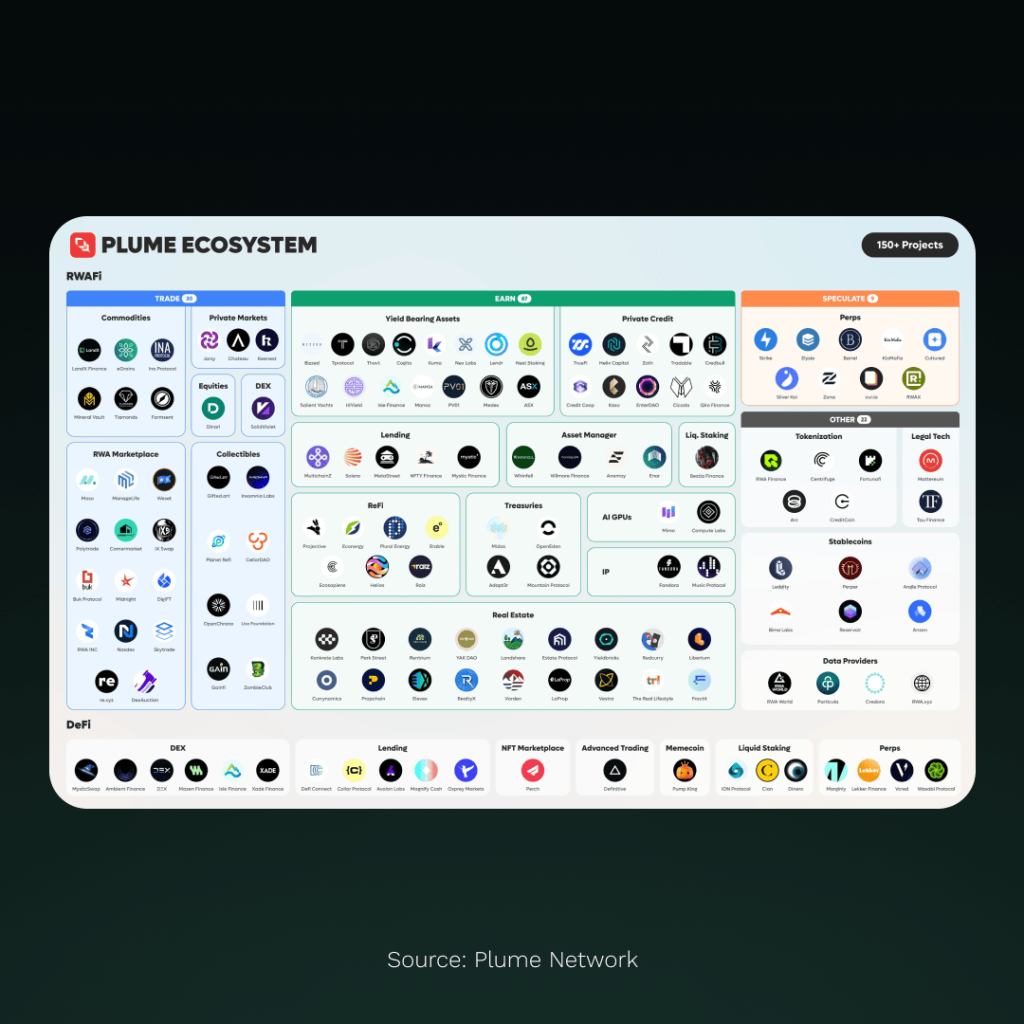

The RWA ecosystem is rapidly evolving, featuring a diverse range of projects that are bringing traditional assets onto the blockchain. This sector spans from conventional financial instruments such as tokenized treasuries and securities to more unconventional developments like tokenized intellectual property. Projects in this ecosystem are working to tokenize everything from private credit and real estate to commodities and high-value collectibles, highlighting the versatility of blockchain technology in reimagining how assets are owned and traded.

What makes this ecosystem particularly exciting is its potential to transform traditional markets by increasing accessibility, liquidity, and efficiency. Whether it’s enabling fractional ownership of premium real estate, democratizing access to fine art investments, or creating new ways to trade commodities, these projects are pushing the boundaries of what’s possible in finance and asset management. As the space continues to mature, we’re seeing an increasing convergence between traditional finance and blockchain technology, with stablecoins backed by real-world assets serving as a bridge between these two worlds. This dynamic and rapidly growing ecosystem reflects the broad potential of blockchain to revolutionize how we perceive, value, and trade assets in the global economy.

Now, let’s take a deep dive at some key sectors embracing tokenization.

Infrastructure

The blockchain ecosystem has witnessed significant advancements in recent years, particularly in scalability, security, and interoperability. These improvements have substantially reduced the barriers to adoption for both permissioned and permissionless ledgers. Enhancements in SDKs and tokenization standards have streamlined implementation processes, making it easier for various stakeholders to engage with blockchain technology.

This evolution in infrastructure has led to a surge in real-world assets being brought on-chain. Major financial market infrastructures like DTCC, Clearstream, and Euroclear are launching tokenization pilot projects, indicating a growing acceptance of blockchain technology in traditional finance. These developments have created a solid foundation for the tokenization of a wide range of assets, from real estate to financial instruments.

Current State: Infrastructure Outpacing Adoption

Despite the rapid development of infrastructure, we are currently at an interesting juncture where the technology seems to be ahead of widespread adoption. While the capability to tokenize and fractionalize various asset classes exists, many verticals are struggling to create liquid markets around these tokenized assets. This situation suggests that the opportunity for innovators now lies in building out applications to onboard buyers and create demand for tokenized assets, much like the situation in crypto in general.

Data Accessibility

One of the significant challenges in RWA tokenization is the migration of data from centralized infrastructures to blockchain-based systems. Projects like RWA.xyz are working to make this data readily available and easily accessible. This transition is crucial but complex, sort of like “changing the engine of a car while driving at full speed.” It requires careful management to ensure the security and continuity of daily operations while implementing the new infrastructure. In this context, oracle networks play a vital role in bridging the gap between off-chain data and on-chain smart contracts. Projects like Chainlink have become instrumental in providing reliable, tamper-proof data feeds that are essential for accurately representing and valuing real-world assets on blockchain networks.

The integration of oracle services enhances the reliability and functionality of tokenized assets by providing real-time, accurate data from the traditional financial world to blockchain networks. This includes price feeds, market data, and other crucial information that enables smart contracts to execute based on real-world events and conditions. As the RWA tokenization ecosystem matures, the role of oracles in maintaining the integrity and functionality of these digital representations of physical assets becomes increasingly critical. Their ability to provide secure, decentralized data bridges is fundamental to creating a trustworthy tokenized asset marketplace.

Regulation

Regulation plays a pivotal role in the adoption and growth of RWA tokenization. As the industry evolves, there is an increasing need for clear regulatory frameworks that can accommodate the unique aspects of blockchain-based assets. Major financial institutions are driving conversations with regulatory authorities, as evidenced by industry papers like “Advancing the digital asset era, together” (September 2023). These discussions are crucial for establishing a balanced regulatory environment that encourages innovation while ensuring investor protection.

Looking ahead, several key trends and developments are likely to shape the future of RWA tokenization infrastructure:

- Shift to Specialized Infrastructure: As tokenization becomes more prevalent, we anticipate a move from general-purpose to use case-specific tokenization infrastructure. This shift will enable more robust and tailored solutions for specific applications and asset classes.

- Improved Buyer Onboarding: There is a growing need for infrastructure improvements to facilitate the onboarding of buyers, particularly in emerging asset markets. This will be crucial for creating liquid markets for tokenized assets.

- Enhanced Cross-Chain Capabilities: As the ecosystem expands, improvements in cross-chain interoperability will become essential to provide token holders with a frictionless experience when navigating across different blockchain networks.

- Modular Architecture: The industry is moving towards a more modular architecture, aiming to enhance interoperability, spur innovation, enable customization, and create a seamless ecosystem.

- Flexibility and Agility: As the technology landscape evolves, founders and developers in this space need to maintain flexibility. Different components of the existing stack may emerge as more preferred or effective, necessitating adaptability in approaches.

While significant progress has been made in developing the infrastructure for RWA tokenization, there is still a long way to go before the full scope of The Great Tokenization can be realized. The focus is now shifting towards creating more specialized applications, improving market liquidity, and addressing regulatory challenges. As these areas develop, we can expect to see a more mature and widely adopted RWA tokenization ecosystem emerge.

Infrastructure Examples

Let’s look at some of the infrastructure projects that are specifically focused on the RWA space.

Chainlink

Chainlink is a decentralized oracle network that plays a crucial role in connecting blockchain-based smart contracts with real-world data and off-chain systems. Founded in 2017, Chainlink has positioned itself as a critical infrastructure provider for the emerging tokenized economy, facilitating the secure and reliable transfer of information between on-chain and off-chain environments.

At its core, Chainlink offers a suite of services designed to support the tokenization of real-world assets (RWAs) and enable their integration into blockchain ecosystems. These services include:

- Proof of Reserve: This feature provides autonomous, reliable, and timely verifications of cross-chain or off-chain reserves backing tokenized assets. It enhances transparency and allows for the implementation of circuit breakers to protect users if discrepancies arise between off-chain assets and their tokenized counterparts.

- Data Feeds and Data Streams: Chainlink offers secure and decentralized sources of financial market data covering commodities, equities, forex, indices, and cryptocurrencies. This real-time information is crucial for accurately pricing and managing tokenized assets.

- Cross-Chain Interoperability Protocol (CCIP): This protocol enables the secure transfer of data and assets across different blockchain networks, addressing the fragmentation issues in the blockchain space and facilitating seamless interactions between various tokenized assets.

- Functions: This service allows any off-chain event or data to be synchronized or published on-chain, including corporate actions, proxy voting, ESG data, dividends, and net asset values (NAV). This capability is essential for maintaining up-to-date information on tokenized assets.

Chainlink’s current efforts in aiding tokenization are evident through its collaborations with major financial institutions and market infrastructure providers. For instance, Chainlink has worked with SWIFT, the global messaging system for financial institutions, to demonstrate interoperability between blockchain networks and traditional banking systems. The company has also partnered with the Depository Trust & Clearing Corporation (DTCC) to explore bringing capital markets on-chain.

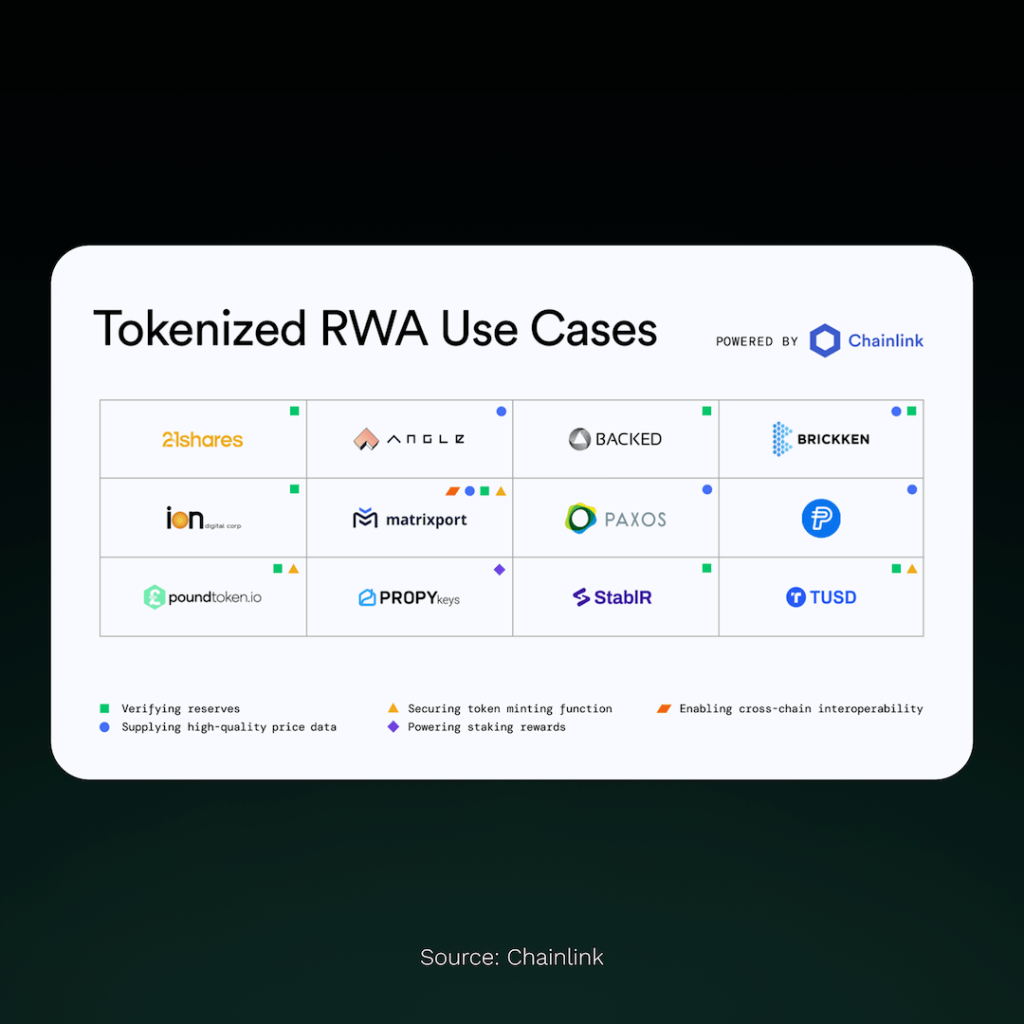

Chainlink’s role in real-world asset tokenization is demonstrated through its partnerships across blockchain projects. The image above illustrates how protocols utilize Chainlink’s services for RWA-related functions. These functions include reserve verification, price data provision, token minting security, cross-chain interoperability, and staking reward calculation. This range of applications indicates Chainlink’s position in supporting RWA tokenization infrastructure across multiple blockchain use cases.

Chainlink’s importance in the future of bringing assets on-chain stems from several factors:

- Trust and Reliability: With over $14 trillion in total transaction value enabled since 2022, Chainlink has demonstrated its capacity to handle large-scale financial operations securely.

- Interoperability: As the tokenized asset ecosystem grows across multiple blockchains, Chainlink’s CCIP will be crucial in enabling seamless cross-chain interactions and liquidity.

- Data Integrity: The ability to provide accurate, real-time data from off-chain sources is vital for maintaining the value and functionality of tokenized assets.

- Compliance and Identity: As regulatory scrutiny increases, Chainlink’s development of privacy-preserving identity solutions like DECO will be essential for ensuring compliant transactions in the tokenized asset space.

- Scalability: Chainlink’s infrastructure is designed to scale, making it capable of supporting a growing ecosystem of tokenized assets across various sectors.

Chainlink’s suite of services, established partnerships, and proven track record position it as a key enabler in the ongoing transition towards a tokenized economy. As the bridge between traditional finance and blockchain technology, Chainlink is set to play a crucial role in unlocking the full potential of real-world asset tokenization.

Stellar Foundation

Stellar, launched in 2014, is a blockchain network designed for efficient cross-border transactions and asset tokenization. The platform has grown to over 8 million accounts and developed a infrastructure for handling real-world assets. Stellar’s focus on transaction efficiency is reflected in its average transaction cost of $0.000065, which facilitated 460 million transactions in the first quarter of 2024.

Stellar’s capacity for tokenizing and managing RWAs has led to partnerships with established financial institutions. MoneyGram and Circle utilize Stellar for cross-border payments, while Franklin Templeton has implemented its BENJI token and money market fund on the platform. Additionally, WisdomTree has issued 13 regulated funds, a digital gold token, and a digital dollar on Stellar, all under US regulations, with a growing supply of around $23 million USD. The Stellar ecosystem’s RWA metrics indicate growth, with a total asset supply of over $533 million and an RWA payments volume of $1.6 billion, illustrating its role in integrating traditional finance with blockchain technology.

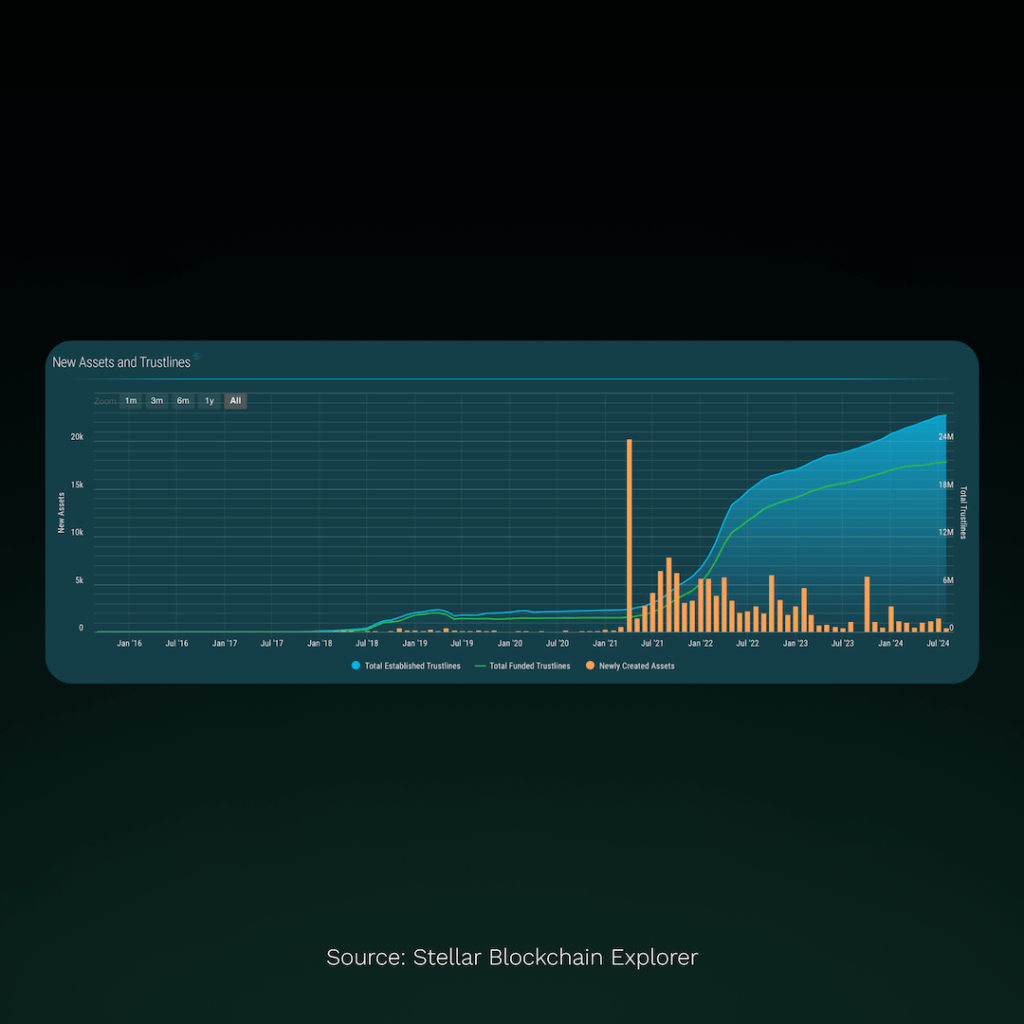

A key feature of Stellar’s architecture is the concept of trustlines. A trustline is essentially a connection between two accounts that allows them to hold and transact in a specific asset. Before an account can receive any asset other than the native XLM, it must establish a trustline with the issuing account. This mechanism enables Stellar to support a wide variety of assets while maintaining user control over which assets they interact with. The chart above provides insight into the growth of Stellar’s ecosystem. It shows a significant increase in total established trustlines and funded trustlines starting from mid-2020, with the number of trustlines reaching over 20 million by 2024. This trend indicates growing adoption and utilization of various assets on the Stellar network. The sporadic spikes in newly created assets suggest periodic waves of new token issuances or projects joining the Stellar ecosystem.

Projects are attracted to Stellar for its asset tokenization infrastructure and its potential to adapt traditional financial products. The Franklin OnChain U.S. Government Money Fund on Stellar demonstrates the platform’s applicability in making financial markets more accessible. This aligns with Stellar’s stated mission of creating a more inclusive financial system, as noted by Denelle Dixon, CEO and Executive Director of the Stellar Development Foundation.

Stellar has supported basic smart contract functionality since its inception, but the introduction of Soroban, its advanced smart contracts platform, in March 2024 represents a significant development. This upgrade expands the potential use cases for the network, allowing for more complex decentralized applications to be built on Stellar. Soroban addresses limitations in Stellar’s previous smart contract capabilities, which were primarily used for basic functions like multi-signature transactions and atomic swaps. The new platform offers improved features including reduced transaction fees, increased scalability, and built-in contracts and host functionality. These enhancements position Stellar to compete more effectively in the smart contract space and potentially develop a more comprehensive DeFi ecosystem.

To support the adoption of Soroban, the Stellar Development Foundation has committed $100 million to projects building on the platform. This investment indicates Stellar’s focus on expanding its smart contract capabilities and serves as an incentive for developers to explore the network’s potential. As Stellar continues to evolve, it may play an increasingly significant role in the development of tokenized assets and decentralized finance applications.

Here’s a nice video from Stellar showing the real life impact of their work.

“We’re proud of all we’ve built with our ecosystem partners regarding payments and RWA capabilities. It’s only by merging those capabilities, real world assets and real world payment channels that we can truly enable financial equality and wealth preservation in much needed regions and demographics across the globe.”

Rob Durscki,

Senior Director of RWA Tokenization at Stellar Foundation

re.al

re.al, an EVM Layer 2 solution, launched its mainnet in May 2024, positioning itself as a dedicated platform for RWAs and DeFi. Built on Arbitrum Orbit technology, re.al aims to provide a permissionless environment for RWA tokenization and trading, addressing key challenges in traditional markets.

The platform’s architecture incorporates several key features designed to enhance its functionality and efficiency. At its core, reETH serves as the native gas token, accruing value through underlying ETH staking. re.al’s modular structure allows for potential future upgrades, ensuring adaptability in the evolving blockchain landscape. The initial configuration utilizes the Arbitrum Data Availability Committee (DAC) for transaction settlement, striking a balance between speed and cost efficiency.

In its first three months post-launch, re.al demonstrated promising traction, reporting a Total Value Locked of $76.75 million by August 2024. This TVL is distributed across several protocols within the re.al ecosystem, including Tangible, veRWA, Pearl, Arcana, and Stack. With 2,170 user accounts and 1.3 million processed transactions, the platform shows notable early adoption, though these figures represent a small fraction of the broader L2 and DeFi markets.

re.al’s focus on RWAs distinguishes it in the L2 landscape, aiming to address challenges such as limited liquidity and high barriers to entry by enabling fractional ownership and increased tradability. However, this specialization presents unique challenges, particularly in navigating the complex regulatory considerations involved in integrating real-world assets with blockchain technology.

The platform’s governance token, RWA, incorporates an innovative approach to L2 tokenomics. Utilizing a vote-escrow model (veRWA) for ecosystem participation and revenue sharing, re.al launched with 100% of the token supply in circulation and no future VC unlocks. The deflationary model, where tokens are burned when veRWA positions are unlocked early, aims to create scarcity over time. RWA accrues 100% of chain profits from transaction fees, with protocols on re.al sharing a portion of their fees with veRWA holders. This approach aligns long-term holder interests with the platform’s development, though its effectiveness in practice remains to be seen over a longer period.

As re.al continues to evolve, critical factors to monitor include its ability to attract and retain liquidity, navigate complex regulatory landscapes, and scale efficiently while maintaining security. The platform’s long-term viability and impact will depend on its ability to effectively bridge traditional finance with blockchain technology, all while competing in an increasingly crowded L2 market. re.al’s unique approach to tokenomics and RWA integration may prove to be key differentiators in its quest for widespread adoption in the emerging tokenized real-world assets market.

“Tokenized Real World Assets currently represent a $6.5 billion market, but we believe their true potential is yet to be realized. Tokenizing RWAs and bringing them onto the blockchain offers numerous advantages: transactions become faster, easier, free from third-party intermediaries, and unrestricted by geographical boundaries.

DeFi innovations have already revolutionized finance, and when combined with RWA tokenization, the possibilities are endless. At re.al, we bridge these two worlds by merging RWA tokenization with a DeFi ecosystem specifically tailored for RWAs. This unique combination enhances composability, boosts capital efficiency, and introduces new financial primitives designed for this emerging category.”

Christian Santagata

Product Marketing Manager at re.al

Plume Network

Plume Network, launched in 2024, represents a novel approach to bringing real-world assets onto the blockchain through a specialized Layer 2 solution. Built on the Arbitrum Nitro stack and leveraging Celestia for data availability, Plume aims to create a more efficient and cost-effective environment for RWA tokenization and trading. The platform’s unique selling proposition lies in its integrated compliance tools and focus on regulatory adherence, addressing key concerns in the RWA space.

At the core of Plume’s offering is its support for multiple token standards, including ERC-3643, which is specifically designed for regulated securities. This standard incorporates built-in compliance features such as transfer restrictions and identity management, making it particularly suitable for tokenized RWAs. By integrating these standards directly into its infrastructure, Plume simplifies the process of bringing regulated assets on-chain while maintaining necessary compliance measures.

The platform’s architecture is designed to significantly reduce gas costs for RWA-related operations. By optimizing the execution of common RWA functions and leveraging Celestia’s data availability solution, Plume expects to achieve a 99.9% reduction in gas fees compared to traditional Ethereum transactions. This cost efficiency could prove crucial in attracting a wide range of RWA projects and investors to the platform, potentially catalyzing greater adoption of tokenized real-world assets.

As of September 2024, Plume was still in its testnet phase but has already attracted over 150 RWA and DeFi projects to its ecosystem. These projects span a diverse range of assets, including collectibles, luxury goods, real estate, and more traditional financial instruments. The platform’s ability to support such a wide array of asset types demonstrates its flexibility and potential to become a comprehensive solution for the RWA market.

Looking ahead, Plume’s success will largely depend on its ability to navigate the complex regulatory landscape surrounding RWAs while maintaining the decentralized ethos of blockchain technology. The platform’s focus on compliance and its partnership with established players in both traditional finance and the crypto space position it well to tackle these challenges. However, as with any new entrant in the rapidly evolving L2 and RWA markets, Plume will need to prove its long-term viability and ability to compete with both established financial systems and other blockchain solutions targeting the RWA space.

“For the first time, we’re building a fully composable Real World Asset Finance (RWAfi) ecosystem centered around RWAs and DeFi, all within one unified and integrated platform. We provide an end-to-end tokenization engine and a seamless plug-and-play financial infrastructure for builders to create tangible value both onchain and offchain. With over 165 applications and teams onboard, we’re witnessing ‘The Great Tokenization’ in action—unlocking access to asset ownership, trading, and liquidity across a diverse array of markets, from real estate to intellectual property, in ways that were once unimaginable.”

Chris Yin

CEO & Founder at Plume Network

Mode Network

Mode is an Ethereum Layer 2 building as the DeFi hub of the Optimism Superchain. Mode boasts an innovative, aggressive ecosystem of talented DeFi builders and researchers.The dApps and initiatives are representative of this culture, including assets woven across multiple dApps to stack yield, bespoke AI products to abstract away the process of finding opportunities and managing positions, and a governance model that uses classic DeFi power games to align and direct incentives.

Amongst Mode’s many progressive DeFi initiatives, is the effort to build a native yield layer, ensuring most DeFi strategies have a base layer of appreciation. Chains like Blast have implemented this strategy transforming non-yield bearing assets on their bridge into the likes of sDAI and stETH, and rebranding the assets on the native chain. Mode is taking a different approach, while adhering to Superchain standards.

Although RWAs are a minor piece in this overall architecture, Mode’s design of their native yield layer illustrates how RWAs can be a critical piece in the bottom layer of the stack, especially when the objective is to create predictable, reliable yield for market participants.

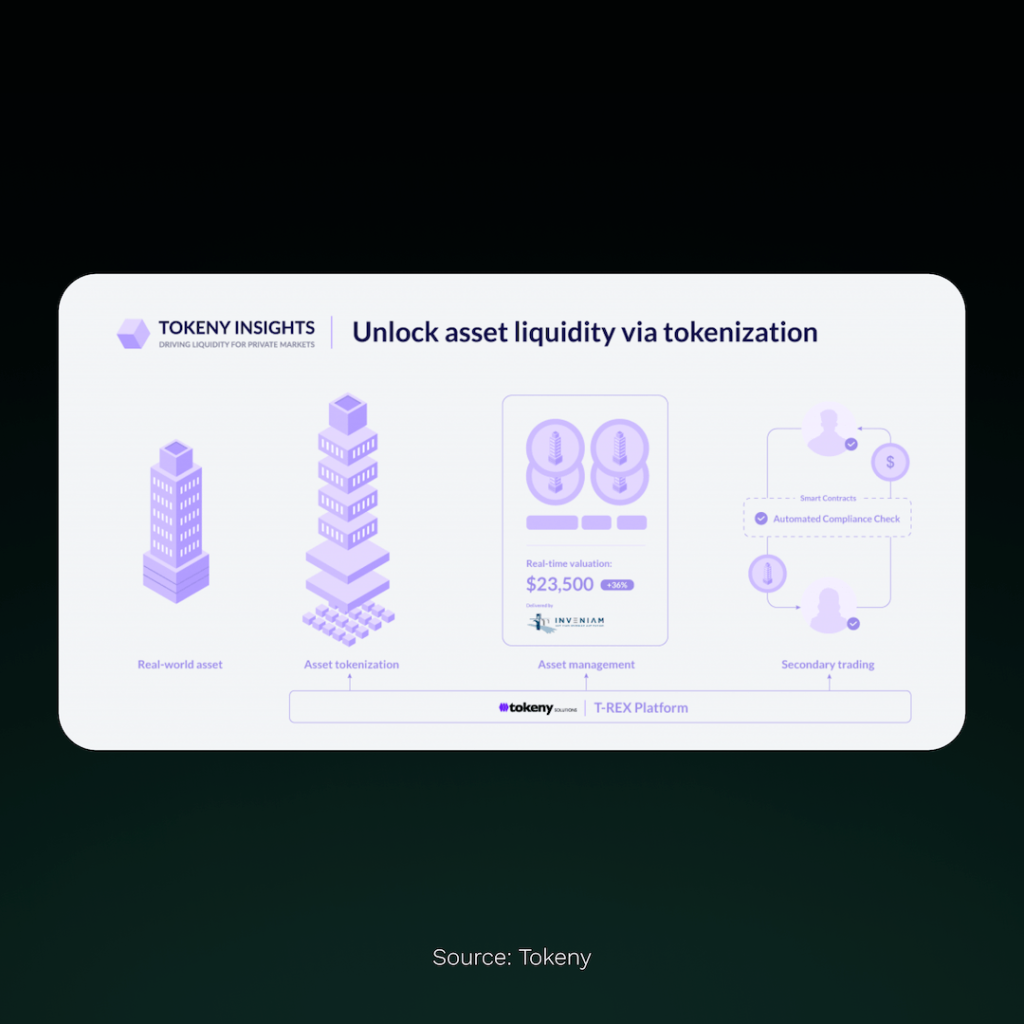

Tokeny

Tokeny Solutions, founded in 2017, develops tokenization infrastructure for the issuance and management of security tokens and regulated digital assets. The company created the T-REX (Token for Regulated EXchanges) protocol to address challenges in bringing real-world assets on-chain while maintaining regulatory compliance.

Central to Tokeny’s offering is the ERC-3643 token standard, designed for permissioned tokens suitable for regulated securities. ERC-3643 incorporates identity management and transfer restrictions directly into token smart contracts, allowing issuers to enforce investor eligibility, KYC/AML checks, and compliance rules on-chain.

Key features of Tokeny’s infrastructure include:

- On-chain identity management via ONCHAINID

- Customizable modular compliance rules

- Recovery mechanisms for lost private keys

- Support for corporate actions such as dividends and voting

As of 2024, Tokeny’s platform has facilitated the tokenization of over $28 billion in assets across more than 60 jurisdictions. Their technology has been used for tokenization projects in real estate, private equity, bonds, and carbon credits.

BlocHome, a real estate tokenization project using Tokeny’s technology, reported a 90% reduction in administrative costs. In another implementation, ABN AMRO used Tokeny to issue a €5 million tokenized green bond on the Polygon blockchain.

Tokeny’s infrastructure aims to increase liquidity and create new opportunities in private markets by enabling compliant on-chain representation of real-world assets. Their open-source approach with ERC-3643 contributes to standardization efforts in the tokenization sector.

As the tokenization market grows, Tokeny’s role as an infrastructure provider bridges aspects of traditional finance with blockchain technology. The continued development of ERC-3643 and related standards may influence the evolution of tokenized securities.

Government Securities

Government securities, also known as sovereign debt or government bonds, are debt instruments issued by a country’s government to finance its operations. These financial instruments are considered among the safest investments available, as they are backed by the full faith and credit of the issuing government. Currently, the primary buyers of government securities are institutional investors such as banks, pension funds, and insurance companies, as well as foreign governments and central banks.

There are several types of government securities, each serving different purposes and catering to various investor needs:

- Treasury Bills (T-Bills): Short-term securities that mature in one year or less.

- Treasury Notes: Medium-term securities with maturities between two and ten years.

- Treasury Bonds: Long-term securities with maturities of 20 or 30 years.

- Treasury Inflation-Protected Securities (TIPS): Securities that protect against inflation by adjusting the principal based on changes in the Consumer Price Index.

- Floating Rate Notes (FRNs): Securities with interest payments that rise and fall based on prevailing interest rates, typically with a 2-year maturity.

Traditionally, access to government securities has been limited to large institutional investors or high-net-worth individuals due to high minimum purchase requirements and complex trading processes. However, the emergence of tokenization is changing this landscape.

Market Size

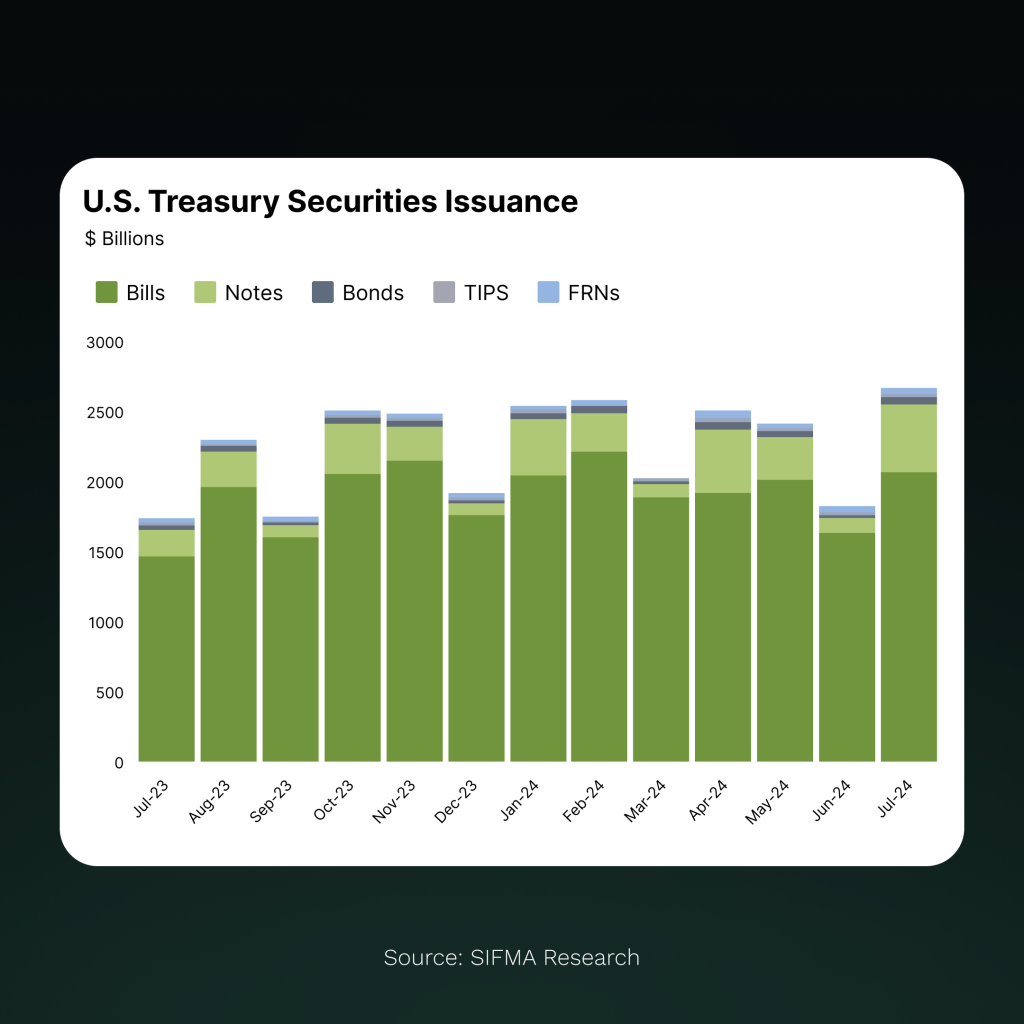

The image provides a snapshot of U.S. Treasury Securities issuance from July 2023 to July 2024, broken down by type of security: Bills, Notes, Bonds, TIPS (Treasury Inflation-Protected Securities), and FRNs (Floating Rate Notes).

Several observations can be made:

- Treasury Bills consistently make up the largest portion of issuances, indicating a significant demand for short-term government debt.

- There’s a noticeable increase in total issuance from June 2024 to July 2024, with the total rising from about $1.8 trillion to over $2.6 trillion.

- Treasury Notes (medium-term securities) show the most significant growth in this period, nearly doubling in volume.

- Bonds, TIPS, and FRNs make up a smaller but stable portion of the issuances throughout the year.

- The overall trend shows fluctuations in monthly issuance, but with a general upward trajectory, suggesting an increasing government borrowing need.

This data underscores the massive scale of the traditional government securities market, with monthly issuances in the trillions of dollars.

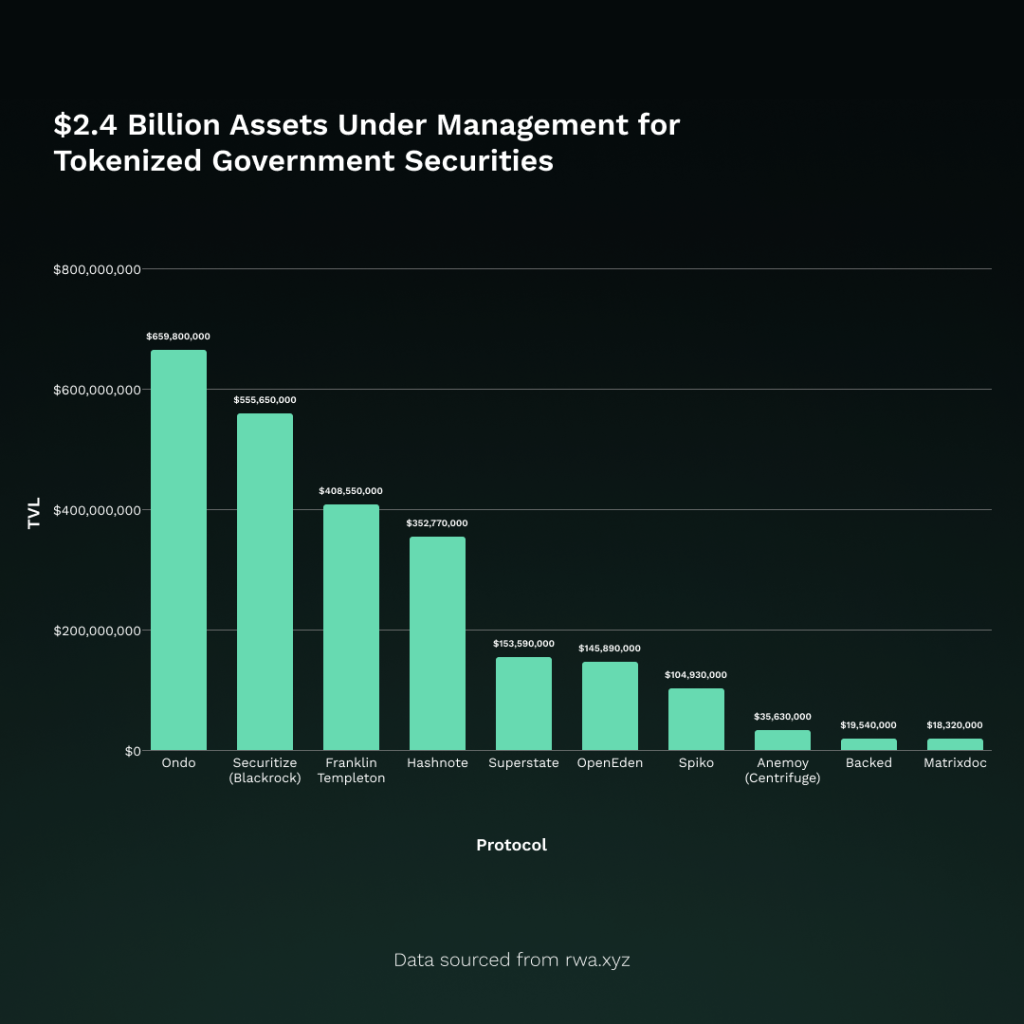

In contrast, as of October 2024, the total Assets Under Management (AUM) in tokenized government securities has reached $2.4 billion, according to data from rwa.xyz. This figure, while significant in the context of the nascent tokenized securities market, represents just a fraction of a percentage of the traditional market’s monthly issuance.

However, the $2.4 billion AUM in tokenized government securities underscores the growing acceptance and adoption of these innovative financial products. The landscape is diverse, with various tokenized government securities products currently available, spanning different blockchain networks and issuers.

This comparison highlights the enormous growth potential for tokenized government securities. As the technology matures and gains wider acceptance, there’s an opportunity to capture even a small portion of the traditional market, which could lead to exponential growth in the tokenized sector.

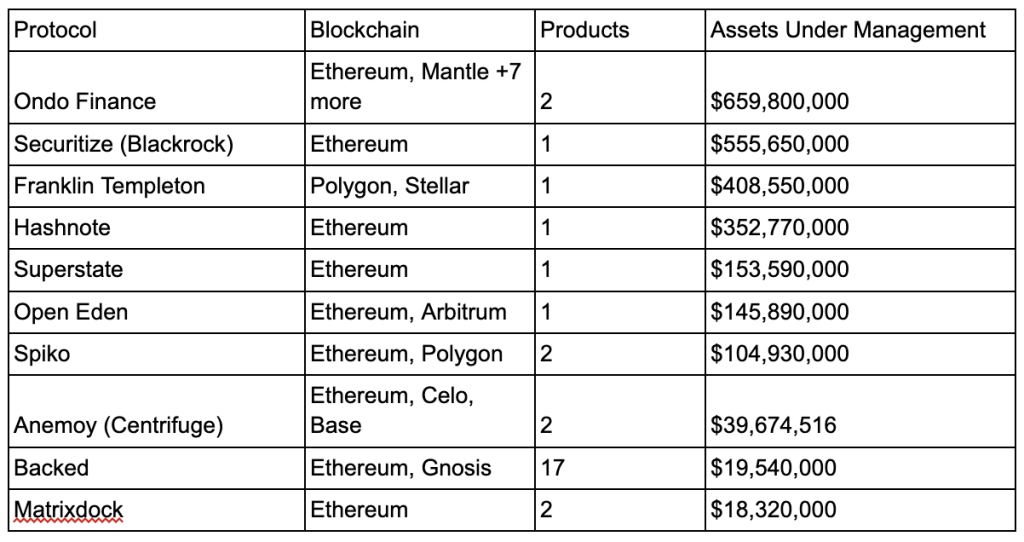

Protocol Overview

The tokenization of government securities is gaining traction across various blockchain platforms. Notably, Ethereum emerges as the dominant blockchain for these initiatives, hosting the majority of the listed protocols. This preference for Ethereum likely stems from its well-established smart contract capabilities and extensive developer ecosystem. However, we also see protocols leveraging other networks, such as Mantle, Polygon, Stellar, and Arbitrum, indicating a trend towards multi-chain strategies to enhance accessibility and potentially reduce transaction costs.

Among the protocols, Blackrock stands out as the leader in Assets Under Management with over $519 million, closely followed by Ondo Finance and Franklin Templeton. This significant participation from traditional financial giants like Blackrock and Franklin Templeton signals growing institutional confidence in blockchain-based financial products.

Among the protocols, Ondo Finance stands out as the leader in Assets Under Management with over $659 million, closely followed by Blackrock and Franklin Templeton. This significant participation from traditional financial giants like Blackrock and Franklin Templeton signals growing institutional confidence in blockchain-based financial products.

Opportunities & Challenges

The tokenization of government securities, spanning T-Bills, Notes, Bonds, TIPS, and FRNs, offers several potential benefits. It could significantly increase market accessibility, allowing for fractional ownership and potentially lowering barriers to entry for smaller investors who have traditionally been excluded from this market. The diverse range of protocols and blockchains involved, as seen in our overview, suggests a competitive landscape that could drive innovation and efficiency.

Additionally, the use of blockchain technology may enhance transparency and reduce settlement times, although these benefits are still being evaluated in real-world applications. The substantial AUM already achieved by leading protocols like Blackrock, Ondo Finance, and Franklin Templeton indicates growing confidence in these tokenized instruments.

However, challenges remain. Regulatory frameworks are still evolving to accommodate these new financial instruments, and questions about interoperability between different blockchain networks persist. The dominance of Ethereum in the current protocol landscape highlights the need for cross-chain solutions to ensure broader accessibility and resilience. Moreover, the technology’s ability to handle high-volume trading environments, typical in government securities markets which issue trillions in debt annually, is yet to be fully tested at scale.

As the market for tokenized government securities continues to grow, it will be crucial to monitor how these products perform in various market conditions and their impact on broader financial market dynamics. The involvement of major financial institutions, alongside crypto-native entities, suggests that tokenization is moving from the fringes of finance into the mainstream. This convergence of traditional finance and blockchain technology is potentially reshaping how we interact with government debt markets, promising a future where these foundational financial instruments are more accessible, efficient, and integrated with the digital economy.

Tokenized Government Securities Examples

Let’s look at some of the government securities projects making waves.

Blackrock BUIDL Fund

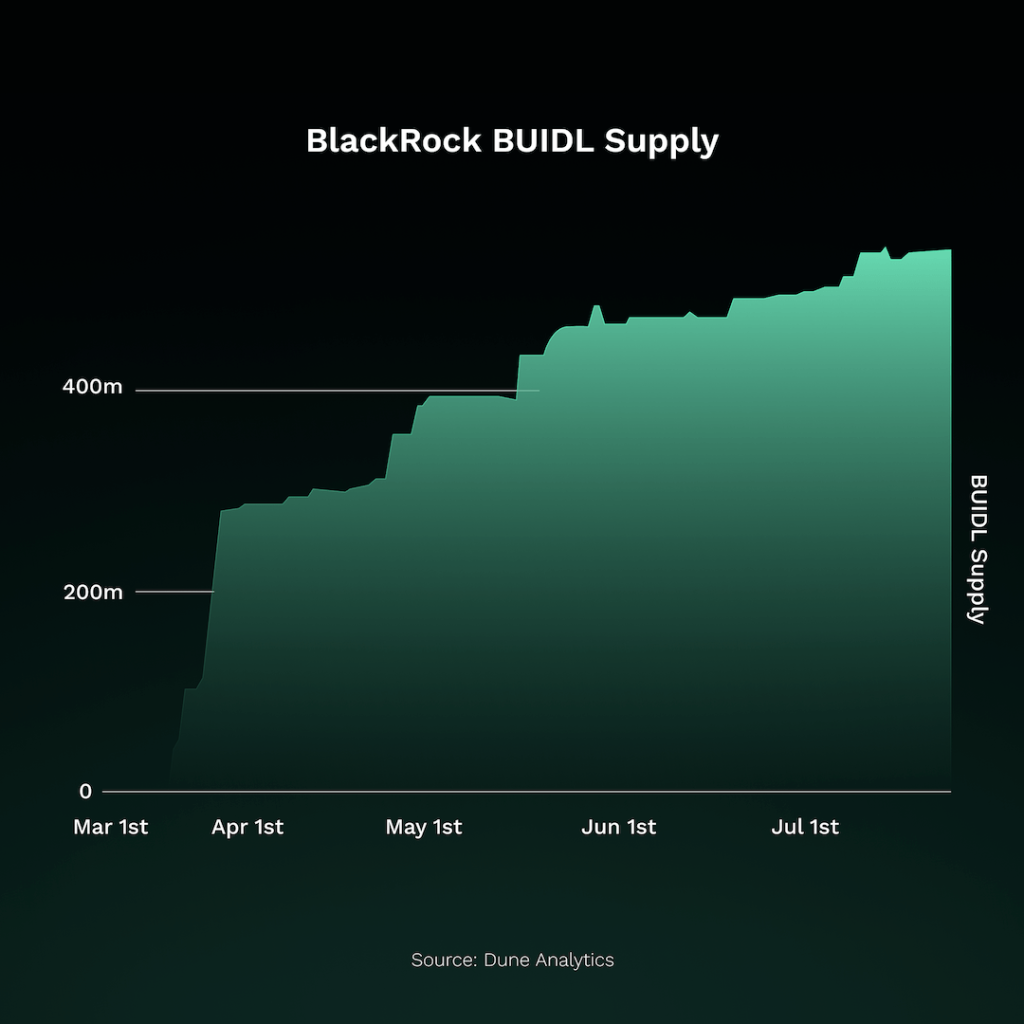

BlackRock, the world’s largest asset manager, made a significant leap into the tokenization space with the launch of its BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on the Ethereum network in March 2024. This fund, developed in partnership with Securitize, allows qualified investors to earn US Treasury yields through tokenized assets, combining traditional finance with blockchain technology.

Securitize’s role in this venture is crucial. As the transfer agent and issuance platform for BUIDL, Securitize provides the necessary infrastructure for the fund’s operation. This collaboration marks a significant milestone in the regulated, compliant tokenization market in the United States, potentially attracting institutional capital and serious money managers to the Securitize ecosystem.

BUIDL’s impact has been substantial and rapid. Within four months of its launch, the fund reached a market cap of $500 million, making it the first tokenized treasury fund to achieve this milestone. As of September 2024, BUIDL’s assets under management had grown to $514 million, capturing around 23% of the $2.2 billion tokenized US Treasury market. The fund’s success demonstrates the scalability and demand for tokenized financial products in institutional markets.

The fund’s approach includes daily accrued dividends deposited directly into investors’ wallets as new tokens each month, maintaining a stable $1 per token value. This model has attracted significant players in the crypto space, with Ondo Finance becoming the largest holder of BUIDL at $173.7 million. Notably, on March 27, 2024, Ondo Finance reallocated $95 million of its own tokenized short-term bond fund to BUIDL, further validating the fund’s appeal.

BlackRock’s entry into tokenization, facilitated by Securitize, not only validates the technology but also paves the way for broader adoption of blockchain in traditional finance. As fiduciaries onboard with Securitize for access to BUIDL, they are likely to move significant capital into the fund and the broader Securitize ecosystem. This could lead to an increase in capital flows and activity for alternative investment products and listings on Securitize Markets’ primary and secondary trading venues, setting a precedent for other regulated venues in their issuer structuring and strategies.

“BUIDL became the largest tokenized treasury fund ever in just forty days, and currently makes up over 25% of the entire tokenized treasury market, but it’s important to note that we’re just scratching the surface on the fund’s potential. In traditional finance, nobody posts dollars as collateral. For every dollar in traditional finance there are two dollars in treasuries. In crypto the ratio is completely reversed. That will change as larger crypto institutions tap into tokenized funds like BUIDL to overhaul their treasury management systems. If you’re a DAO, you finally have a way to buy a treasury management product from a trusted asset manager like BlackRock that earns yield at very low risk. That will expedite the growth as more asset managers join the market. If stablecoins sit at $150B, the tokenized treasury market will naturally grow into the tens of billions range, soon.”

Carlos Domingo,

CEO & Co-Founder of Securitize

Franklin Templeton’s OnChain U.S. Government Money Fund

Franklin Templeton, one of the world’s largest asset managers, has pioneered the integration of blockchain technology into traditional financial products with its Franklin OnChain U.S. Government Money Fund (FOBXX). Launched in April 2021, FOBXX represents a significant step in the tokenization of regulated investment vehicles, offering investors the stability of a government money market fund combined with the transparency and efficiency of blockchain technology.

The fund’s impact on the financial services sector has been substantial. As of June 30, 2024, FOBXX had grown to over $360 million in assets under management, with a weighted average maturity of 25 days and a weighted average life of 39 days. This growth demonstrates the increasing acceptance of blockchain-based financial products among both retail and institutional investors. The fund invests at least 99.5% of its total assets in U.S. government securities, cash, and repurchase agreements collateralized by government securities or cash, maintaining a stable $1.00 share price while providing daily liquidity to investors.

What sets FOBXX apart is its use of a proprietary blockchain-integrated system for recordkeeping. The fund’s transfer agent maintains the official record of share ownership using features of traditional book-entry form combined with one or more public blockchain networks. This allows for real-time recording of fund ownership and has the potential to provide significant operational efficiencies. Investors can access their ownership information and initiate transactions through a mobile application, offering unprecedented convenience and transparency in the mutual fund space. Despite using blockchain technology, the fund does not invest in cryptocurrencies, maintaining its focus on traditional government securities.

ONDO Finance

Ondo Finance, established in 2021, focuses on tokenizing real-world assets, particularly U.S. Treasuries and money market funds. The company’s main products are USDY (US Dollar Yield) and OUSG (Ondo Short-Term US Government Bond Fund). USDY is a tokenized note backed by short-term U.S. Treasuries and bank deposits, while OUSG is a tokenized version of a BlackRock short-term U.S. Treasuries ETF. These products aim to provide blockchain-based access to traditional financial instruments.

As of August 2024, Ondo Finance’s Total Value Locked across its two main products has reached $577 million+, making it the largest issuer of tokenized treasuries. USDY accounts for $371 million+ of this total, with OUSG representing the remaining $206 million. This growth in TVL indicates increasing adoption of Ondo’s tokenized products since their launch.

Ondo’s approach includes implementing regulatory compliance measures, regular reporting, and third-party audits. The company has also established partnerships with firms in both traditional finance and the cryptocurrency sector, including BlackRock and Coinbase. These collaborations facilitate the creation and custody of Ondo’s tokenized products.

A key feature of Ondo’s USDY is its composability with DeFi and permissionless nature. Recently, USDY has gained significant momentum in DeFi protocols, being used for lending, borrowing, margins/perpetual trading, and more, all while earning yield. USDY uniquely combines investor protections typically found in traditional finance with yield generation, composability, and permissionless characteristics – advantages not offered by either stablecoins or other yieldcoins.

As of its one-year anniversary on the 26th of August 2024, USDY has expanded its presence to eight blockchains (Ethereum, Solana, Sui, Aptos, Arbitrum, Mantle, Mantra, and Cosmos). With integration across 70+ projects, USDY’s growing ecosystem reflects the increasing interest in bridging traditional finance with blockchain technology. As the market for tokenized RWAs continues to develop, Ondo’s progress offers valuable insights into the potential integration of traditional financial assets with blockchain technology.

“One novel distinction of Ondo’s USDY is that it is both composable with DeFi and permissionless. We have a lot of recent momentum in DeFi protocols, such as using yield-bearing assets for lending, borrowing, margins/perpetual trading and more all while earning yield. Other tokenized RWAs such as BlackRock’s BUIDL and Franklin Templeton’s Benji, while novel products, were not composable with DeFi or permissionless. USDY offers robust investor protections typically found in traditional finance and yield while also being composable and permissionless. Neither stablecoins nor other yieldcoins offered all of these advantages.”

Ben Grossman,

Sr. Director of Marketing at Ondo Finance

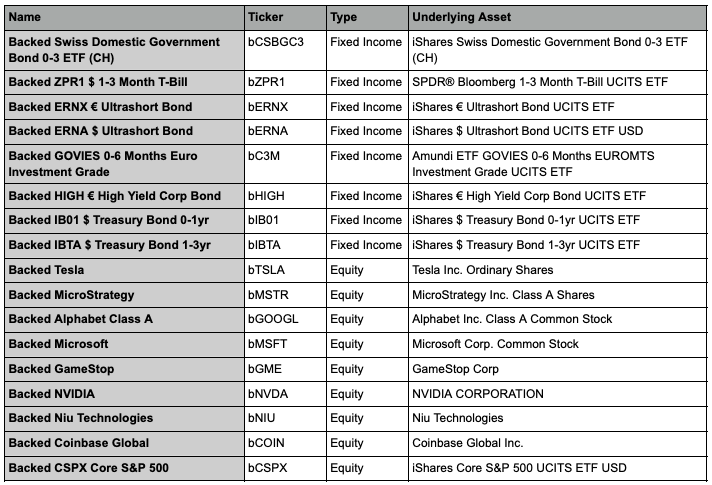

Backed

Backed has emerged as a significant player in the tokenization of government securities, demonstrating the growing appetite for blockchain-based representations of traditional financial instruments. The company has achieved a total issuance volume of $52,043,275, a figure that underscores the substantial market interest in tokenized government securities. This volume suggests that investors are increasingly comfortable with the concept of holding government debt instruments in tokenized form, potentially benefiting from the increased liquidity and accessibility that blockchain technology offers.

The company’s reach extends beyond mere issuance, as evidenced by its network of 40 ecosystem partners and 10 protocol integrations. These partnerships and integrations are crucial for creating infrastructure around tokenized securities, enabling seamless trading, custody, and settlement processes.

Products

Backed’s product lineup, as illustrated in the above table, showcases a diverse range of tokenized assets, including both fixed income and equity products. Notably, the company offers tokenized versions of various government securities and ETFs, such as the Backed Swiss Domestic Government Bond 0-3 ETF (bCSBGC3) and the Backed ZPR1 $ 1-3 Month T-Bill (bZPR1). This comprehensive offering extends to equity products as well, including tokens representing shares in major tech companies like Microsoft (bMSFT) and NVIDIA (bNVDA). All products are launched with a total issuance volume of 100,000,000 CHF, indicating Backed’s commitment to providing ample liquidity. Furthermore, the company’s support for EVM-compatible chains across various networks enhances interoperability, allowing these tokenized assets to integrate seamlessly with DeFi protocols.

The case of Backed provides valuable insights into the evolving landscape of tokenized securities. While the current issuance volume represents a small fraction of the traditional securities market, it signifies a noteworthy start in bridging the gap between traditional finance and blockchain technology. As regulatory frameworks continue to develop and institutional adoption increases, companies like Backed are likely to play a pivotal role in shaping the future of securities trading and ownership. The company’s progress thus far, coupled with its diverse product offering and focus on interoperability, suggests that tokenized securities could become an increasingly important component of both the digital asset ecosystem and the broader financial markets.

“The tokenization revolution is in full swing. Financial institutions are embracing this technology, recognizing its potential to reshape the global financial landscape. The distinction between ‘real-world’ and digital assets will blur as blockchains become the settlement layer for all financial transactions, democratizing access to markets worldwide. The future of finance is borderless and inclusive.”

David Henderson,

Head of Marketing at Backed

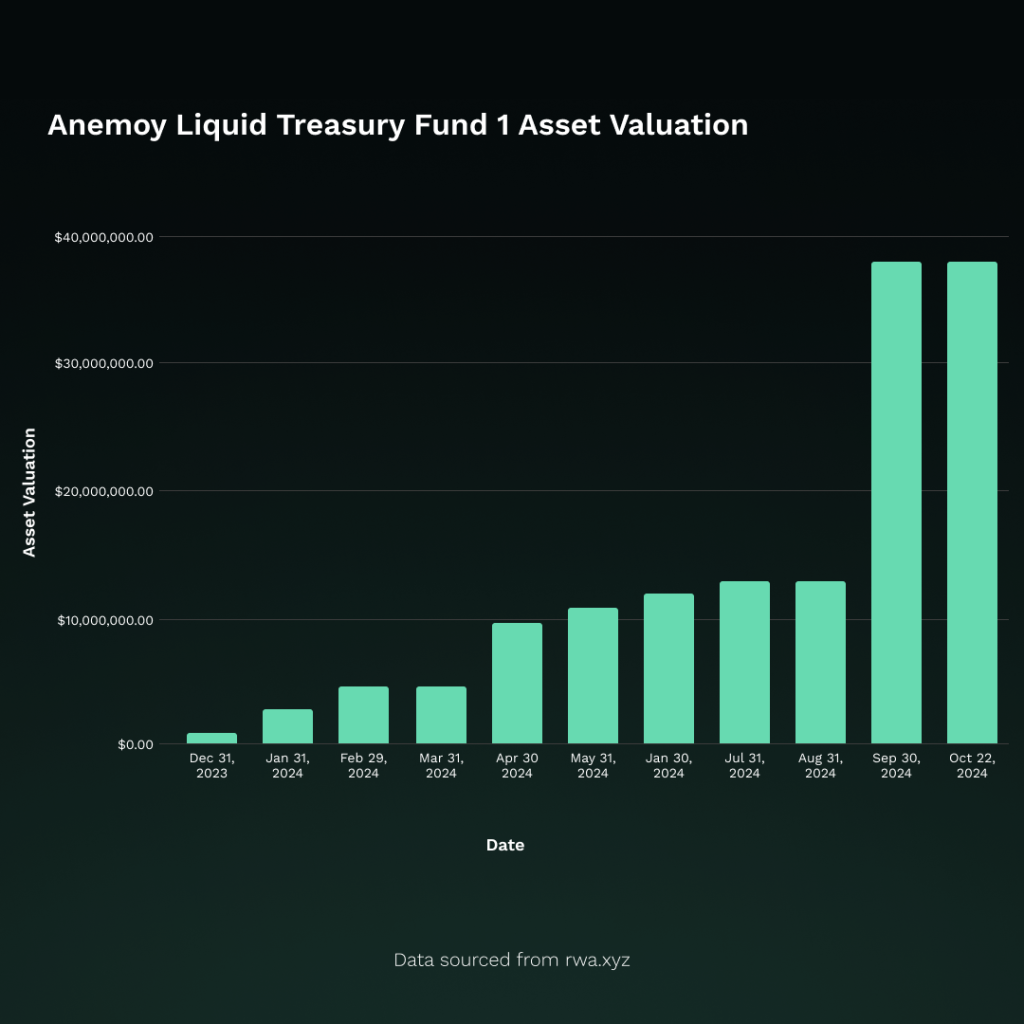

Anemoy

Anemoy, launched in 2023, operates as a web3-native asset manager providing regulated, fully on-chain investment products. Their flagship offering, the Anemoy Liquid Treasury Fund, represents a novel approach to tokenizing U.S. Treasury bills through a regulated British Virgin Islands fund structure. The fund holds U.S. Treasury Bills with a maximum maturity of six months and processes investments and redemptions in USDC, offering daily liquidity to qualified non-U.S. professional investors with a minimum investment threshold of $500,000.

The fund’s architecture combines traditional financial infrastructure with blockchain technology. The physical Treasury bills are held by established Wall Street custodians, while the fund shares are issued as tokens through the Centrifuge protocol. This structure provides investors with direct legal ownership of fund shares, effectively reducing counterparty risk compared to traditional tokenized treasury products. Since its launch in December 2023, the fund has demonstrated significant growth, with assets under management increasing from approximately $1 million to over $38 million by October 2024, marking particularly strong expansion in September 2024.

A key distinguishing feature of Anemoy’s approach is its regulatory compliance and institutional-grade infrastructure. The fund operates under BVI Financial Services Commission oversight, requiring strict adherence to KYC and AML requirements. The tokens representing fund shares provide investors with legal claims on the underlying assets and include redemption-in-kind rights, allowing token holders to claim the physical Treasury bills directly from the custodian if needed. This regulatory framework, combined with the fund’s transparent structure, has attracted institutional investors, particularly DAO treasuries seeking regulated exposure to U.S. Treasury yields.

In 2024, Anemoy expanded its offerings by launching the DeFi Yield Fund, a market-neutral fund investing in DeFi strategies, demonstrating the platform’s capability to bridge traditional finance with decentralized systems. The fund uses Centrifuge’s infrastructure for tokenization and distribution, enabling investors to track assets and performance through public blockchain networks including Ethereum and Polkadot, with planned expansion to additional networks such as Arbitrum and Base. This infrastructure allows for cross-chain accessibility while maintaining the regulatory compliance and transparency standards established with their Treasury fund.

Private Credit

Private credit refers to loans provided by non-bank lenders, typically to mid-sized companies that are too large for traditional bank loans but too small to access public debt markets. These borrowers often include private equity-backed companies, growing businesses in need of flexible financing, and firms in specialized sectors.

Tokenized private credit takes this concept further by converting these loans into digital tokens on a blockchain. This process allows the loans to be divided into smaller, more tradable units, making them accessible to a broader range of investors, including retail participants who were previously excluded from this market.

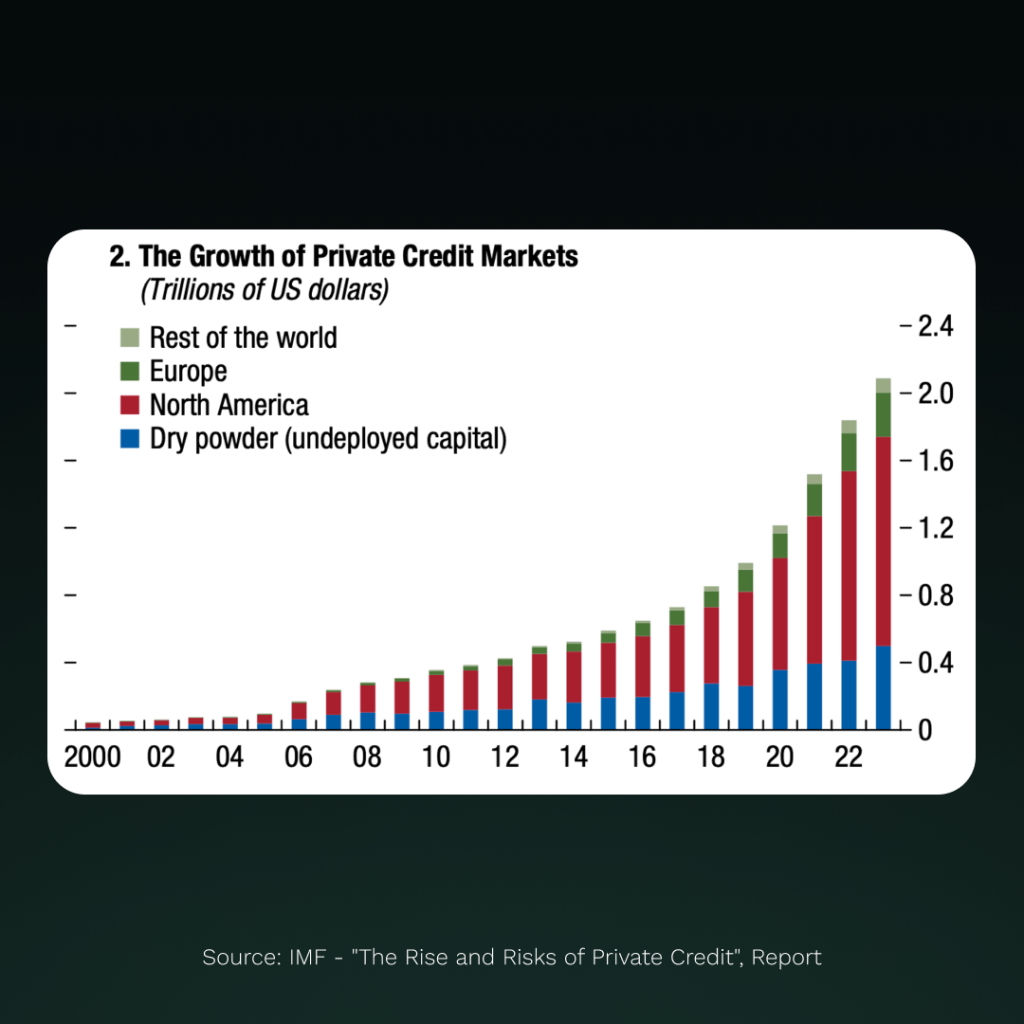

According to the International Monetary Fund (IMF), the private credit market has experienced significant growth, reaching $2.1 trillion globally in 2022. This represents a substantial increase from just $0.2 trillion in 2000, demonstrating the rapid expansion of this asset class over the past two decades. As tokenization technology advances, it has the potential to further accelerate this growth by increasing liquidity and accessibility in the private credit market.

Market Growth

The chart above illustrates the growth of private credit markets from 2000 to 2022. The total market size has expanded from less than $0.2 trillion in 2000 to over $2.0 trillion by 2022, representing a tenfold increase in just two decades. This growth has been predominantly driven by North America, which accounts for the largest share of the market, followed by Europe, while the rest of the world shows a smaller but growing presence.

A notable feature of this growth is the increasing presence of “dry powder” or undeployed capital, particularly since 2014. This suggests a growing pool of available funds ready for investment in private credit opportunities. The steepening of the growth curve from 2014 onwards indicates an acceleration in market expansion, likely due to increased investor interest and favorable market conditions.

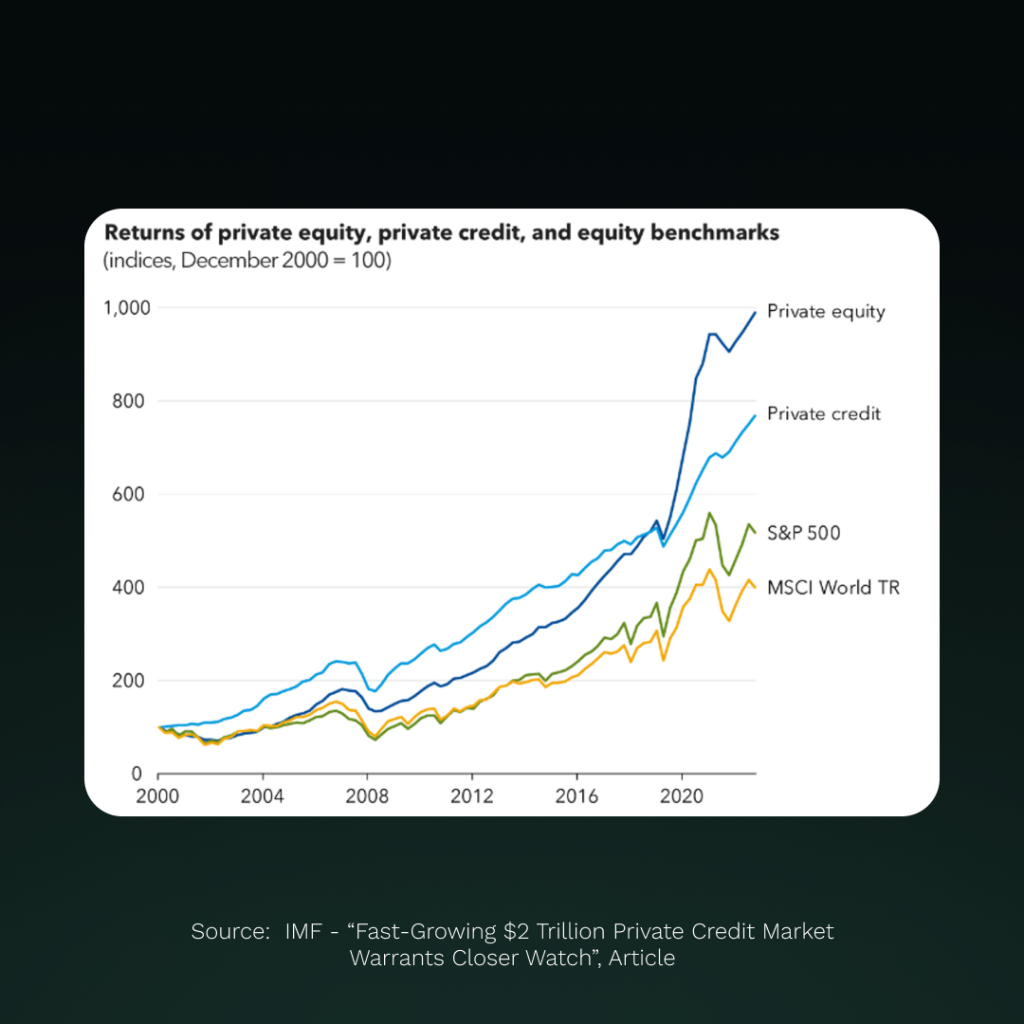

When comparing the returns of private equity, private credit, and equity benchmarks from 2000 to 2020, some important insights can be found. Both private equity and private credit have significantly outperformed traditional equity benchmarks (S&P 500 and MSCI World TR) over the 20-year period. Private credit, in particular, shows a more stable growth trajectory compared to private equity and public markets, with fewer sharp declines during market downturns.

Since 2016, private equity and private credit have shown accelerated growth, widening the performance gap with public market indices. Notably, during the 2008 financial crisis, private credit demonstrated better resilience compared to other asset classes, experiencing a smaller decline and quicker recovery. This performance history highlights the potential benefits of including private credit in a diversified investment portfolio.

These charts highlight the growth potential and attractive risk-adjusted returns offered by the private credit market. As tokenization makes this asset class more accessible, it could potentially unlock substantial value and democratize access to these high-performing investments, bringing the benefits of private credit to a broader range of investors.

Current Problems

The traditional private credit market, despite its growth, faces several significant challenges:

- Limited Liquidity: Private credit investments are typically illiquid, with long lock-up periods often lasting several years. This lack of liquidity makes it difficult for investors to exit their positions quickly if needed, potentially tying up capital for extended periods. For borrowers, this can mean less flexibility in refinancing or restructuring their debt.

- High Barriers to Entry: The private credit market has traditionally been accessible only to institutional investors and high-net-worth individuals. Minimum investment requirements often run into millions of dollars, effectively excluding retail investors and smaller institutions from participating. This limitation restricts the potential investor base and capital flow into the market.

- Lack of Transparency: Private credit transactions often lack the transparency found in public markets. Information about loan terms, borrower performance, and overall market trends can be difficult to obtain. This opacity can make it challenging for investors to accurately assess risks and make informed decisions.

- Inefficient Processes: Many aspects of private credit transactions, from origination to servicing, still rely on manual, paper-based processes. This inefficiency can lead to slower deal execution, higher operational costs, and increased potential for errors. It also limits the scalability of private credit operations, potentially constraining market growth.

Process

The process of tokenizing private credit typically involves the following steps:

- Asset Selection: Identify suitable private credit assets for tokenization.

- Legal Structure: Establish the legal framework for tokenizing the assets, ensuring compliance with relevant regulations.

- Smart Contract Creation: Develop smart contracts that encode the terms and conditions of the private credit assets.

- Token Issuance: Create digital tokens representing ownership or fractional ownership of the private credit assets.

- Distribution: List the tokens on appropriate platforms for trading or investment.

- Ongoing Management: Implement systems for managing loan servicing, interest payments, and compliance.

Overview

A Promising Future

The integration of blockchain technology into private credit markets presents a transformative opportunity to address longstanding challenges while unlocking new potential. Tokenization can significantly enhance liquidity by creating a more accessible secondary market for private credit assets. This increased liquidity could lead to more efficient price discovery and potentially lower borrowing costs for companies. Moreover, the fractional ownership enabled by tokenization can dramatically lower barriers to entry, allowing a broader range of investors to participate in this historically exclusive market.

Blockchain’s inherent transparency and immutability offer solutions to the opacity that has long characterized private credit markets. Smart contracts can automate many aspects of loan servicing, including interest payments and covenant monitoring, reducing operational costs and minimizing human error. This automation, combined with the real-time visibility of blockchain networks, can provide investors with unprecedented insight into the performance of their investments and the overall health of the market.

Perhaps most excitingly, tokenized private credit has the potential to unlock global liquidity pools, connecting borrowers and lenders across jurisdictions more efficiently than ever before. This global accessibility could lead to more diverse investment opportunities and potentially higher yields for investors, while providing businesses with access to a broader range of funding sources. As regulatory frameworks evolve to accommodate these innovations, we anticipate seeing accelerated growth in tokenized private credit, potentially reshaping the broader financial landscape. The convergence of traditional finance expertise with blockchain technology promises to create a more efficient, and dynamic private credit market, benefiting both investors and borrowers alike.

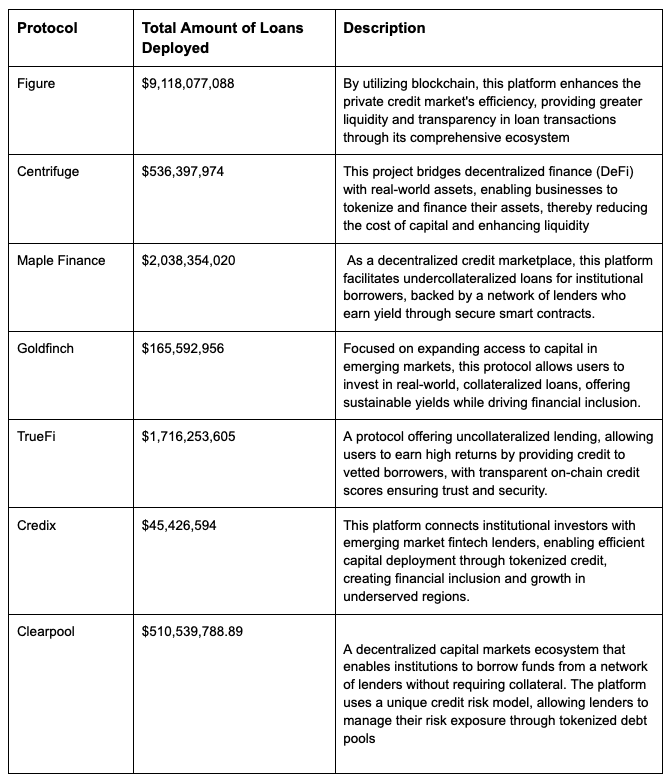

Tokenized Private Credit Examples

Let’s look at some of the private credits projects tokenizing assets.

Centrifuge

Founded in 2017, Centrifuge, focuses on integrating RWAs into the blockchain ecosystem. The platform aims to create a more efficient, transparent, and accessible financial system by tokenizing real-world assets and enabling their use in DeFi protocols. Centrifuge has achieved a cumulative loan amount of $636,033,954 and has tokenized 1,536 assets.

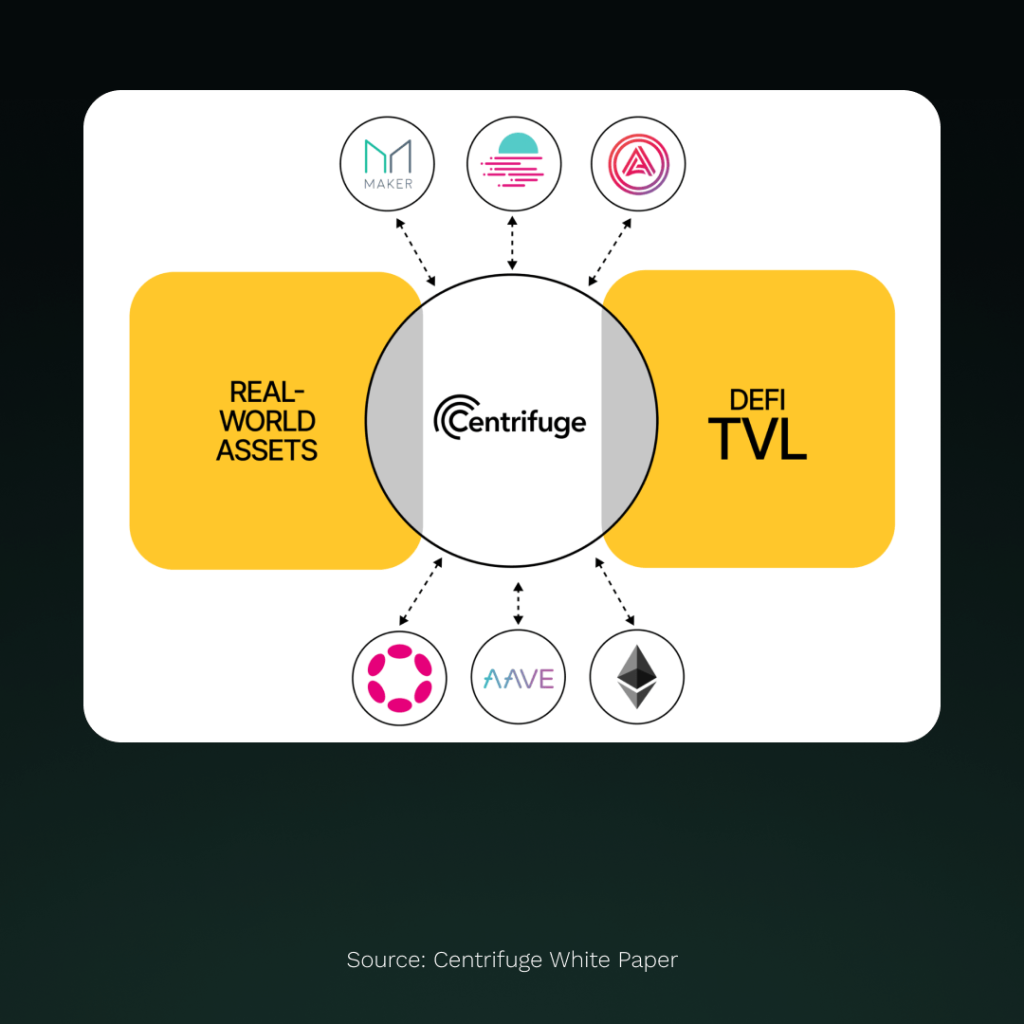

Centrifuge’s process for bringing off-chain assets on-chain involves several steps. Initially, real-world assets are represented as Non-Fungible Tokens (NFTs) on the Centrifuge Chain. These NFTs contain asset information used for pricing, financing, and valuation. To address confidentiality needs in financial transactions, Centrifuge developed a Private Data Layer, allowing secure access to additional asset data. The platform’s on-chain securitization process pools assets together, facilitating management of asset-backed securities. Centrifuge’s Liquidity Pools integrate with various DeFi protocols and chains, connecting traditional finance with DeFi. This approach has led to partnerships with entities such as MakerDAO, Aave, and BlockTower Credit.

What makes Centrifuge particularly interesting is its role as a bridge between real-world assets and the DeFi ecosystem. As illustrated in the image above, Centrifuge acts as a central hub, connecting traditional real-world assets on one side with various DeFi protocols and platforms on the other. This unique position allows Centrifuge to tokenize and integrate real-world assets into the DeFi space, making them accessible to protocols like MakerDAO, Aave, and other Ethereum-based DeFi applications. The platform’s ability to interact with multiple chains and DeFi protocols significantly enhances its adoption potential and liquidity options. By facilitating this connection, Centrifuge opens up new possibilities for asset financing and trading, potentially increasing the accessibility of real-world assets to a wider range of DeFi investors and protocols

Centrifuge’s progress showcases the practical application of blockchain technology in traditional financial systems. The platform’s combination of asset tokenization, privacy-preserving technology, and cross-chain compatibility positions it uniquely at the intersection of traditional finance and DeFi. This convergence of traditional and decentralized finance opens up new possibilities for asset liquidity, global accessibility, and financial inclusion. As Centrifuge continues to develop and refine its offerings, it has the potential to play a significant role in shaping the future landscape of digital asset integration in finance, potentially unlocking new value in previously illiquid assets and creating more efficient capital markets..

“At Centrifuge, we’re focused on bringing real-world assets onchain to connect traditional finance with DeFi. Our goal is straightforward: to create a compliant and convenient way for investors to access a range of credit opportunities in one place. By curating quality assets and providing a secure platform, we’re making it easier for investors to engage with the future of finance.”

Bhaji Illuminati

CMO of Centrifuge

Maple Finance

By focusing on institutional-grade lending and borrowing, Maple Finance has carved out a unique niche, facilitating secured, collateralized loans to crypto-native institutions. This approach marries the efficiency of blockchain technology with traditional financial expertise, creating a lending ecosystem that’s attracting attention from both crypto enthusiasts and traditional finance professionals.

At the heart of Maple’s growth in the past twelve months has been its launch of Maple Direct to fill the void left by CeFi lenders since 2022. Maple internally hired experienced credit underwriters with Wall Street backgrounds so that it could manage lending pools itself. This involves performing due diligence, setting loan terms, and managing risk. This structure brings a level of professional financial oversight to the DeFi space that’s rarely seen, helping to build trust and credibility among institutional participants.

Maple’s expansion hasn’t been limited to a single blockchain. While primarily built on Ethereum, the protocol has extended its reach to other chains like Solana, increasing its market accessibility and offering cross-chain lending opportunities. This multi-chain approach has contributed to Maple’s growing total value locked, which currently stands at $342,231,443.

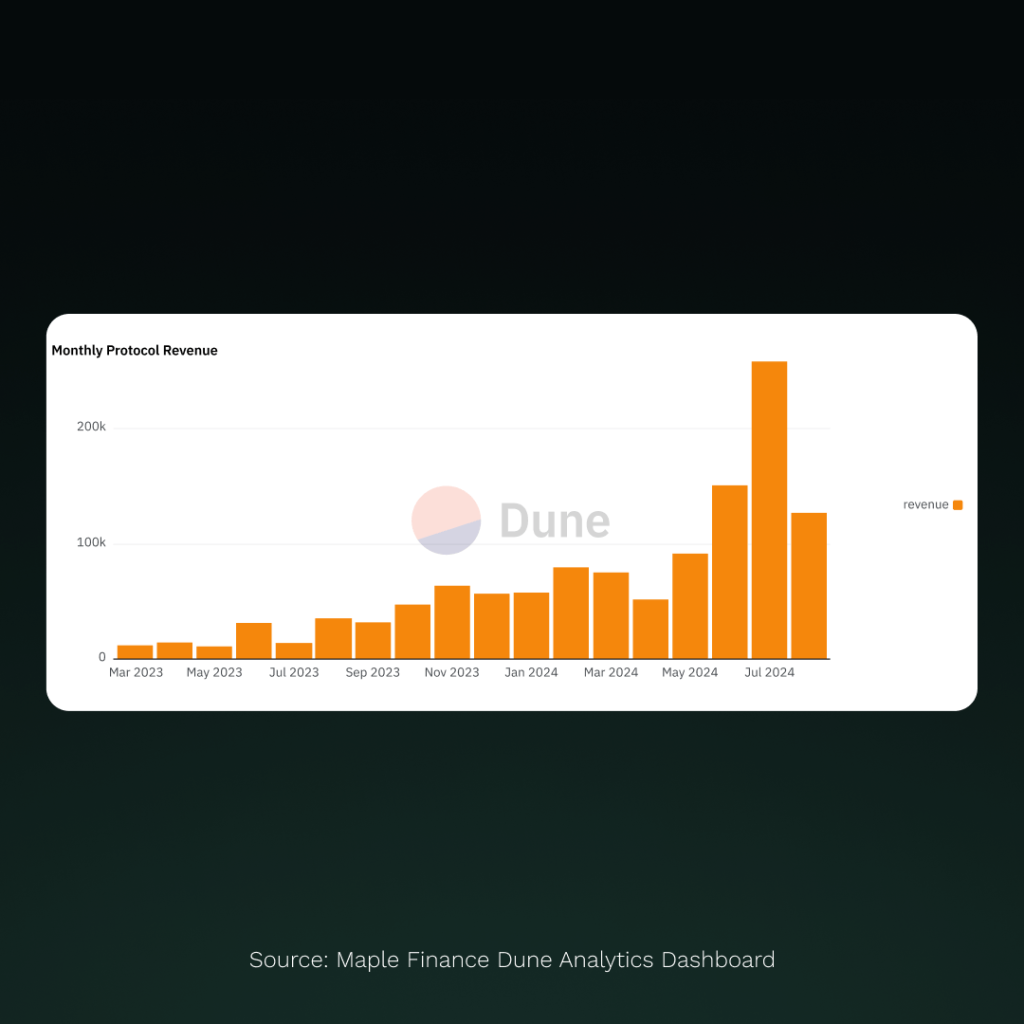

The protocol’s growth trajectory is perhaps best illustrated by its monthly revenue, as shown in the following graph:

The chart reveals a clear upward trend in Maple’s monthly revenue, with a particularly sharp increase in mid-2024. The spike in July 2024 is especially noteworthy, showing revenue reaching a new high of 300k for the month. This substantial growth in fee generation is a strong indicator of increased protocol usage and adoption, reflecting Maple’s expanding role in the DeFi lending space.

Maple Finance has significantly expanded its product suite to cater to a diverse range of lender needs, marking a major step in broadening its user base. In June 2024, the protocol introduced Syrup.fi, a retail-focused arm providing permissionless access to institutional-grade yields. This move not only expands Maple’s market reach but also democratizes access to sophisticated financial products. Alongside Syrup, Maple Direct offers both High Yield and Blue Chips categories, with the latter having already issued over $160 million in loans to established, lower-risk institutions.

One of Maple’s most intriguing developments is its integration of real-world assets into its offerings. The Maple Cash pool, backed by short-dated U.S. Treasury bills, represents a significant step towards bridging traditional finance with DeFi. This product offers a lower-risk investment option while still leveraging the benefits of blockchain technology, potentially attracting more risk-averse investors. As the DeFi sector matures, Maple Finance’s institutional approach and innovative products may well serve as a model for bringing traditional finance practices into the blockchain era, potentially reshaping the future of lending itself.

“As pioneers in institutional lending, Maple Finance is bringing the trillion-dollar private credit market on-chain. Our vision is to be the gold standard for institutional lending in the digital age, which is evident in our approach to tokenizing Real World Assets and the phenomenal growth we’ve seen this year in our collateralized lending products to institutions. By bridging traditional finance with DeFi, we’re reshaping the market to create a more accessible, competitive, and forward-thinking lending ecosystem for institutional clients worldwide.”

Sidney Powell

CEO & Co-Founder of Maple Finance

GoldFinch

Goldfinch is a decentralized credit protocol that aims to bridge the gap between crypto-backed lending and real-world financing. Founded in 2020 by Mike Sall and Blake West, both former Coinbase employees, Goldfinch has quickly established itself as a significant player in the DeFi lending space. The protocol’s unique approach to undercollateralized lending has attracted substantial attention and investment, with over $37 million raised from 23 investors as of 2023.

At its core, Goldfinch operates on the principle of “trust through consensus,” a credit model that evaluates borrowers’ creditworthiness based on their past behavior and the collective assessment of other participants. This approach allows Goldfinch to offer loans without requiring crypto collateral, making it accessible to a broader range of borrowers, particularly those in developing countries who may lack access to traditional financial services. As of August 2024, Goldfinch has $72,330,392.46 in active loans, demonstrating the significant demand for its services.

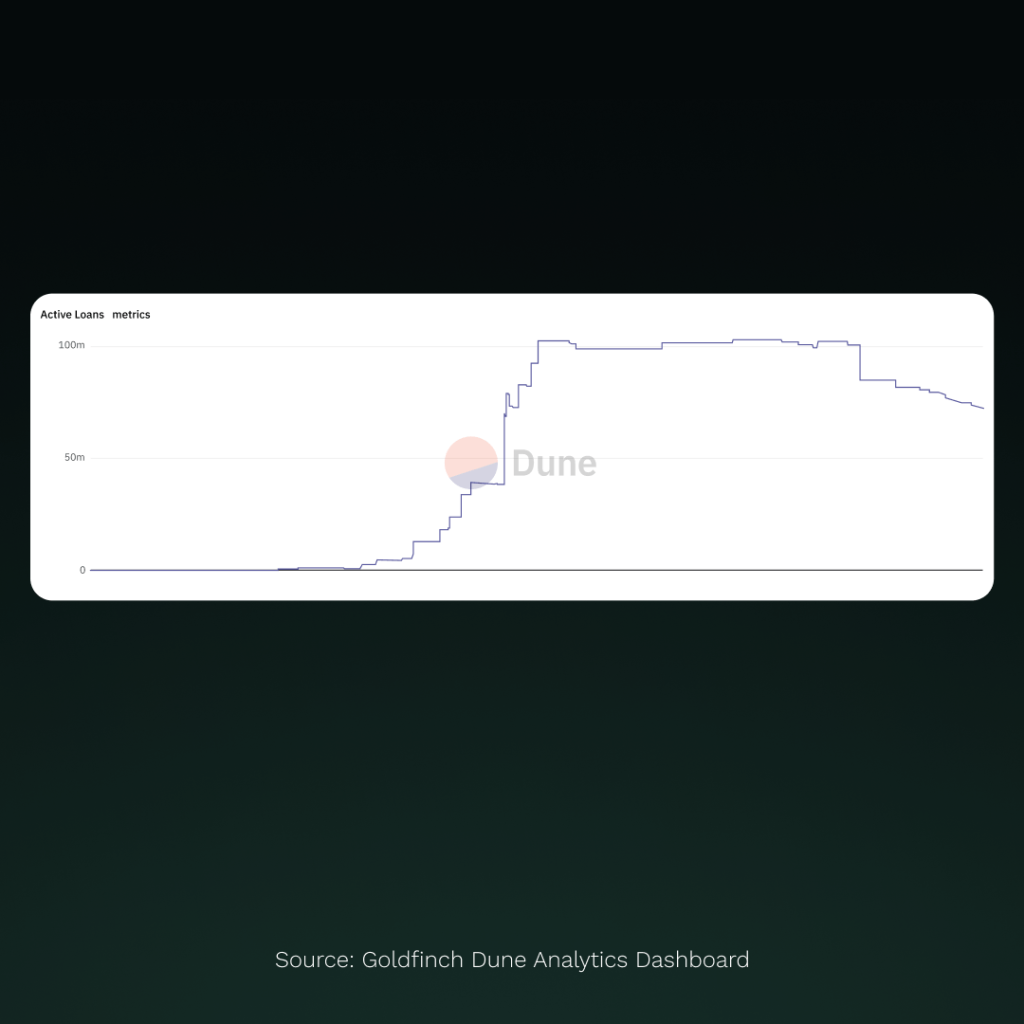

The protocol’s growth trajectory is evident in the Active Loans metrics chart, which shows a dramatic increase in loan volume from early 2021 to mid-2022, followed by a period of stability and a recent decline. This pattern reflects Goldfinch’s rapid expansion phase and subsequent maturation as it navigates market conditions and refines its lending strategies. Despite recent fluctuations, the protocol continues to generate substantial activity, with $60,523.32 in protocol fees collected over a 30-day period from July 15 to August 15, 2024.

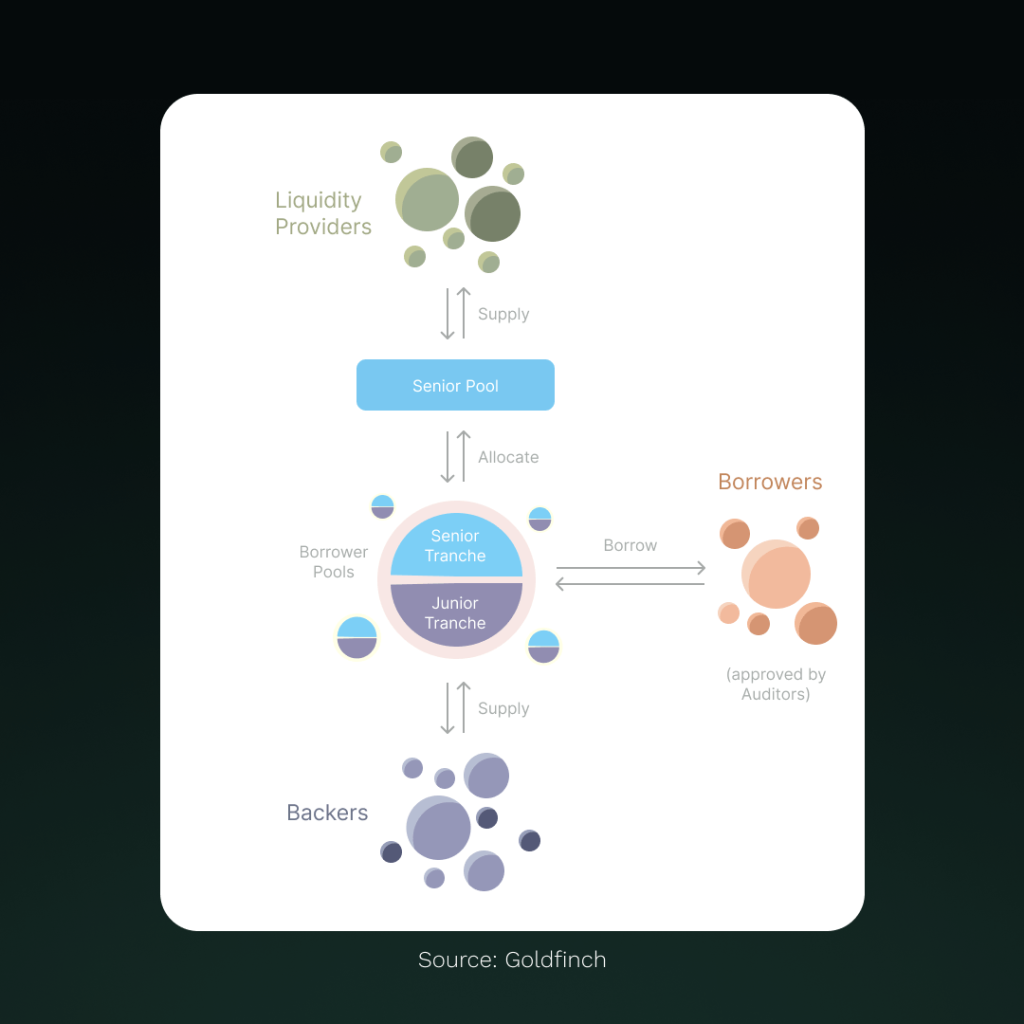

Goldfinch’s ecosystem is designed to create a symbiotic relationship between various participants. The protocol comprises Liquidity Providers, who supply capital to the Senior Pool; Backers, who provide first-loss capital to individual Borrower Pools; and Borrowers, who are approved by Auditors to access loans. This multi-layered structure allows for risk diversification and creates opportunities for different types of investors to participate based on their risk appetite and investment goals.

The Senior Pool acts as a central hub, allocating funds to various Borrower Pools. Each Borrower Pool is divided into a Senior Tranche and a Junior Tranche, with the latter absorbing potential losses first, providing an additional layer of security for Senior Tranche investors. This structure enables Goldfinch to offer more competitive rates to borrowers while still providing attractive yields to investors, particularly in the current low-yield environment of traditional finance.

By enabling the financing of off-chain economic activity through on-chain mechanisms, Goldfinch is creating a bridge between traditional finance and the crypto world, opening up new investment opportunities and potentially driving financial inclusion on a global scale. As the protocol continues to evolve, it faces both opportunities and challenges, with its ability to maintain growth while managing risk being crucial, especially as it expands into new markets and asset classes. The recent decline in active loans suggests that Goldfinch may be entering a phase of consolidation and refinement, potentially focusing on improving its risk assessment models and expanding its borrower base.

Stablecoins

Originally developed to address the high volatility of cryptocurrencies like Bitcoin and Ethereum, stablecoins have evolved to serve multiple functions within and beyond the cryptocurrency markets. Their primary purpose remains mitigating the price fluctuations that have historically hindered the widespread adoption of cryptocurrencies for everyday financial activities.

As the cryptocurrency and blockchain sectors have matured, stablecoins have gained increased attention from both the digital asset community and traditional financial institutions. Their potential to impact global finance extends beyond their original scope, with implications for payment systems, cross-border transactions, and financial inclusion.

The sustained interest in stablecoins reflects ongoing challenges in the broader cryptocurrency ecosystem. While decentralized currencies offer benefits such as trustless and borderless transactions, their price volatility continues to be a significant barrier to adoption for routine financial tasks, from daily purchases to long-term financial planning.

The first stablecoin - BitUSD

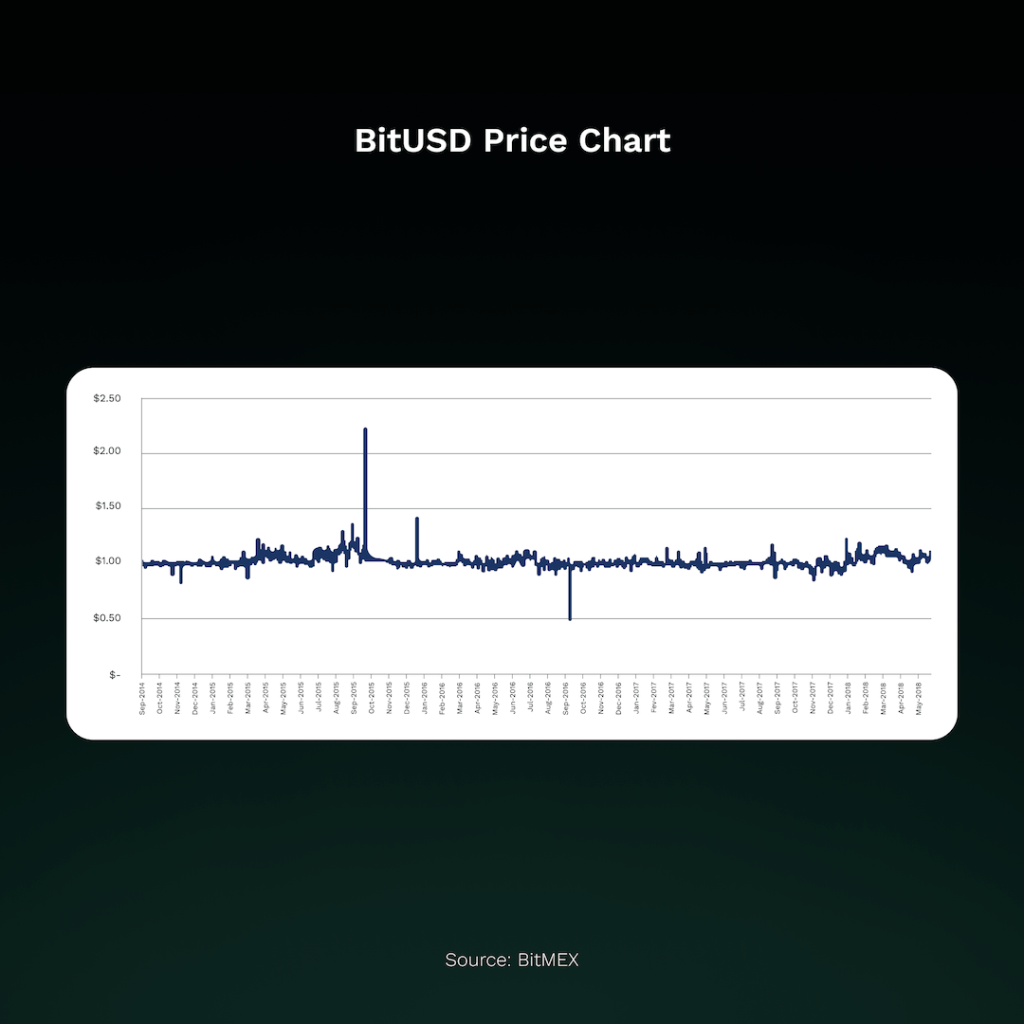

The concept of stablecoins, now a cornerstone of the cryptocurrency ecosystem, has its roots in an early project launched on July 21, 2014. BitUSD, the world’s first stablecoin, emerged on the BitShares blockchain, marking a significant milestone in the evolution of digital assets.

Conceived by visionaries Dan Larimer (EOS) and Charles Hoskinson (Cardano), BitUSD aimed to address the volatility issues plaguing early cryptocurrencies. This innovative approach sought to create a digital asset that could maintain a stable value relative to the US dollar, opening new possibilities for practical use cases in the blockchain world.

BitUSD employed a crypto-backed model, using the native BitShares token as collateral. This design attempted to maintain a 1:1 parity with the US dollar through a system of smart contracts and market incentives. However, the inherent volatility of its collateral asset proved to be a significant weakness.

In 2018, BitUSD lost its dollar peg and failed to recover, highlighting critical flaws in its design:

Collateral Vulnerability: The use of BitShares, itself an untested and volatile asset, as collateral exposed BitUSD to significant risk. Sharp declines in BitShares’ value could potentially leave insufficient collateral to maintain the peg.

Absence of a Price Oracle: The lack of a reliable mechanism to provide real-world exchange rates was a controversial aspect of BitUSD’s design. This omission made it challenging to maintain accurate pricing and stability.

Limited Arbitrage Mechanics: While the system allowed for arbitrage when BitShares prices fell, it didn’t provide mechanisms for the opposite scenario, leading to asymmetric risk.

Despite its ultimate failure to maintain stability, BitUSD’s importance in the history of cryptocurrencies cannot be overstated. It successfully introduced the concept of pegged stablecoins to the wider blockchain community, paving the way for future innovations in this space.

The lessons learned from BitUSD’s challenges have been invaluable for subsequent stablecoin projects. Modern stablecoins have implemented more sophisticated mechanisms, such as diversified collateral, improved price oracles, and enhanced governance models, addressing many of the issues faced by their predecessor.

Type of Stablecoins

As the stablecoin ecosystem has evolved, three primary categories have emerged, each with distinct mechanisms for maintaining price stability: fiat backed, crypto backed, and algorithmic stablecoins.

1. Fiat Backed Stablecoins

Fiat backed stablecoins, also known as centralized or off-chain collateralized stablecoins, are backed 1:1 by reserves of fiat currency, typically U.S. dollars. These reserves are held in traditional financial institutions.

- Maintained by centralized entities

- Backed by highly liquid, low-risk assets (cash or cash equivalents)

- Subject to regular audits to verify reserves

- Generally considered the most stable and least risky

Advantages

Disadvantages

High stability and low volatility

Easier to understand for traditional investors

Often more regulatory compliant

Reliance on centralized entities

Potential lack of transparency in reserve management

Susceptible to regulatory actions

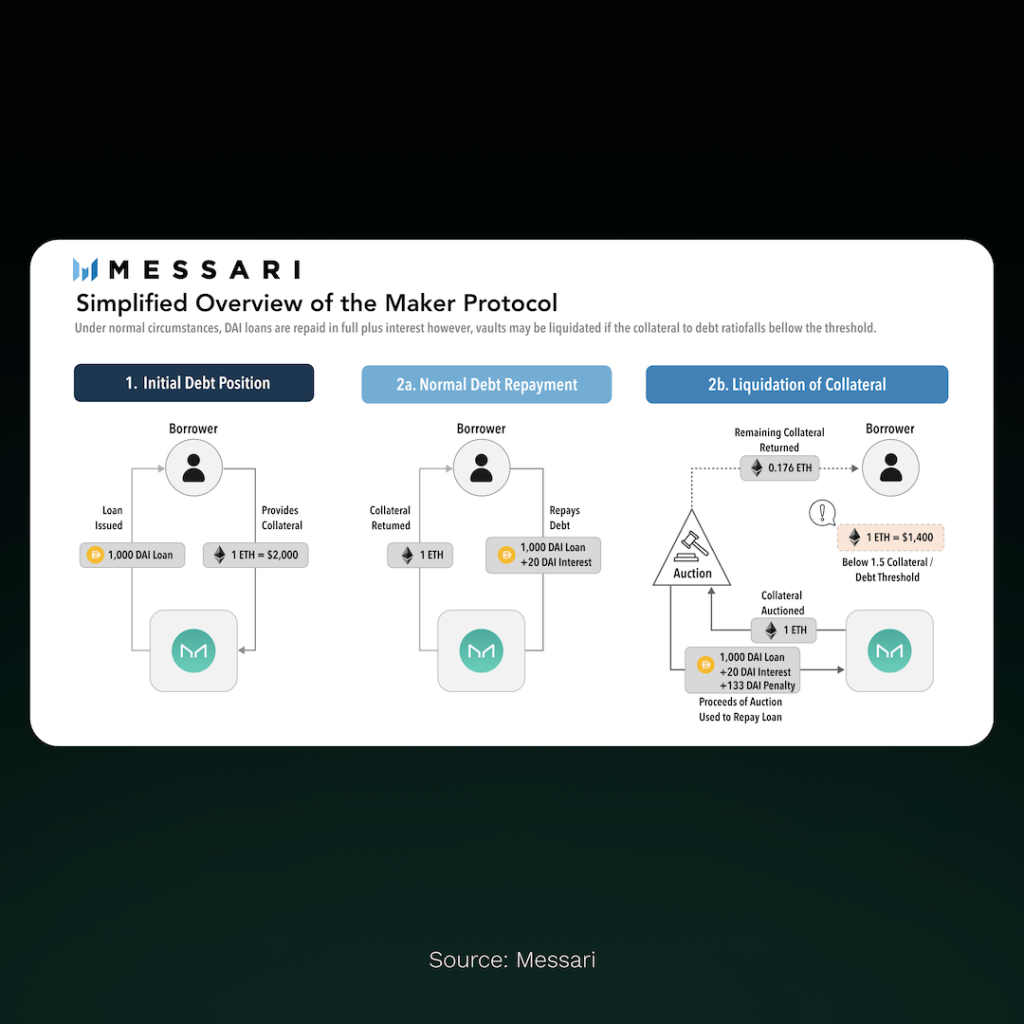

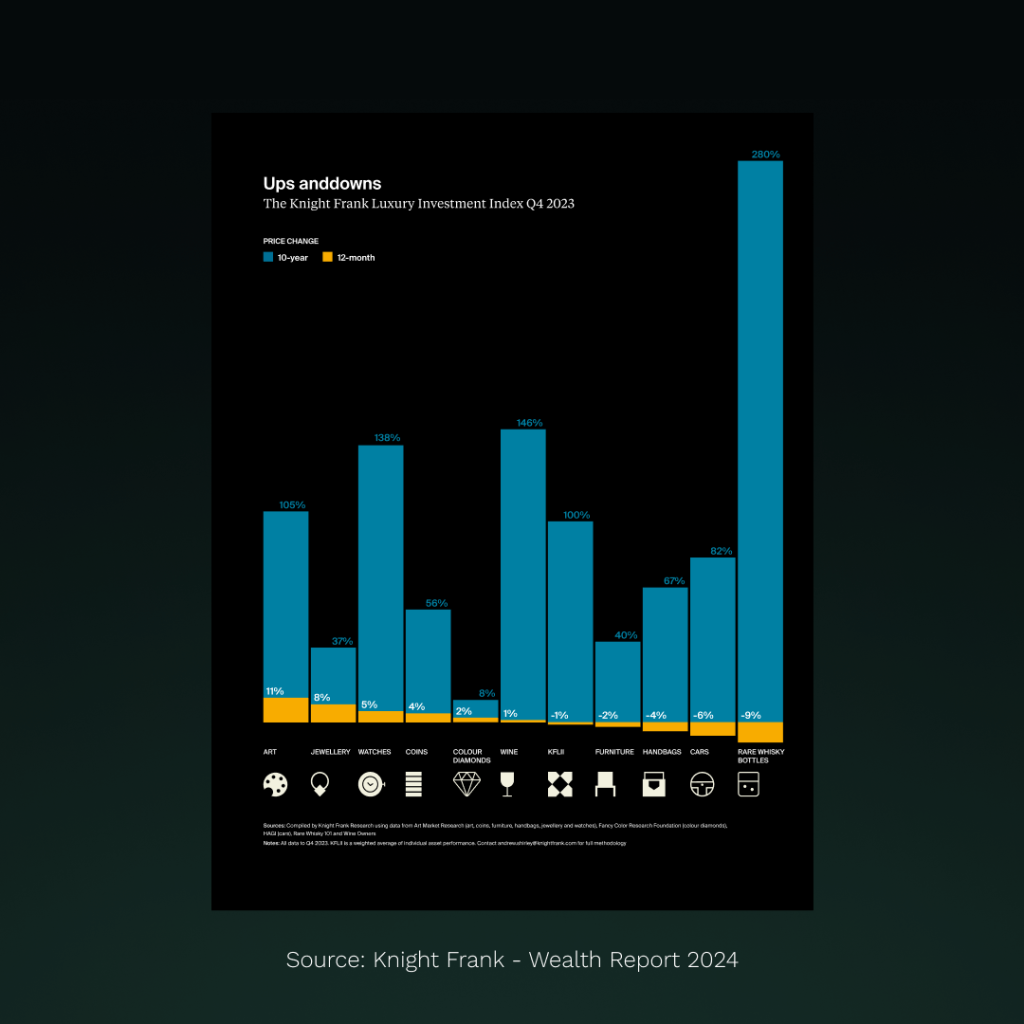

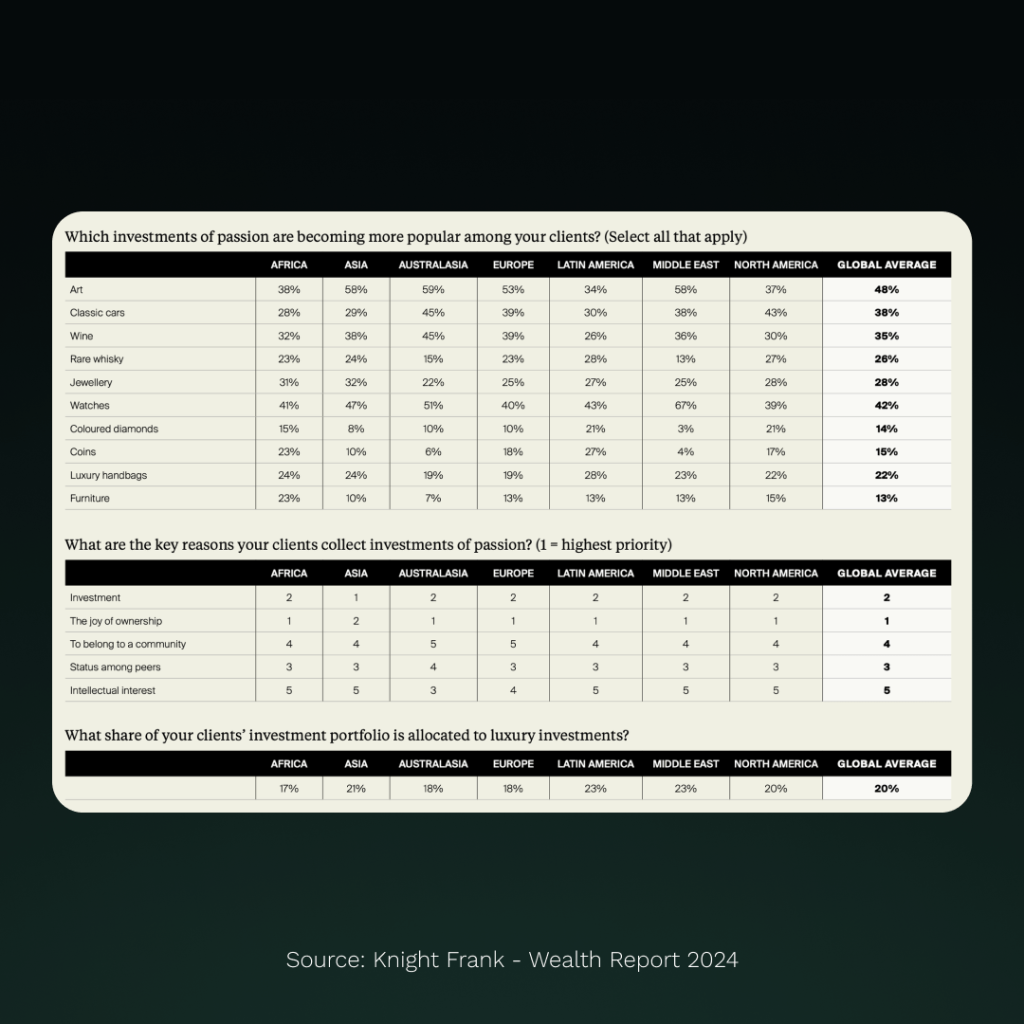

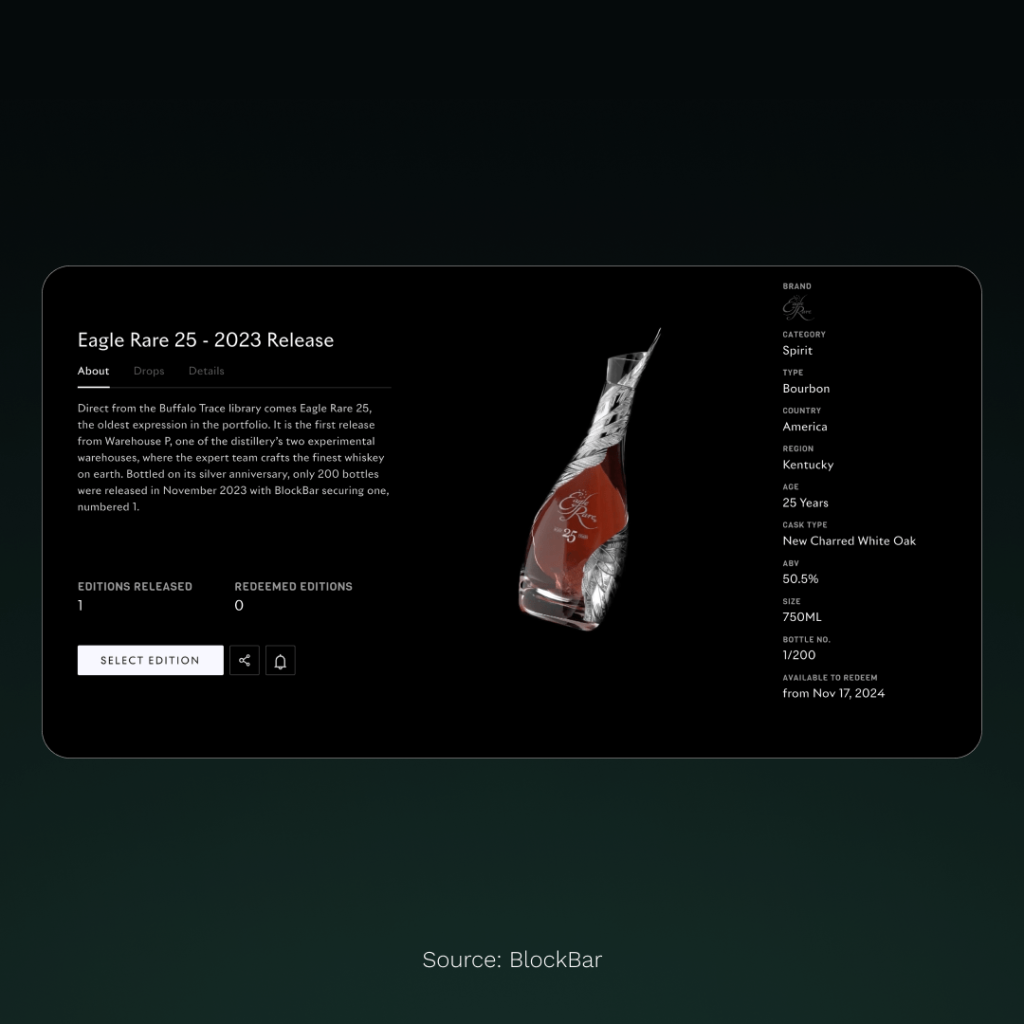

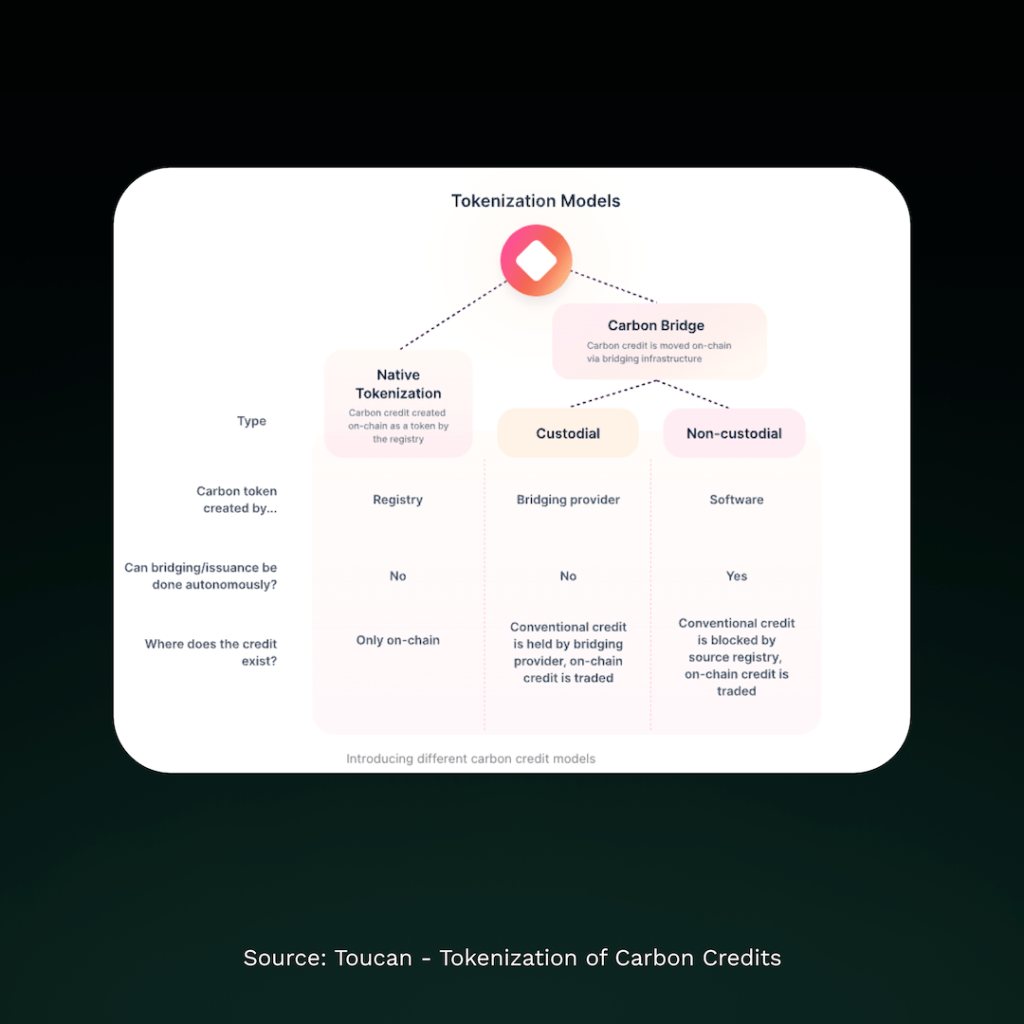

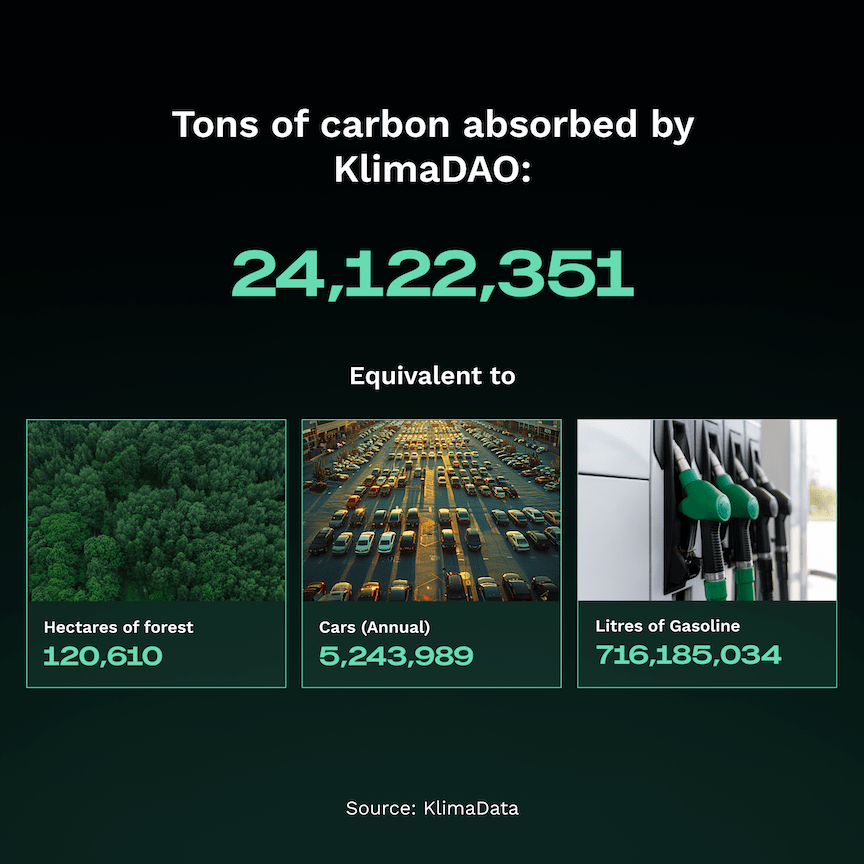

2. Crypto Backed Stablecoins