Table of Contents

Beyond the Peg: An Analysis of Modern Stablecoin Ecosystems

Stablecoins have become a crucial component of the web3 ecosystem, serving as a bridge between traditional finance and the digital asset space. These digital tokens are designed to maintain a stable value relative to a reference asset, most commonly the US dollar. As the cryptocurrency market has grown and matured, stablecoins have emerged as essential tools for trading, remittances, and DeFi applications, offering users a way to mitigate the volatility inherent in many cryptocurrencies.

The stablecoin landscape has evolved significantly since the introduction of the first iterations, with various models emerging to address the challenges of maintaining price stability in a decentralized environment. These models range from fiat-backed currencies issued by centralized entities to algorithmic stablecoins that rely on complex mechanisms to maintain their peg. Each approach presents its own set of advantages and risks, contributing to a diverse ecosystem that continues to adapt to market demands and regulatory pressures.

This report examines the current state of the stablecoin market, analyzing key players, innovative approaches, and the challenges facing the sector. By exploring use cases, technical implementations, and market dynamics, we aim to provide a comprehensive overview of stablecoins and their role in shaping the future of digital finance. The analysis will cover various categories of stablecoins, including fiat-backed, crypto-backed, and algorithmic models, offering insights into their mechanisms, adoption, and potential impact on the broader financial system.

Use Cases

Stablecoins have expanded far beyond their initial adoption as a trading tool in cryptocurrency markets. A survey conducted by Castle Island Ventures, detailed in their report “Stablecoins: The Emerging Market Story,” provides valuable insights into the various uses of these digital assets. The study surveyed 2,541 adults across five key emerging market countries – Brazil, India, Indonesia, Nigeria, and Turkey – focusing on individuals who had used cryptocurrency or blockchain networks in the past 12 months.

The report presents a revealing chart that outlines the primary goals users have when utilizing stablecoins. While trading crypto or NFTs remains the most common objective at 50% of respondents, it’s closely followed by several non-trading use cases. Saving money in dollars (47%) and obtaining better currency conversion rates (43%) are the next most popular goals, highlighting stablecoins’ role as a tool for preserving value and facilitating more efficient currency exchanges. This is especially significant in countries grappling with high inflation or volatile local currencies.

Interestingly, earning yield through mechanisms like DeFi platforms is cited by 39% of users, indicating a growing interest in stablecoins as an investment vehicle. The ability to convert local currency to dollars (38%) and gain access to the broader crypto economy (38%) further underscore stablecoins’ function as a bridge between traditional and crypto finance. These use cases demonstrate how stablecoins are fulfilling needs that traditional financial systems may not adequately address in certain regions.

The chart also reveals that stablecoins are increasingly being used for everyday financial activities. Buying or selling goods and services (34%) and sending money internationally (32%) point to their growing role in commerce and remittances. Moreover, the desire for financial autonomy is evident, with 34% of users citing “taking my finances into my own hands” as a goal, and 29% valuing the self-custody aspect of stablecoins.

Beyond these primary use cases, the report indicates that stablecoins are gaining traction in business applications. Some companies are adopting stablecoins for B2B payments and corporate treasury management, particularly in emerging markets where they offer a hedge against local currency volatility. In the realm of employment, 23% of survey respondents have either received or paid salaries in stablecoins, pointing to their growing acceptance as a medium for payroll.

History

BitUSD

BitUSD, launched in July 2014 on the BitShares platform, was one of the first efforts in the decentralized stablecoin space. Developed by Daniel Larimer, who later created EOS, BitUSD was designed as an algorithmic stablecoin backed by the volatile BitShares cryptocurrency rather than traditional US Dollar reserves. The mechanics of BitUSD involved users creating the stablecoin by posting BitShares as collateral, with an initial maintenance margin of 150% to protect against liquidation. The value of BitUSD relative to BitShares was determined through a decentralized exchange within the BitShares ecosystem.

However, the system lacked a proper price stability mechanism, instead relying on a somewhat circular logic where the price essentially referenced itself without a direct link to real-world US Dollar values. Proponents of BitUSD argued that the system’s design would naturally maintain the peg through market forces and participant behavior. They claimed that automatic margin calls and the assumption that rational actors would trade based on future expectations would create a self-reinforcing peg. The argument was that market participants would have no reason to trade BitUSD at any price other than its intended $1 value, as deviating from this would either present arbitrage opportunities or signal a lack of faith in the entire system.

Despite these theoretical underpinnings, BitUSD faced significant challenges in practice. The lack of a price oracle to provide external US Dollar price information was a contentious aspect of its design. Additionally, the system struggled to achieve substantial adoption, with periods where only around $40,000 worth of BitUSD was in circulation. Liquidity remained low, and price stability proved elusive. While BitUSD represented an interesting early experiment in decentralized stablecoins, it ultimately fell short of its goals.

The experience with BitUSD highlighted the complexities and potential vulnerabilities of algorithmic stablecoins, particularly their susceptibility to market manipulation and instability during volatile financial conditions. Its design, while innovative, proved to be naive and incapable of scaling effectively. The possibility of turbulence during volatile financial periods and the potential for sophisticated trading firms to profit by attacking the peg underscored the challenges inherent in maintaining a stable value without traditional backing. Despite its limitations, BitUSD served as a valuable learning experience for future decentralized stablecoin projects, paving the way for more sophisticated designs in the years that followed.

NuBits

NuBits, launched in September 2014, represented another early attempt at creating a decentralized stablecoin and was one of the first to incorporate backing from an underlying asset, in this case, Bitcoin. The project introduced a dual-token system consisting of NuBits (USNBT) as the stablecoin pegged to $1, and NuShares (NSR) as the governance token. This crypto-collateralized approach aimed to provide more stability than its predecessor, BitUSD, by using Bitcoin as a reserve asset. NuBits sought to maintain its peg through a combination of mechanisms, including adjusting supply based on demand, offering interest rates to incentivize users to hold their NuBits during periods of low demand, and utilizing its Bitcoin reserves to support the peg.

The NuBits system relied on NuShare holders voting to increase the USNBT supply when demand rose, or to offer “parking” incentives when the price dropped below $1. This parking mechanism allowed users to temporarily remove their NuBits from circulation in exchange for interest payments, effectively reducing the available supply. However, the system lacked a direct method to reduce the overall supply of NuBits, which would later prove problematic.

Despite initial success, NuBits experienced its first major crisis in 2016 when the price of Bitcoin spiked. Many NuBits holders, seeking to capitalize on Bitcoin’s rise, sold their stablecoins en masse. The sudden drop in demand overwhelmed the system’s stabilization mechanisms, causing the peg to break. NuBits traded below $1 for an extended period of about three months before eventually recovering. This event highlighted the vulnerability of the system to rapid shifts in market sentiment and the challenges of maintaining a peg during periods of high cryptocurrency volatility.

NuBits managed to repeg, even experiencing a significant boom in late 2017 during a Bitcoin price crash. As crypto investors sought refuge from market volatility, NuBits saw its market cap grow from $950,000 to $14 million in a short period. However, this growth was short-lived. In March 2018, NuBits suffered a second, more severe crash from which it never fully recovered. This time, insufficient reserves and poor diversification of collateral (primarily held in volatile cryptocurrencies) left the system unable to defend its peg against even a modest decline in demand. The price of NuBits plummeted, trading as low as $0.25 and effectively ending its viability as a stablecoin.

Stablecoin Challenges: Terra UST's Collapse and BUSD's Retirement

The cryptocurrency market has faced significant challenges in recent years, with major stablecoins experiencing very different fates. Stablecoins, designed to maintain a steady value pegged to a reserve asset like the US dollar, have become integral to the crypto ecosystem. However, the sudden collapse of Terra’s UST in 2022 and the managed, gradual retirement of Binance’s BUSD in 2023 have highlighted the diverse risks and regulatory pressures in the stablecoin space.

While UST’s crash was a catastrophic event driven by inherent design flaws and market pressures, BUSD’s retirement was a more controlled process initiated by regulatory action. By examining these contrasting scenarios, we can better understand the range of issues facing stablecoin issuers, from algorithmic stability mechanisms to regulatory compliance. The lessons learned from these events are crucial for investors, developers, and policymakers as the industry continues to navigate the complex landscape of digital assets and increasing regulatory scrutiny.

Binance

Token: BUSD

Peak Supply: $23,361,438,102

Binance’s BUSD was a popular USD-pegged stablecoin issued by Paxos Trust in partnership with Binance, following on USDC and USDT in supply. In February 2023, the New York Department of Financial Services (NYDFS) ordered Paxos to stop minting new BUSD tokens, citing “several unresolved issues related to Paxos’ oversight of its relationship with Binance.” This regulatory action effectively began the phaseout of BUSD.

Following the NYDFS order, Paxos announced it would end its relationship with Binance for BUSD issuance, while continuing to support existing tokens through at least February 2024. Binance initially stated BUSD would “slowly wind down over time,” but in August 2023 announced plans to gradually cease support for BUSD products. The exchange urged users to convert their BUSD holdings into other assets by February 2024.

By November 2023, Binance confirmed it would halt support for BUSD on December 15, 2023. The exchange stated that users could still redeem their BUSD until February 2024, after which any remaining BUSD balances would be automatically converted to FDUSD, a stablecoin issued by First Digital Limited. This marked the final stage in the retirement of what was once the third-largest stablecoin by market capitalization.

The BUSD situation offers several lessons for the crypto industry. It highlights the growing regulatory scrutiny of stablecoins and the importance of proper compliance measures. The case also highlights the risks of relying heavily on a single stablecoin or exchange, as many users were affected by the sudden phaseout. Furthermore, it demonstrates the need for clear communication and transition plans when major changes occur in cryptocurrency ecosystems. Lastly, the BUSD retirement emphasizes the importance of diversification in the stablecoin market and the potential benefits of regulatory-compliant alternatives.

Terra

Token: UST

Peak Supply: $18,708,520,935

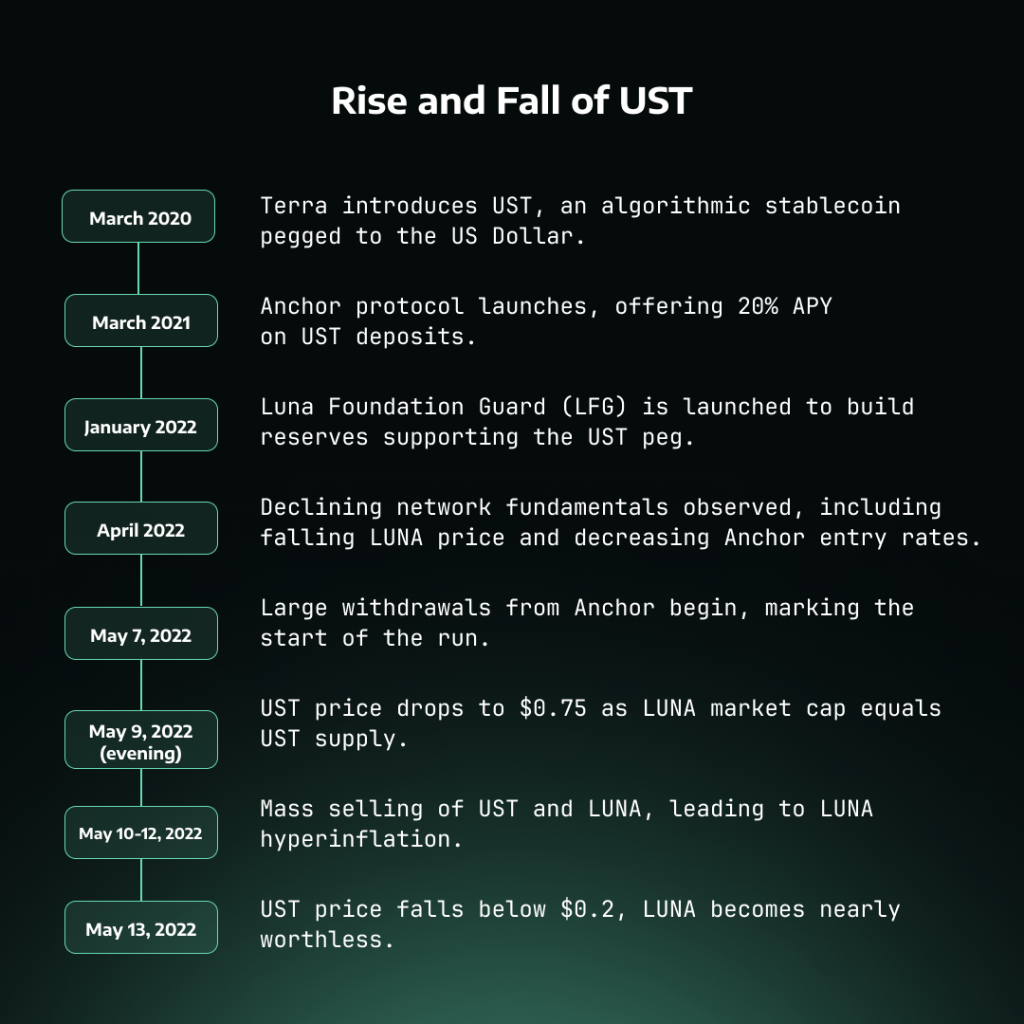

The collapse of Terra’s algorithmic stablecoin UST in May 2022 was one of the most significant events in the cryptocurrency industry, wiping out $50 billion in market value over just three days. At the center of the ecosystem was Anchor, a lending protocol offering unsustainably high 20% interest rates on UST deposits. This attracted massive inflows, driving up demand for UST and its sister token LUNA. However, the subsidies required to maintain these rates became increasingly unsustainable.

The run on Terra began on May 7, 2022, when large depositors started withdrawing funds from Anchor and selling UST. Despite efforts by Terraform Labs to defend the peg, the UST price plummeted to $0.75 on May 9 as withdrawals accelerated. UST’s design allowed holders to swap it for $1 worth of LUNA, leading to a “death spiral” where LUNA was rapidly minted and its price collapsed. By May 13, UST had fallen below $0.2 and LUNA was essentially worthless.

The Terra Luna collapse offered several important lessons for the cryptocurrency industry:

- It highlighted the inherent risks of algorithmic stablecoins, especially those not backed by sufficient reserves

- It demonstrated the dangers of unsustainably high yield offerings, which can create fragile ecosystems prone to rapid collapse

- The event underscored the importance of transparency and clear communication about risks, as many investors did not fully understand the complex mechanisms underlying Terra’s stability.

Analysis of the crash revealed that wealthier and more sophisticated investors were able to exit earlier and suffer smaller losses, while smaller retail investors were slower to react and incurred larger losses. The complexity of Terra’s system made it difficult for many participants to fully understand the risks. While blockchain technology allowed investors to monitor large transactions, this information asymmetry ultimately exacerbated rather than mitigated inequalities during the crash.

Current Market Overview

The stablecoin market exhibits a high degree of concentration, with Tether’s USDT and Circle’s USDC collectively dominating 95.8% of the total market capitalization. This duopoly highlights the pivotal role these centralized, fiat-backed stablecoins play in providing liquidity and stability to cryptocurrency markets. Their widespread adoption and perceived stability have made them cornerstone assets in the crypto ecosystem, facilitating trading, serving as a store of value, and enabling various DeFi applications.

Beyond the dominance of USDT and USDC, a diverse ecosystem of smaller stablecoins has emerged, collectively representing a market capitalization of $6.8 billion. This diverse segment of the stablecoin ecosystem showcases a wide array of designs, each attempting to carve out its own niche in the rapidly evolving digital asset landscape.From fiat-backed tokens like FDUSD to more complex, algorithmic models such as FRAX.

These smaller players are not just imitating their larger counterparts but are actively innovating in areas such as collateralization methods, blockchain interoperability, and governance structures. For example, some are exploring cross-chain compatibility to enhance liquidity and accessibility, while others are implementing novel stability mechanisms that blend algorithmic controls with collateral backing. This experimentation is crucial for the long-term development of the stablecoin sector, as it stress-tests different models and potentially uncovers more efficient or resilient designs. As the stablecoin market matures, these innovations could play a pivotal role in shaping regulatory frameworks and user adoption patterns, potentially influencing the direction of the entire cryptocurrency ecosystem.

Distribution Across Chains

The distribution of stablecoins across different blockchain networks reveals interesting patterns in user preferences and technological adoption. Ethereum maintains a commanding lead, hosting the majority of stablecoin value. This dominance likely stems from Ethereum’s first-mover advantage in the smart contract space and its DeFi ecosystem.

Tron emerges as a strong second in stablecoin distribution, significantly ahead of other alternative networks. This position is primarily due to the massive amount of USDT issued on the Tron blockchain, with over $61.8 billion in USDT supply. Tether’s decision to leverage Tron’s network for a substantial portion of its stablecoin issuance has catapulted Tron to this prominent position. This strategic move by Tether, combined with Tron’s low transaction fees, has made it an attractive option for USDT transactions, particularly for smaller value transfers or in regions where transaction costs are a significant concern.

The remaining distribution across chains like BSC, Arbitrum, Solana, and others indicates a gradual diversification of the stablecoin ecosystem. This spread across multiple chains reflects the broader trend of multi-chain strategies in the crypto space, as projects and users seek to optimize for factors like speed, cost, and specific ecosystem benefits.

Growth Trends

The stablecoin market has exhibited remarkable growth, particularly since 2020. The market cap chart illustrates a trajectory from relative obscurity in 2016-2019 to explosive growth beginning in 2020. This growth coincides with the broader DeFi boom and increased institutional interest in cryptocurrencies.

Several key phases are evident:

- Initial slow growth (2016-2019): Limited adoption and use cases.

- Rapid expansion (2020-2021): Coinciding with DeFi summer and bull market.

- Peak and correction (2022): Reflecting broader crypto market dynamics and specific events like the Terra/LUNA collapse.

- Recovery and continued growth (2023-2024): Indicating resilience and continued demand for stablecoins.

This growth pattern suggests that stablecoins have transitioned from a niche product to an essential component of the crypto ecosystem, serving critical functions in trading, yield generation, and as a store of value during market volatility.

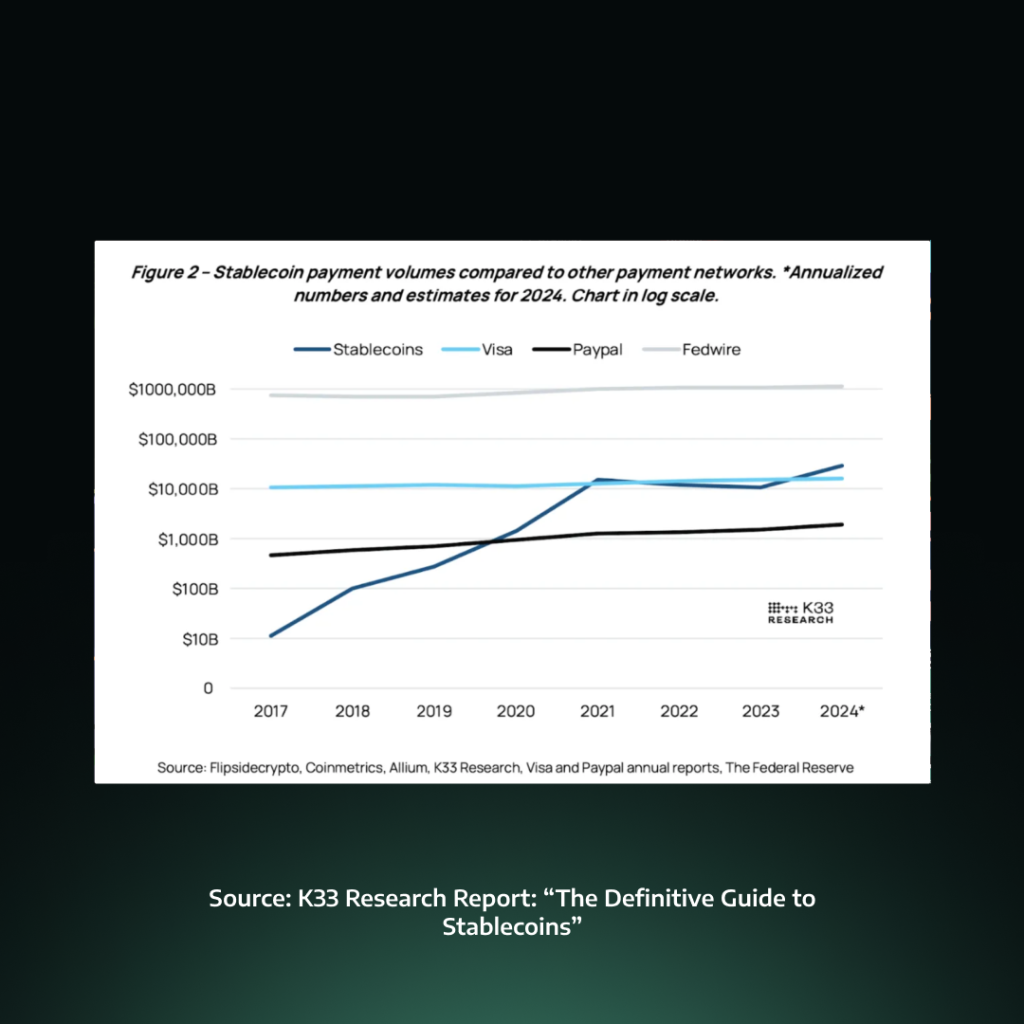

Transaction Volumes Compared to Web2 Solutions

Perhaps the most striking indicator of stablecoins’ growing importance is their transaction volume compared to traditional payment networks. The chart comparing stablecoin volumes to Visa, PayPal, and Fedwire reveals a rapid ascent of stablecoin usage.

Starting from a relatively low base in 2017, stablecoin transaction volumes have grown exponentially, surpassing PayPal’s volume by 2020 and rivaling Visa’s volume by 2021. Projections for 2024 suggest stablecoin volumes may even exceed Visa’s, though still falling short of Fedwire’s massive interbank transfer volumes.

This comparison underscores the disruptive potential of stablecoins in the global payments landscape. It’s important to note, however, that these volumes likely represent different types of transactions – stablecoin volumes may include more trading and DeFi activity, while Visa’s volumes primarily represent consumer spending.

Case Studies

Real-World Asset-Backed Stablecoins

Real-World Asset (RWA) backed stablecoins have become the dominant form of stablecoins over the past eight years, evolving beyond their initial fiat-backed iterations. While many maintain a 1:1 backing with US dollars in bank accounts, the ecosystem has expanded to include diverse asset backings. For instance, Paxos Gold (PAXG) offers exposure to physical gold within the crypto ecosystem, demonstrating the RWA model’s flexibility in accommodating various store-of-value preferences.

Despite this diversification, fiat-backed tokens like Tether’s USDT remain the most widely adopted, serving as essential tools for trading and hedging against crypto market volatility. The success of USDT has inspired other major players like Circle’s USDC and Binance’s BUSD, each backed by their own pools of real-world assets.

The peg stability of these RWA-backed stablecoins shows their relative success in maintaining value close to $1. However, the graph above also reveals periods of volatility, particularly in recent years. This volatility underscores the ongoing challenges in maintaining a stable peg, even with RWA backing. It’s important to note that USDY is a non-rebasing token. Its apparent increase in price does not indicate a deviation from its peg. Instead, this price movement reflects the accumulation of yield for USDY token holders.

The centralized nature of RWA-backed stablecoins presents both advantages and challenges. While they offer high stability and facilitate large-scale institutional investments, they require issuers to maintain traditional banking relationships and operate through regulated entities. This centralization has led to concerns about transparency, trust, and potential censorship. Issuers have responded with voluntary attestation reports and audits, but controversies persist, particularly regarding the composition and adequacy of reserves.

As the stablecoin landscape continues to evolve, the future of RWA-backed tokens will likely be shaped by regulatory developments in major jurisdictions and ongoing innovations in backing mechanisms. The ability of these stablecoins to bridge traditional finance and crypto markets remains unparalleled, though recent incidents involving address blacklisting have highlighted the potential for censorship. The challenge moving forward will be to balance the stability offered by RWA backing with the decentralization ethos of the broader crypto ecosystem, all while navigating an increasingly complex regulatory environment.

Tether

Token: USDT

Supply: $119,147,677,308

Yield: N/A

Network(s): Ethereum, Tron, Solana, Optimism + 65 Other chains

Tether’s USDT is one of the oldest and largest stablecoin by market capitalization. Launched in 2014 by Tether Limited, USDT was created to bridge the gap between cryptocurrencies and traditional fiat currencies. It is designed to maintain a 1:1 peg with the US dollar, offering the benefits of cryptocurrency transactions while minimizing price volatility.

As of September 2024, USDT has a market capitalization of approximately $119 billion, making it the third-largest cryptocurrency overall and the dominant stablecoin. Its daily trading volume often exceeds that of Bitcoin, highlighting its crucial role in the crypto ecosystem. USDT is widely supported across multiple blockchains, including Ethereum, Tron, and Solana, which enhances its accessibility and utility.

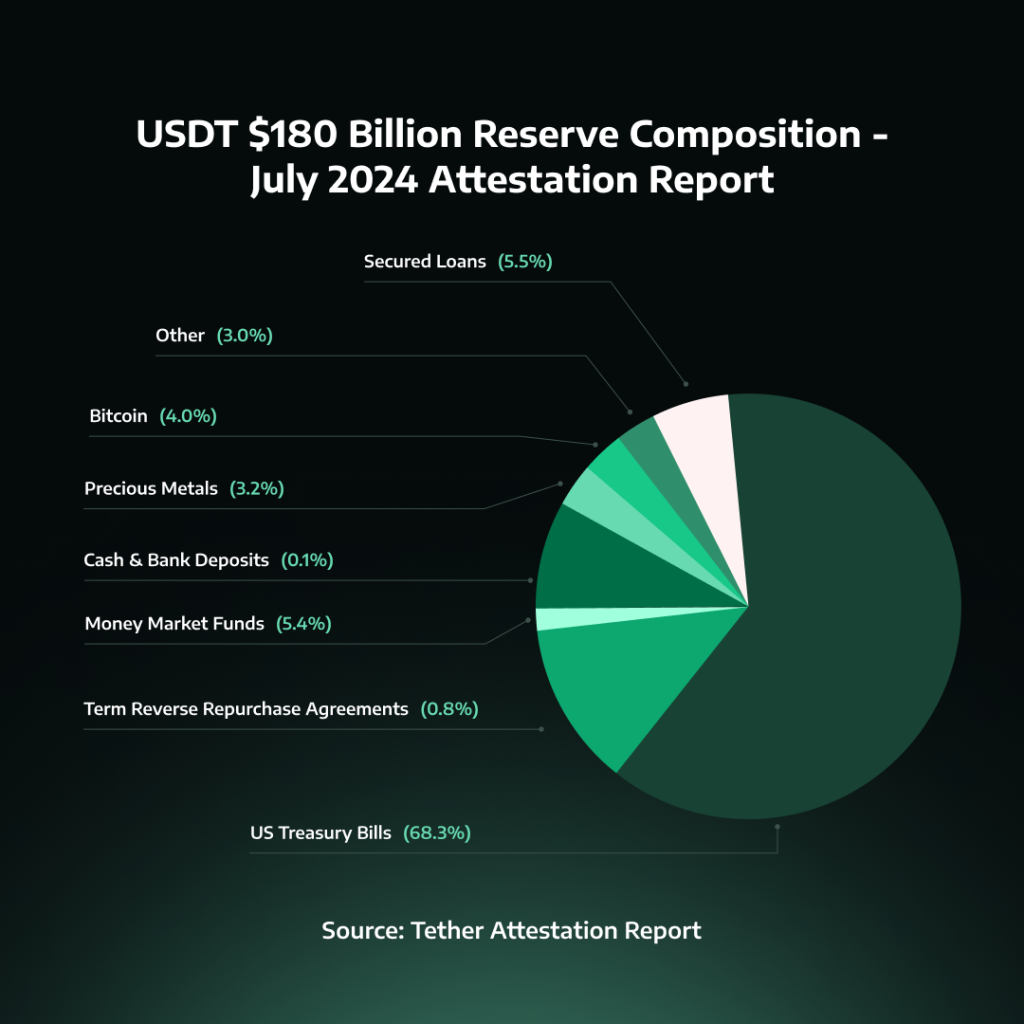

Tether’s backing mechanism has been a subject of both innovation and controversy. The company claims that each USDT token is backed by reserves consisting of cash, cash equivalents, and other assets. As of the latest attestation report (June 2024), approximately 68% of Tether’s reserves are held in U.S. Treasury Bills, with the remaining reserves diversified across secured loans (5.5%), Bitcoin (4%), and various other investments including corporate bonds and precious metals.

This diverse reserve composition has drawn scrutiny from regulators and the crypto community. In response, Tether has increased its transparency efforts, providing quarterly attestation reports and daily updates on its reserve holdings. However, some critics continue to call for more comprehensive audits.

Despite facing challenges, including a brief de-pegging incident in 2022 where USDT dropped to $0.95 due to the terraUSD crash causing market panic. Tether demonstrated resilience during this time with the stablecoin quickly recovering from its peg, reinforcing market confidence in its stability. USDT’s widespread adoption in cryptocurrency trading, its use in cross-border transactions, and its integration into various DeFi protocols underscore its importance in the digital asset ecosystem.

Looking ahead, Tether faces both opportunities and challenges. The growing demand for digital dollar equivalents in global finance positions USDT well for continued growth. However, evolving regulations around stablecoins, particularly in the United States and Europe, may require Tether to adapt its operations and increase its regulatory compliance efforts. As the stablecoin market matures, Tether’s ability to maintain its market leadership while addressing transparency concerns and navigating regulatory landscapes will be crucial to its long-term success.

Circle

Token: USDC

Supply: $36,203,104,616

Yield: N/A

Network(s): Ethereum, Arbitrum, Base, Celo, NEAR, Solana, Hedara + 10 more

Circle’s USD Coin (USDC), launched in September 2018 through a collaboration between Circle and Coinbase, is one of the leading stablecoin in the cryptocurrency ecosystem. Founded by Jeremy Allaire in 2013, Circle initially aimed to simplify digital currency transactions. The introduction of USDC marked a significant step towards addressing regulatory concerns in the stablecoin space, with the Centre Consortium, a joint venture between Circle and Coinbase, overseeing its governance and establishing standards for fiat representation on the internet.

USDC distinguishes itself through its commitment to regulatory compliance and transparency. Its cornerstone is a 1:1 backing, where Circle maintains an equivalent amount in cash and highly liquid, short-term U.S. government securities for every USDC in circulation.

The price stability of USDC is one of its key features, despite small fluctuations, USDC has maintained an incredibly tight peg to the US dollar, rarely deviating more than 5-10 basis points from its $1.00 target. However there have been a few instances where the peg has been compromised, with the most recent example coming in 2023 with the collapse of Silicon Valley Bank where they had $3.3 billion in cash reserves. As USDC is used as backing for other stables such as DAI, USDD and USDP, this depeg event also affected the pegs of these tokens. Circle’s USDC managed to regain its peg shortly after and has not experienced a similar incident since, but it highlights the risk associated with centralized issuers.

USDC’s market position is strong, with availability in over 180 countries and support across 15 blockchain networks, with most supply on Ethereum. Key statistics highlight its significant adoption, including a monthly transfer volume of $44M, 2.9M monthly active addresses, and 17M holders.

The company aims to position it as a platform for building new financial systems, the digital currency of choice for institutional investors, and a tool for frictionless, borderless value exchange. Circle’s expansion into euro-pegged stablecoins with EURC, compliant with MiCA regulations, demonstrates its intent to diversify and adapt to regional regulatory frameworks. As the digital asset ecosystem continues to evolve, USDC’s role in facilitating cross-border transactions and providing a stable digital representation of fiat currency will become increasingly relevant.

Ondo Finance

Ondo Finance is a DeFi platform that aims to bridge traditional finance with blockchain technology. Founded with the mission of making institutional-grade financial products and services accessible to a broader audience, Ondo leverages blockchain technology to improve both the infrastructure and accessibility of financial products. The company’s approach combines innovative blockchain solutions with best practices from traditional finance, including investor protections, transparent reporting, and regulatory compliance.

At the core of Ondo’s offerings are two main products: USDY (US Dollar Yield) and OUSG (Ondo Short-Term US Government Treasuries). These products cater to different investor needs and regulatory requirements, providing unique solutions in the tokenized asset space. Here’s a brief comparison:

USDY

Token: USDY

Supply: $396,396,512

Yield: 5.35%

Network(s): Ethereum, Solana, Sui, Aptos, Arbitrum, Mantle, Mantra, and Cosmos.

USDY is Ondo’s decentralized, overcollateralized stablecoin designed to maintain a soft peg to the US dollar. It represents a significant innovation in the stablecoin space by offering a yield-bearing alternative to traditional stablecoins. USDY is backed by a combination of short-term US Treasuries and bank demand deposits, providing a stable and secure foundation for its value.

One of the key features of USDY is its dual token structure. It’s available in two versions: USDY, an accumulating token whose price increases as yield accrues, and rUSDY, a rebasing token that maintains a constant $1.00 price while increasing the token balance to reflect yield. This structure allows for flexibility in how users can benefit from the yield generated by the underlying assets.

USDY incorporates several institutional-grade investor protections, setting it apart from many other crypto assets. These include bankruptcy remoteness, where the issuing entity is structured to protect token holders in case of bankruptcy of related entities, and oversight by a third-party collateral agent. Additionally, USDY implements a unique cohort system and a 40-50 day restricted period before token minting to ensure compliance with regulatory requirements.

The product is designed to be accessible to a global audience of non-US individual and institutional investors, combining the utility of a stablecoin with the yield potential of short-term US Treasuries. This makes USDY an attractive option for those seeking to optimize their idle capital in the crypto space while maintaining a stable value pegged to the US dollar.

OUSG

Token: OUSG

Supply: $226,349,355

Yield: 5.36%

Network(s): Ethereum, Solana, Polygon

OUSG provides more direct tokenized exposure to short-term US Treasuries. The majority of OUSG’s portfolio is invested in the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), with additional allocations to other high-quality, liquid assets. This product is designed to offer the safety and stability of US Treasury investments with the added benefits of blockchain technology.

A standout feature of OUSG is its instant, 24/7/365 minting and redemption capabilities. This allows qualified investors to quickly enter or exit positions, providing a level of liquidity typically unavailable in traditional Treasury investment products. Like USDY, OUSG is available in both accumulating (OUSG) and rebasing (rOUSG) versions, catering to different investor preferences for yield accrual.

OUSG targets a more specific investor base compared to USDY. It’s available to Qualified Purchasers globally, which typically includes high-net-worth individuals and large institutional investors. This targeting allows OUSG to operate under certain exemptions from US securities regulations, enabling features like instant transactions that may not be possible with more broadly accessible products.

First Digital

Token: FDUSD

Supply: $2,511,567,480

Yield: N/A

Network(s): Ethereum, Binance

First Digital Labs, a subsidiary of Hong Kong-based First Digital Group, launched First Digital USD (FDUSD) in June 2023 as a new stablecoin aimed at restoring confidence in the crypto market. First Digital Labs has quickly established FDUSD as a significant player in the stablecoin space. The launch of FDUSD came at a critical time, following the collapse of several prominent stablecoins and amid growing regulatory scrutiny of the crypto industry.

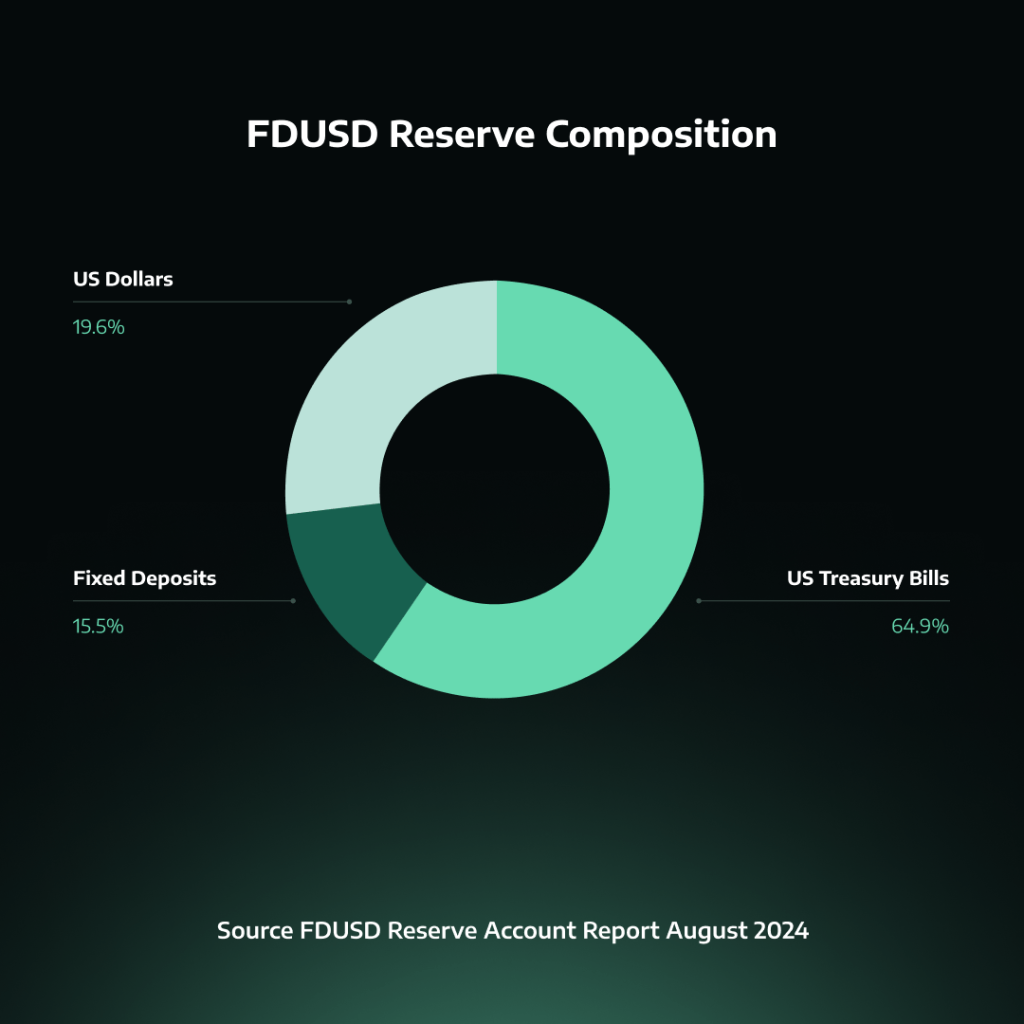

FDUSD is designed as a fully collateralized stablecoin, maintaining a 1:1 peg with the US dollar. Its stability is underpinned by a reserve of liquid assets, primarily consisting of short-term US Treasury bills and a combination of fixed deposits and cash. These reserves are held in custody by a public trust company registered in Hong Kong and in various financial institutions across multiple countries, including Hong Kong, Singapore, Australia, Canada, Luxembourg, and the United States. This diverse geographic spread of reserve holdings aims to enhance the security and stability of FDUSD.

One of the most notable developments for FDUSD has been its integration with Binance, the world’s largest cryptocurrency exchange by trading volume. Following the deprecation of Binance USD (BUSD) due to regulatory pressures, Binance has adopted FDUSD as its primary stablecoin. This partnership has significantly boosted FDUSD’s visibility and liquidity, rapidly increasing its market capitalization and trading volume. Binance’s support, including the introduction of zero-fee trading for FDUSD pairs, has been instrumental in driving adoption among crypto traders and investors.

The stability mechanism of FDUSD relies on market arbitrage. When the price of FDUSD deviates from its $1 peg, arbitrageurs can profit by minting or redeeming FDUSD directly with First Digital Labs, effectively pushing the market price back towards the peg. However, it’s worth noting that direct redemption is currently limited to institutional clients who have completed KYC procedures, while retail users must rely on secondary market liquidity for conversions.

Transparency and regular audits are key components of FDUSD’s strategy to build trust. First Digital Labs publishes monthly reserve reports, with attestations provided by Prescient Assurance, a US-based accounting firm. These reports aim to assure users that each FDUSD token is fully backed by reserves. However, some analysts have raised concerns about the lack of detailed information regarding the specific banks holding the cash reserves and the potential risks associated with asset segregation in the event of issuer insolvency.

Usual

Usual introduces two main stablecoin products, USD0 and USD0++, each designed to serve different purposes within the DeFi ecosystem while maintaining a strong connection to traditional financial assets. Usual’s approach seeks to address key issues in the current stablecoin market, including security, efficiency, and fairness, by leveraging the stability of US Treasury Bills and overnight repos while redistributing value to users through its governance token, USUAL.

USD0

Token: USD0

Supply: $225,651,265

Yield: N/A

Network(s): Ethereum

USD0, Usual’s primary stablecoin offering, is designed as a Liquid Deposit Token (LDT) that is fully backed by Real-World Assets with ultra-short maturity. It serves as a safer and more transparent alternative to traditional stablecoins like USDT and USDC. USD0 is backed 1:1 by RWAs, primarily US Treasury Bills and overnight repos, ensuring unparalleled stability and security. This backing mechanism sets USD0 apart from many competitors, as it is not exposed to the fractional reserve system of commercial banks, thereby reducing systemic risks that have plagued other stablecoins in the past.

One of the key features of USD0 is its transparency. The protocol maintains real-time transparent reserves, avoiding fractional reserve practices that have been a point of concern with some centralized stablecoin issuers. This commitment to transparency allows users to have greater confidence in the stability and backing of their holdings. Additionally, USD0 is designed to be permissionless and easily transferable, facilitating seamless integration within the broader DeFi ecosystem.

USD0 also serves as an aggregator for various US Treasury Bill tokens, enhancing liquidity and accessibility in the DeFi space. This function allows Usual to bridge the gap between traditional finance and DeFi, providing users with exposure to the stability of government securities while maintaining the flexibility and programmability of blockchain-based assets. By doing so, USD0 aims to create a more efficient and interconnected financial ecosystem that benefits both individual users and the broader DeFi landscape.

USD0++

Token: USD0++

Supply: $185,000,195

Yield: Yes

Network(s): Ethereum

USD0++, an enhanced version of USD0, functions as a Liquid Bond Token (LBT) and can be considered an “enhanced and boosted 4-year DeFi T-bill.” It is designed to offer users the potential for higher yields while maintaining a strong connection to the stability of USD0. The core mechanism of USD0++ involves locking USD0 for a period of 4 years, ensuring principal protection and creating a basis for additional yield generation.

One of the key features of USD0++ is its yield generation mechanism. It offers yield in USUAL tokens, aiming to outperform the risk-free rate while simultaneously guaranteeing the risk-free yield. This dual approach to yield allows users to potentially benefit from the success and growth of the Usual protocol while maintaining a baseline of returns tied to the underlying USD0. To further enhance the appeal and security of USD0++, Usual has implemented a Base Interest Guarantee (BIG) mechanism, which ensures a minimum yield equal to the actual risk-free rate, paid in USD0.

Despite the 4-year lock-up period of the underlying USD0, USD0++ remains liquid through secondary market trading. This liquidity feature allows users to exit their positions before the maturity date if needed, providing flexibility that is often lacking in traditional time-locked financial products. The trading of USD0++ on secondary markets also creates opportunities for price discovery and potentially allows users to capture additional value based on market dynamics and perceptions of the Usual protocol’s future success.

USD0++ is a unique approach to combining the stability of stablecoins with the yield-generating potential of more speculative DeFi assets. By offering exposure to protocol success through USUAL token rewards while maintaining a strong connection to the stability of USD0, Usual aims to create a financial product that appeals to both conservative and yield-seeking users in the DeFi space. This balanced approach could potentially attract a wider range of participants to the Usual ecosystem, contributing to its growth and liquidity over time.

Anzen

Token: USDz

Supply: $32,681,943

Yield: 18.5%

Network(s): Ethereum, Arbitrum, Base, Blast, Manta

Anzen Finance is a protocol that aims to bring RWA yields to the onchain. The platform’s core offering is USDz, a stablecoin backed by a diversified portfolio of private credit assets. Unlike traditional stablecoins pegged directly to fiat currencies, USDz represents tokenized real-world assets, providing users with exposure to stable, off-chain yields within the DeFi space.

USDz, Anzen Finance’s native stablecoin, is designed to maintain a stable value relative to the US dollar while offering users the potential for yield generation. Each USDz token is backed on a 1:1 basis with SPCT (Secured Private Credit Token), a permissioned token representing tokenized real-world assets. This structure allows USDz to combine the stability of traditional finance with the efficiency and accessibility of DeFi.

The protocol implements several mechanisms to maintain the stability and utility of USDz. Users can mint USDz by depositing accepted backing assets, primarily USDC. The minted USDz can then be staked to receive sUSDz, which automatically accrues staking rewards over time. This staking mechanism provides an incentive for users to hold USDz and participate in the protocol’s ecosystem.

Anzen Finance also emphasizes transparency in its operations. All transactions related to the issuance and redemption of USDz are recorded on the blockchain, allowing users to verify the solvency of the stablecoin at any time. The protocol provides a transparency page where users can view the current state of the reserves backing USDz.

“USDz is a multichain digital dollar backed by a diversified portfolio of credit assets. The RWA portfolio is designed to mitigate crypto volatility and enable sustainable rewards through all market cycles. Anzen’s unique and differentiated platform is a core building block in DeFi that all users can build on top of.”

Ben Shyong

Founder of Anzen

Angle

Token: USDA

Supply: $31,637,004

Yield: 7.7%

Network(s): Ethereum, Polygon, Optimism, Arbitrum, Base +10 more

Angle Finance aims to create stable, capital-efficient stablecoins pegged to various fiat currencies. The protocol’s innovative approach combines aspects of over-collateralization with capital efficiency, allowing users to mint and burn stablecoins at oracle prices with minimal fees. This design aims to provide full convertibility between stable assets and collateral, making the protocol highly liquid and efficient compared to traditional stablecoin models.

USDA, Angle’s dollar-pegged stablecoin, offers a combination of reliability, yield, liquidity, and transparency. It is designed to tackle main challenges faced by stablecoin users, including fears of depegging, “frozen” assets in wallets, lack of yield sharing from backing assets, and opaque reserves. USDA is available across multiple blockchain networks, providing users with liquidity comparable to USDC while incorporating additional features and benefits.

USDA’s stability and reliability are reinforced by its diverse collateral backing, totaling over $35 million across various blockchain networks and assets. This backing includes significant allocations to established DeFi protocols and stablecoins, such as stakeUSDC on Ethereum and USDC across multiple chains. This diversified approach, combining on-chain DeFi assets with off-chain traditional finance instruments, provides a balanced risk profile and enhances USDA’s resilience to depeg events.

One of USDA’s key features is its native Savings solution, which allows users to earn passive yield on their stablecoin holdings. By depositing USDA into Angle’s Savings solution (known as stUSD), users can automatically accrue rewards generated from the protocol’s collateral and lending activities. This yield comes from returns on Real-World Assets like Treasury bills and tokenized securities, as well as DeFi yield-bearing assets and interest rates paid by USDA borrowers.

To ensure stability, USDA uses advanced anti-depeg mechanisms based on Angle’s proprietary Price Stability Module (also known as The Transmuter). This risk management framework, developed from years of research and insights gained from recent stablecoin depeg incidents, allows all USDA or stUSD holders to redeem their tokens for any of the protocol’s collateral assets in the event of a black swan scenario.

USDA also offers borrowing and leverage features, allowing users to borrow the stablecoin and get leverage on assets like Liquid Staking Tokens and Liquid Restaking Tokens through integration with platforms such as Morpho Blue. Additionally, Angle Protocol provides full transparency of USDA’s collateral reserves through a real-time balance sheet accessible on their website, enabling users to verify the backing of their stablecoins at any time.

By combining USDA with EURA, Angle Finance aims to establish itself as a hub for efficient on-chain foreign exchange trading. The protocol has developed systems to minimize slippage for on-chain forex trades, potentially offering users the ability to conduct cross-currency transactions at rates competitive with traditional forex markets. This development could unlock new opportunities in the DeFi space for cross-border transactions, remittances, and forex trading.

Verified

Token: USDV

Supply: $1,516,183

Yield: N/A

Network(s): Ethereum, Binance, Avalanche, Arbitrum, Optimism, Polygon, Viction

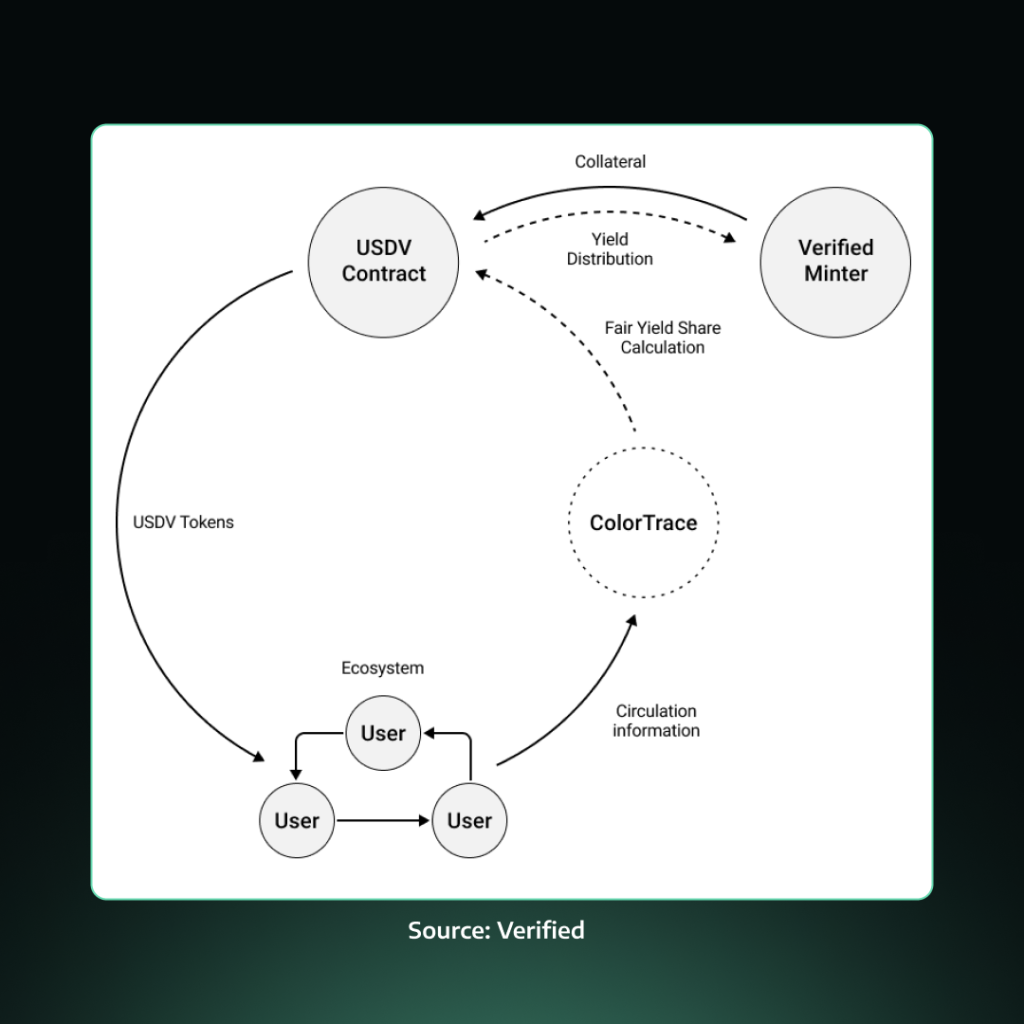

Launched in November 2023, the Verified Foundation aims to create a more equitable and transparent stablecoin environment through its native token, USDV. The foundation’s approach combines the stability of real-world assets with innovative blockchain technology to address current limitations in the stablecoin market.

USDV is a community-driven stablecoin fully backed by tokenized US T-bills. As an ERC-20 compatible token built on the Omnichain Fungible Token (OFT) Standard, USDV operates across multiple blockchain networks, including Ethereum, BNB Smart Chain, Avalanche, Arbitrum, and Optimism. Each USDV token is pegged 1:1 to the US dollar, providing a stable store of value and medium of exchange.

One of USDV’s key features is its use of Matrixport’s Short-term Treasury Bill Token (STBT) as its initial underlying reserve asset. STBT is an ERC-1400 standard token pegged 1:1 to $1 of net asset value (NAV), fully backed by short-term T-bills and secured reverse repurchase agreements. This backing provides USDV with enhanced stability and transparency, as all transactions can be tracked on-chain and verified through Chainlink’s Proof of Reserves system.

USDV employs the ColorTrace algorithm, developed by LayerZero Labs, to ensure fair and transparent reward distribution among verified minters. This system enables minters to mark their circulating tokens and access rewards derived from on-chain reserves without dispute. The ColorTrace technology addresses the challenge of attribution for fungible tokens, creating a more equitable distribution across all contributors to the ecosystem’s success.

The USDV protocol incorporates several mechanisms to maintain stability and transparency. These include a reminting process that allows verified minters to increase their vault share without locking new assets, a redemption process for converting USDV back to underlying assets, and various fees to manage the system’s economics. Additionally, USDV’s integration with LayerZero’s OFT Standard enables seamless operation across multiple blockchain networks, potentially allowing it to become one of the most widely available stablecoins across different chains.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins have emerged as a decentralized alternative to traditional fiat-backed stablecoins, aligning more closely with the core principles of trustlessness and decentralization in the crypto ecosystem. These stablecoins are backed by other digital assets such as Bitcoin, Ethereum, or other tokenized assets, and are typically created through decentralized protocols that enable the issuance and redemption of tokens. The process involves locking digital assets as collateral in smart contracts to mint new stablecoins. A prominent example of this model is DAI, issued by MakerDAO.

The price stability of these stablecoins reveals variations in peg maintenance across different protocols. USC (Orby Network) demonstrates significant volatility, exhibiting some of the largest price fluctuations among the depicted stablecoins. In contrast, USDe (Ethena) has maintained its peg remarkably well, showing minimal deviation from the $1 mark. Other stablecoins display varying degrees of stability, with some like USD+ (Overnight Finance) and VAI (Venus Protocol) showing relatively consistent performance.

Governance of these stablecoin protocols is often managed through DAOs, utilizing governance tokens to make decisions. While this approach enhances censorship resistance, it can lead to slower and potentially less efficient operations compared to centralized models. A key challenge for crypto-collateralized stablecoins is managing the volatility of their backing assets. To mitigate this risk, many protocols implement over-collateralization, requiring users to lock up more value in crypto assets than the stablecoins they mint. For instance, the Maker protocol mandates a 150% collateral ratio for borrowing DAI. This approach, while ensuring stability, results in capital inefficiency.

To address these challenges, some protocols have begun accepting other, more stable cryptocurrencies as collateral, including centralized stablecoins like USDC. This strategy, employed by projects like DAI and FRAX, aims to reduce volatility risk but has faced criticism for potentially reintroducing centralization risks. As the sector evolves, new approaches are being explored, including the use of delta-neutral derivative positions to maintain price stability. The price stability chart underscores the importance of these ongoing innovations, as protocols strive to achieve the delicate balance between decentralization and stability.

Orby Network

Token: USC

Supply: $18,300,000

Yield: 18% via Stability Pool

Network(s): Cronos

Orby Network is a decentralized lending protocol on the Cronos blockchain that allows users to borrow USC, its native stablecoin, without ongoing interest charges. The protocol enables users to deposit accepted collateral types into “shuttles” (similar to collateralized debt positions) to create USC. Orby’s approach replaces continuous interest with a one-time borrowing fee and a refundable liquidation reserve. This structure aims to provide more predictable costs for borrowers while maintaining the protocol’s stability.

USC is an overcollateralized, soft-pegged stablecoin designed to maintain a 1:1 value with the US dollar. It serves as a store of value, unit of exchange, and unit of account within the Orby ecosystem. USC’s stability is maintained through various mechanisms, including market operations, a floating base rate, and a redemption process. The protocol allows users to always exchange 1 USC for $1 worth of underlying collateral, which helps support the peg, especially when USC trades below $1. While USC itself is not natively yield-bearing, users can earn yields by depositing their USC into the Stability Pool, providing an opportunity for passive income.

To ensure the stability and security of USC, Orby employs a comprehensive risk management system. This includes a Stability Pool that acts as an immediate source of liquidity for liquidation events. In case of a liquidation, outstanding debt is offset by USC from the Stability Pool, with the collateral distributed among Stability Pool depositors. Additionally, Orby implements a “Recovery Mode” that activates when the Total Collateral Ratio (TCR) falls below a certain threshold, temporarily raising liquidation thresholds and blocking transactions that would further lower the TCR.

The introduction of USC as a borrowing option without ongoing interest represents a significant development in the DeFi landscape, particularly on the Cronos network. By eliminating continuous interest charges, Orby aims to encourage greater economic activity and capital efficiency. Users can borrow USC for extended periods without the burden of compounding interest, potentially creating new opportunities for using assets and participating in other DeFi activities. As part of the Cronos Accelerator Program, Orby Network and its USC stablecoin are positioned to play a key role in the growing DeFi ecosystem on Cronos, offering users a unique financial tool that balances stability, accessibility, and cost-effectiveness.

“Stablecoins are essential to DeFi, providing price stability and enabling broader financial activities like lending and borrowing. With USC, Orby Network ensures an over-collateralized, decentralized stablecoin that facilitates secure, seamless transactions while mitigating volatility. Our focus is on creating a reliable, transparent stablecoin that helps DeFi users manage volatility and engage with decentralized financial services more confidently.”

Orby Team

Ethena

Token: USDe

Supply: $2,607,358,346

Yield: 12%

Network(s): Ethereum, Solana

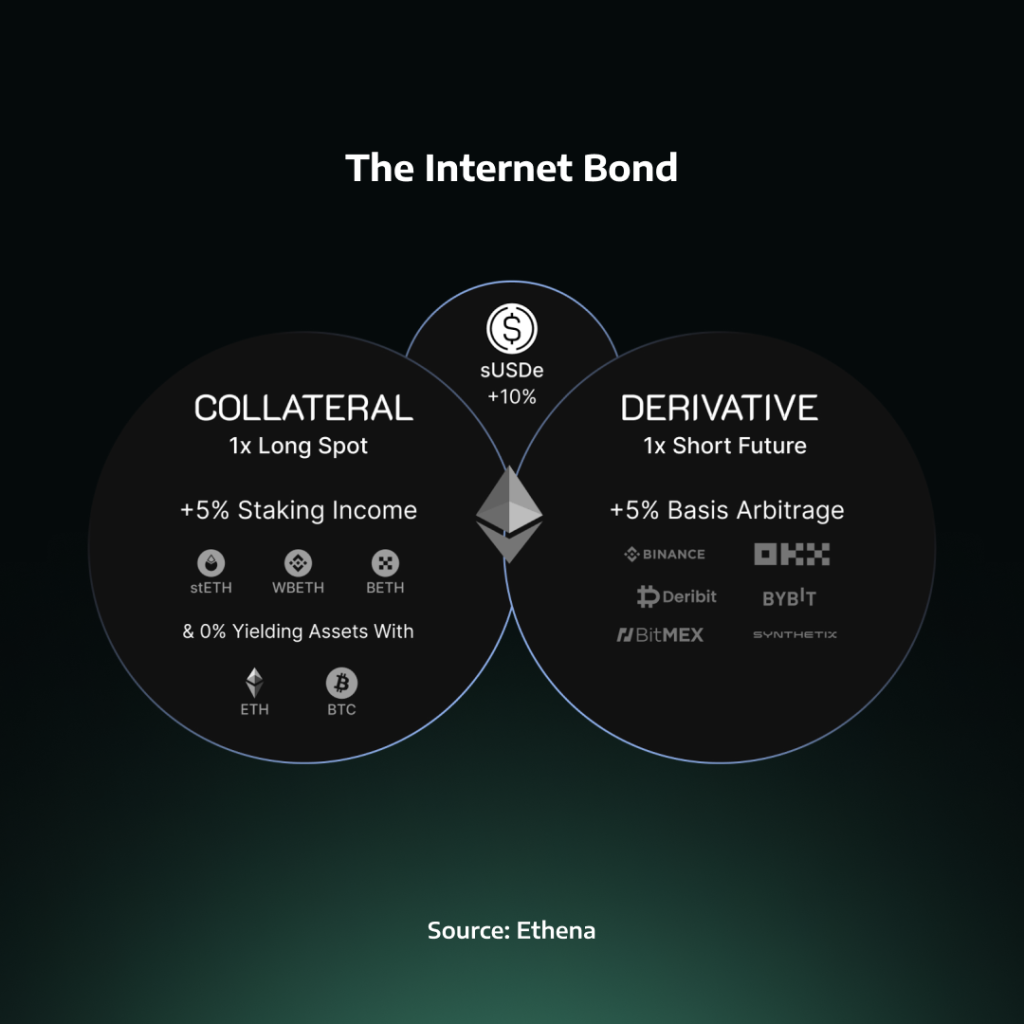

Ethena is a protocol that aims to create a censorship-resistant, scalable, and stable synthetic dollar called USDe. Ethena addresses the limitations of traditional stablecoins by leveraging a unique delta-neutral strategy. The protocol uses crypto assets like Ethereum and Bitcoin as collateral, combined with short positions in perpetual futures contracts to maintain the stability of the value in USD of the backing assets. Ethena’s approach aims to provide a solution that is independent of traditional banking infrastructure while offering attractive rewards to users.

USDe is a synthetic dollar asset that maintains a peg to the US dollar through “delta hedging”, meaning hedging the price risk of the underlying Ethereum and Bitcoin backing assets. Unlike traditional stablecoins backed by fiat reserves or overcollateralized crypto positions, USDe achieves its stability through a combination of long positions in crypto assets (primarily ETH and more recently BTC) and corresponding short positions in perpetual futures contracts. This delta-neutral strategy ensures that the value of USDe remains stable regardless of the underlying crypto asset’s price fluctuations.

When a KYC’d and whitelisted user mints USDe directly with Ethena they often use USDT. Ethena then typically buys BTC or ETH and hedges the corresponding price risk by shorting a perpetual contract. This creates a synthetic dollar position that is resistant to price movements in the underlying asset. The protocol uses off-exchange settlement (OES) providers to custody the collateral and manage exposure to centralized exchanges, greatly reducing counterparty risk.

Ethena’s USDe peg stability since launch demonstrates the protocol’s remarkable ability to maintain a stable peg to the US dollar, even amidst the market volatility of 2024. This stability addresses one of the primary concerns critics had initially, drawing parallels between USDe and the ill-fated Terra/UST. However, the data clearly shows these concerns were largely unfounded and it’s become clear the backing mechanisms of the two projects are fundamentally different. Since its launch in early 2024, USDe has consistently traded within a very tight range around $1, with minimal deviations of ±0.25% at most, which is impressively small for a stable asset in the crypto market.

sUSDe, the staked version of USDe, represents Ethena’s implementation of an “Internet Bond.” Users can stake their USDe tokens to receive sUSDe, which accrues yield over time. sUSDe follows the ERC-4626 Token Vault standard, ensuring composability with other DeFi protocols. The value of sUSDe increases relative to USDe as it accumulates rewards, allowing users to benefit from the protocol’s generated revenue being distributed every eight hours.

Ethena generates yield through three primary mechanisms:

- Staking Rewards: A portion of the yield comes from staking the collateral assets. For example, when ETH or liquid staking tokens like stETH are used as collateral, they generate staking rewards from the Ethereum network. These rewards include consensus layer inflation, execution layer fees, and MEV (Miner Extractable Value) capture.

- Funding Rates from Perpetual Futures: The majority of the yield is derived from the short positions in perpetual futures contracts. In crypto markets, long positions often pay funding to short positions due to the general bullish sentiment and desire for leverage. Ethena capitalizes on this by maintaining short positions and collecting these funding payments. Historically, funding rates for ETH and BTC have been positive, providing a consistent source of yield for the protocol.

- RWA Rewards: A proportion of Ethena’s backing assets earn US Treasury Bill rewards.

ListaDAO

Token: lisUSD

Supply: $36,032,408

Yield: 5.16%

Network(s): Binance

Lista DAO combines liquid staking and collateralized debt positions to offer users a unique yield-generating and borrowing platform. Launched in 2023, Lista DAO aims to address the capital efficiency problems faced by overcollateralized stablecoins while leveraging the benefits of Proof-of-Stake rewards and yield-bearing assets. The protocol operates on a dual-token model, featuring lisUSD, its decentralized stablecoin, and LISTA, its governance token.

lisUSD is a decentralized stablecoin that the protocol refers to as a “destablecoin.” Unlike traditional stablecoins that aim for absolute price parity with fiat currencies, lisUSD is designed to maintain a relatively stable value while allowing for some price fluctuations. This approach enables lisUSD to be more capital efficient and responsive to market conditions. The stability of lisUSD is maintained through a combination of overcollateralization and algorithmic mechanisms, including dynamic borrowing rates that adjust based on the stablecoin’s market price.

lisUSD is generated when users deposit supported collateral assets into the protocol, such as BNB, ETH, stablecoins, and other cryptocurrencies. The collateralization ratio for lisUSD is typically lower than that of other decentralized stablecoins, enhancing capital efficiency for borrowers. What sets lisUSD apart is its integration with Lista DAO’s liquid staking features. The protocol can generate yield on the deposited collateral through staking rewards and other DeFi strategies, which contributes to the overall sustainability of the system and potentially lowers borrowing costs for users.

One of the key innovations of lisUSD is its price stability mechanism. When lisUSD trades above its target price, the protocol incentivizes users to borrow more lisUSD by reducing borrowing interest rates and decreasing lisUSD farming rewards. Conversely, when lisUSD trades below its target, the protocol increases borrowing interest rates and lisUSD farming rewards to encourage users to buy lisUSD from the market to repay their debts. This dynamic approach allows for more organic price stabilization compared to traditional algorithmic stablecoins.

Lista DAO has also implemented an Algorithmic Market Operations (AMO) system for lisUSD, similar to Curve Finance’s MonetaryPolicy contracts for crvUSD. This system introduces a dynamic borrow rate that adjusts based on market conditions, further strengthening lisUSD’s price stability. The AMO takes into account factors such as the current price of lisUSD (determined through oracle data) and preset parameters to calculate the appropriate interest rate. This mechanism allows the protocol to respond more effectively to market pressures and maintain lisUSD’s peg without relying solely on user arbitrage.

Venus Protocol

Token: VAI

Supply: $4,765,896

Yield: 9.83%

Network(s): Binance

Venus Protocol is an algorithmic-based money market system built on the BNB Chain. Launched in 2020, it allows users to supply collateral, borrow assets, and mint synthetic stablecoins within a single decentralized platform. Venus combines elements from successful protocols like Maker and Compound, offering lending, borrowing, and stablecoin minting capabilities.

The protocol aims to improve in key areas like risk management, decentralization, and user experience. It introduces features such as isolated pools for safely onboarding long-tail assets, a multi-source price oracle to reduce single points of failure, and mechanisms to maintain the stability of its native stablecoin. Venus also implements a novel governance model with different proposal tracks to balance the needs for quick parameter adjustments and thorough review of major changes.

VAI is the primary stablecoin of the Venus Protocol, designed to maintain a peg to the US dollar. Users can mint VAI by utilizing vTokens from their underlying collateral that they had previously supplied to the protocol. This allows users to maximize the capital efficiency of their supplied collateral. The stability of VAI is maintained through a system of stability fees, which users incur when repaying their minted VAI.

The stability fee is calculated on a block-by-block basis and added to the user’s minted VAI balance. It consists of a base rate that users always pay, plus a variable rate that depends on VAI’s current price. This mechanism incentivizes users to either mint or burn VAI in response to price fluctuations, thereby contributing to its stability. When VAI’s price is below $1, the stability fee increases, encouraging borrowers to repay and reduce the circulating supply. Conversely, when VAI’s price is above $1, the fee remains at the base rate, potentially encouraging more minting.

Venus has implemented additional measures to support VAI’s stability. These include providing liquidity for the VAI/USDT pair on PancakeSwap to facilitate smoother transactions and mitigate market volatility. The protocol also introduces a global minting cap on VAI to reduce the likelihood of depegging and unwanted liquidations. Furthermore, Venus forces liquidators to liquidate VAI first before other assets in accounts with underwater positions, which helps reduce bad debt associated with VAI.

Alchemix

Token: alUSD

Supply: $163,764,914

Yield: N/A

Network(s): Binance

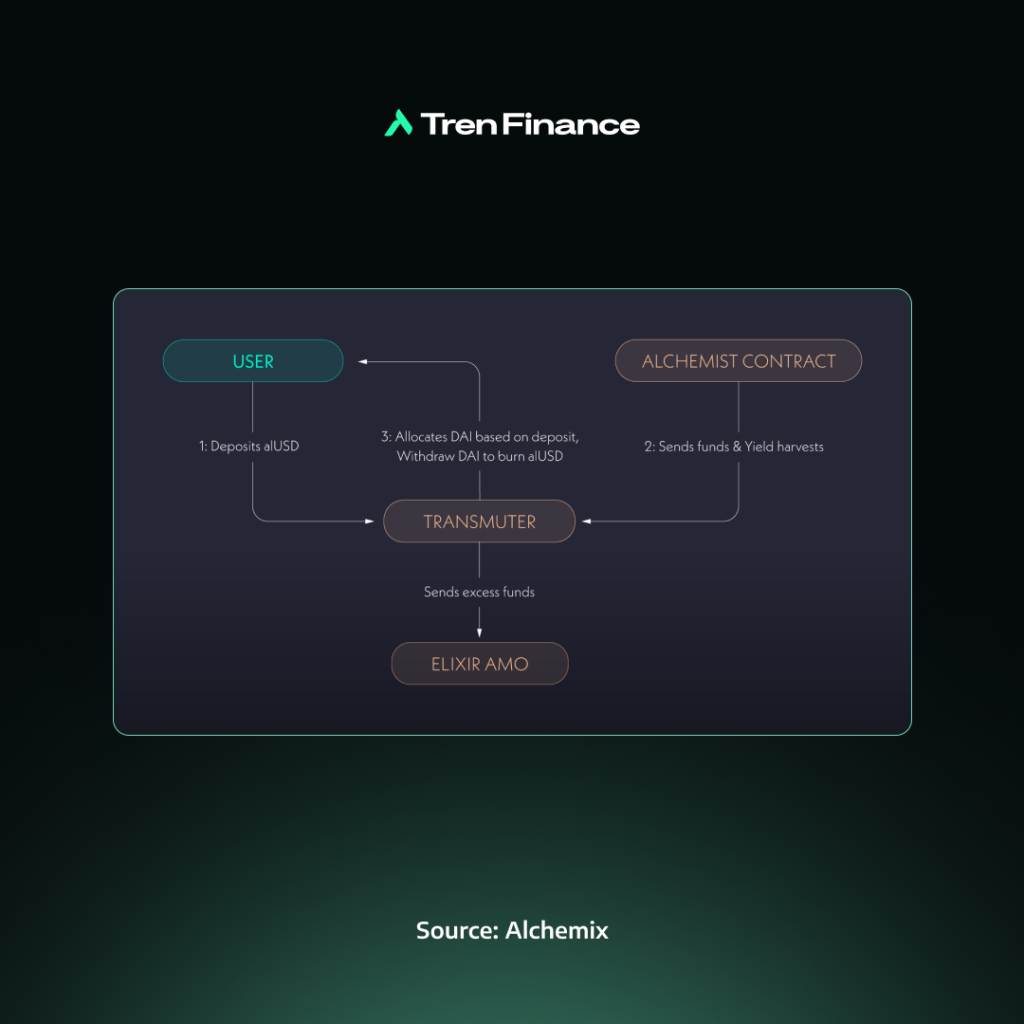

Launched in 2021, Alchemix operates on the Ethereum blockchain and aims to provide users with self-repaying loans through a mechanism that leverages yield farming strategies. The protocol allows users to deposit collateral, typically in the form of stablecoins like DAI, and borrow against it while their initial deposit generates yield to automatically pay off the loan over time.

At the core of Alchemix’s offering is its synthetic token, alUSD, which represents a user’s future yield. When a user deposits DAI into the Alchemix vault, they can borrow up to 50% of their collateral value in alUSD. The deposited DAI is then utilized in yield-generating strategies, primarily through Yearn Finance vaults. As yield accumulates, it is automatically applied to repay the user’s debt, effectively creating a self-repaying loan system. This innovative approach eliminates the need for users to manually manage loan repayments and reduces the risk of liquidation that is common in other DeFi lending platforms.

One of the key components of the Alchemix ecosystem is the Transmuter, a mechanism designed to maintain the peg of alUSD to the US dollar. The Transmuter allows users to convert their alUSD back to DAI at a 1:1 ratio, ensuring stability and liquidity for the synthetic asset. Additionally, yield generated from the protocol’s strategies flows into the Transmuter, further supporting the conversion process and overall system stability.

Alchemix’s native governance token, ALCX, plays a crucial role in the protocol’s decentralized governance model. ALCX holders can participate in voting on important protocol decisions, such as adjusting parameters, introducing new features, and allocating funds for development and ecosystem growth. The token was initially distributed through a fair launch mechanism, with no pre-mine or team allocation, aiming to create a more equitable distribution among users and stakeholders.

The protocol has faced challenges, including maintaining the stability of its synthetic assets and managing the complexities of integrating with various yield strategies. However, Alchemix continues to evolve, exploring new collateral types and yield sources to expand its offerings and improve capital efficiency. As the DeFi landscape matures, Alchemix stands out as an example of innovative financial engineering, offering users a unique way to leverage their assets while minimizing active management and risk.

Cygnus Finance

Token: cgUSD

Supply: $33,351,937

Yield: 15.3%

Network(s): Base

Operating on the Base blockchain, Cygnus Finance is aiming to bridge traditional finance with DeFi through its native stablecoin, cgUSD. The project’s core offering is a yield-bearing stablecoin backed by short-term U.S. Treasury bills, allowing users to earn interest while maintaining stability. By enabling minting of cgUSD using assets from various chains, Cygnus seeks to enhance cross-chain liquidity and accessibility in the DeFi ecosystem.

Cygnus Finance has a rebase mechanism that distributes interest from U.S. Treasury bills directly to cgUSD holders. This system automatically increases users’ cgUSD balances as interest accrues, effectively creating a self-growing stablecoin. The protocol maintains a careful balance between the total cgUSD supply and its underlying asset portfolio, which includes on-chain stablecoins and off-chain Treasury bonds, ensuring a consistent 1:1 redemption ratio with USDC on each New York banking day.

cgUSD functions as an ERC20 rebasing token, designed to maintain a stable $1 value while allowing holders’ balances to grow with accrued interest. This daily rebasing aligns with U.S. banking hours, creating a unique blend of traditional financial cycles and blockchain technology. Users can mint cgUSD with USDC at a 1:1 ratio (excluding fees) and redeem it back to USDC at the same rate, offering flexibility and potential yield generation within a stablecoin framework.

To enhance compatibility with various DeFi protocols, Cygnus introduced wcgUSD, a wrapped version of cgUSD. While wcgUSD maintains a constant token amount, its price increases over time to reflect accrued interest. This non-rebasing design makes wcgUSD more suitable for integration with DeFi platforms that may not support rebasing tokens, expanding the utility of Cygnus within the broader ecosystem.

Cygnus employs multiple mechanisms to maintain cgUSD’s stability and peg. These include the Transmuter, allowing 1:1 conversion between cgUSD and USDC, and the Elixir AMO (Automatic Market Operator) for managing liquidity and price stability. The protocol also implements a 5-7 day withdrawal process, balancing user liquidity needs with the management of the underlying Treasury bill portfolio.

Prisma Finance

Prisma Finance allows users to mint the stablecoin mkUSD using LSTs as collateral, and ULTRA using LRTs as collateral, creating opportunities for increased capital efficiency and yield generation. Prisma’s codebase, based on Liquity, is fully immutable, which enhances the protocol’s security and decentralization.

The protocol’s governance is managed by the Prisma DAO, which controls parameters, emissions, and protocol fees. This structure allows for flexibility in adapting to market conditions while maintaining decentralized control. Prisma integrates with other DeFi protocols, particularly Curve and Convex Finance, to create a capital-efficient system where users can earn multiple revenue streams.

Prisma employs a risk management framework that includes asset analysis before onboarding new collateral types. The protocol uses mechanisms such as minimum collateral ratio, liquidations, and stability pools to maintain solvency. These features are designed to support peg stability for both stablecoins. However, in practice, the effectiveness of these measures has varied. As shown above, mkUSD has demonstrated lower volatility, generally staying closer to its target value. In contrast, ULTRA has exhibited more significant price fluctuations, often deviating from the $1 mark. This indicates that despite the implemented stability mechanisms, maintaining consistent price stability remains a challenge, particularly for ULTRA.

mkUSD

Token: mkUSD

Supply: $3,893,866

Yield: 6.45%

Network(s): Ethereum

mkUSD is the primary stablecoin issued by the Prisma protocol. Users can mint mkUSD by depositing supported LSTs as collateral. The protocol requires a minimum debt of 2,000 mkUSD for each vault, which includes a 200 mkUSD liquidation reserve. This reserve serves to cover potential liquidation costs.

The stability of mkUSD is maintained through various mechanisms. These include redemptions, where users can exchange mkUSD for collateral at face value, and a dynamic fee system that adjusts based on market conditions. The protocol also uses stability pools as a primary defense against insolvency, allowing mkUSD holders to deposit their tokens and potentially profit from liquidations.

ULTRA

Token: ULTRA

Supply: $221,065

Yield: 14.09%

Network(s): Ethereum

ULTRA aims to address the growing demand for LRT utility, similar to how Prisma initially targeted LSTs. The stablecoin allows users to retain the benefits of LRT ownership while accessing additional liquidity. PrismaLRT integrates with the main Prisma interface, allowing users to borrow ULTRA using their LRTs as collateral. This setup enables LRT holders to maintain their rewards and potential upside while unlocking capital in the form of a stablecoin.

Overnight

Token: USD+

Supply: $75,580,596

Yield: 10.3%

Network(s): Optimism, Arbitrum, ZkSync, Linea, Base, Binance, Blast, Polygon

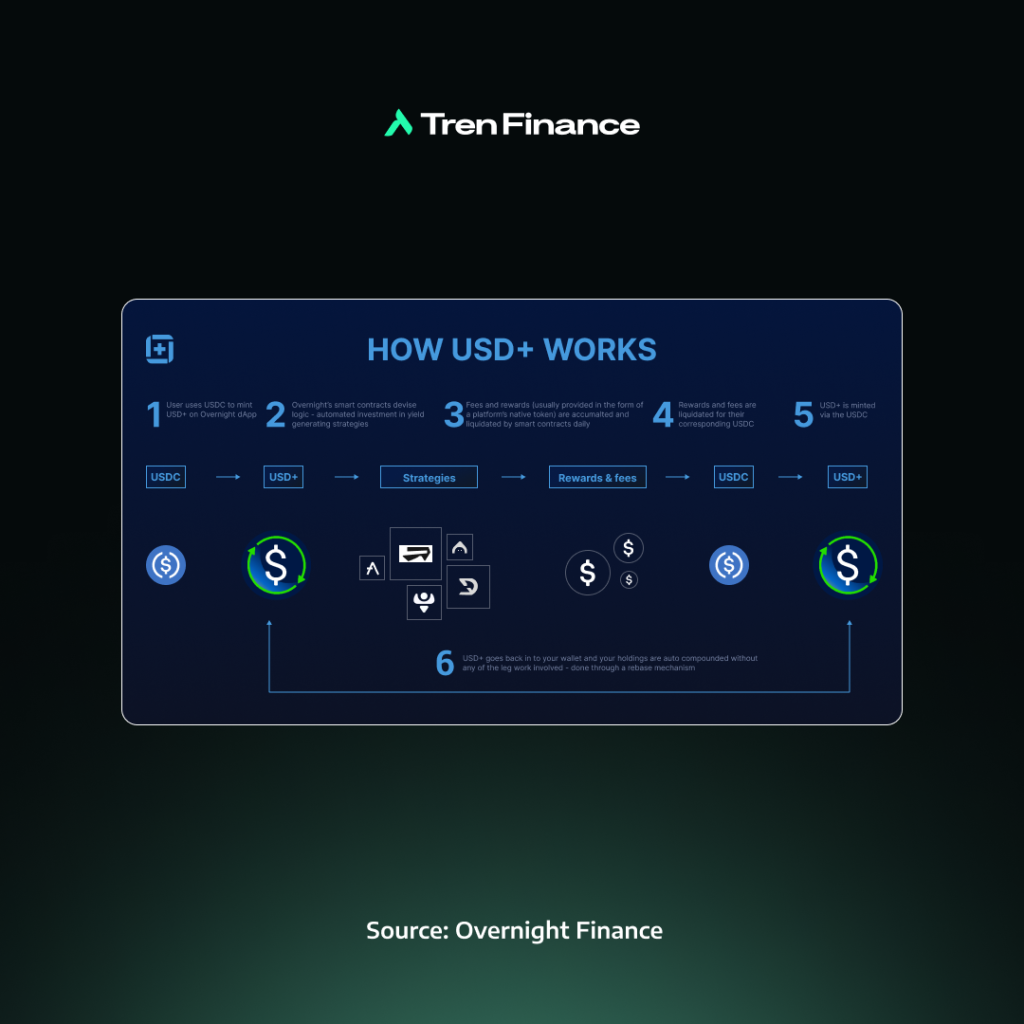

Overnight Finance is a protocol focused on asset management, with a specialization in neutral-risk strategies. The platform aims to simplify stablecoin cash management and maximize yield generation for users. Launched initially on the Polygon network and later expanding to other EVM chains, Overnight Finance offers a suite of products centered around its flagship stablecoin, USD+. The protocol’s approach combines the stability of traditional financial instruments with the advantages of blockchain technology, providing users with innovative solutions to enhance their earning potential in the DeFi space.

USD+ is the main token of the Overnight Finance protocol, designed as a fully collateralized, rebase stablecoin pegged 1:1 to USDC. Unlike algorithmic stablecoins, USD+ is 100% backed by liquid, reliable stablecoins such as USDC, USDT, and DAI. The token employs a unique minting and burning mechanism: when users buy USD+, new tokens are minted, and when they redeem USD+ for USDC, the tokens are burned. This approach ensures that the supply of USD+ remains proportional to the collateral, maintaining its peg and stability.

What sets USD+ apart is its yield-generating capability. The collateral backing USD+ is deployed across a diversified portfolio of low-risk DeFi strategies, including lending protocols, stable liquidity pools, and other conservative yield-farming opportunities. These strategies generate daily yields, which are then passed on to USD+ holders through a rebase mechanism. Every day, the rewards and fees generated from these strategies are collected, converted to USDC, and used to mint new USD+ tokens. These newly minted tokens are then distributed proportionally to all USD+ holders, effectively increasing their token balance without any action required on their part.

This daily rebase feature allows USD+ to function as both a stablecoin and a yield-bearing asset. Users benefit from the stability of a USDC-pegged token while simultaneously earning passive income. The yield can vary daily based on the performance of the underlying strategies, but Overnight Finance reports average APY ranging from 5% to 15%. Additionally, USD+ can be used in liquidity pools and other DeFi applications, potentially allowing users to stack yields and further maximize their returns while maintaining exposure to a stable asset.

Reserve Protocol

Reserve Protocol is a platform that enables the permissionless creation of asset-backed, yield-bearing, and overcollateralized stablecoins on Ethereum. Launched with the goal of providing a scalable and decentralized alternative to volatile cryptocurrencies, Reserve Protocol allows anyone to deploy their own Reserve stablecoin (RToken) with customized collateral baskets, governance systems, and revenue distribution models. This open approach aims to drive exploration and competition in finding the optimal design for on-chain money.

The protocol utilizes a unique system where RTokens are fully backed by baskets of ERC-20 tokens and can be minted or redeemed at any time for the underlying collateral. To enhance stability and security, RTokens can be overcollateralized using Reserve Rights (RSR), the protocol’s native token. RSR holders can stake their tokens on specific RTokens, providing additional protection against collateral defaults and earning a share of the revenue generated by the RToken in return.

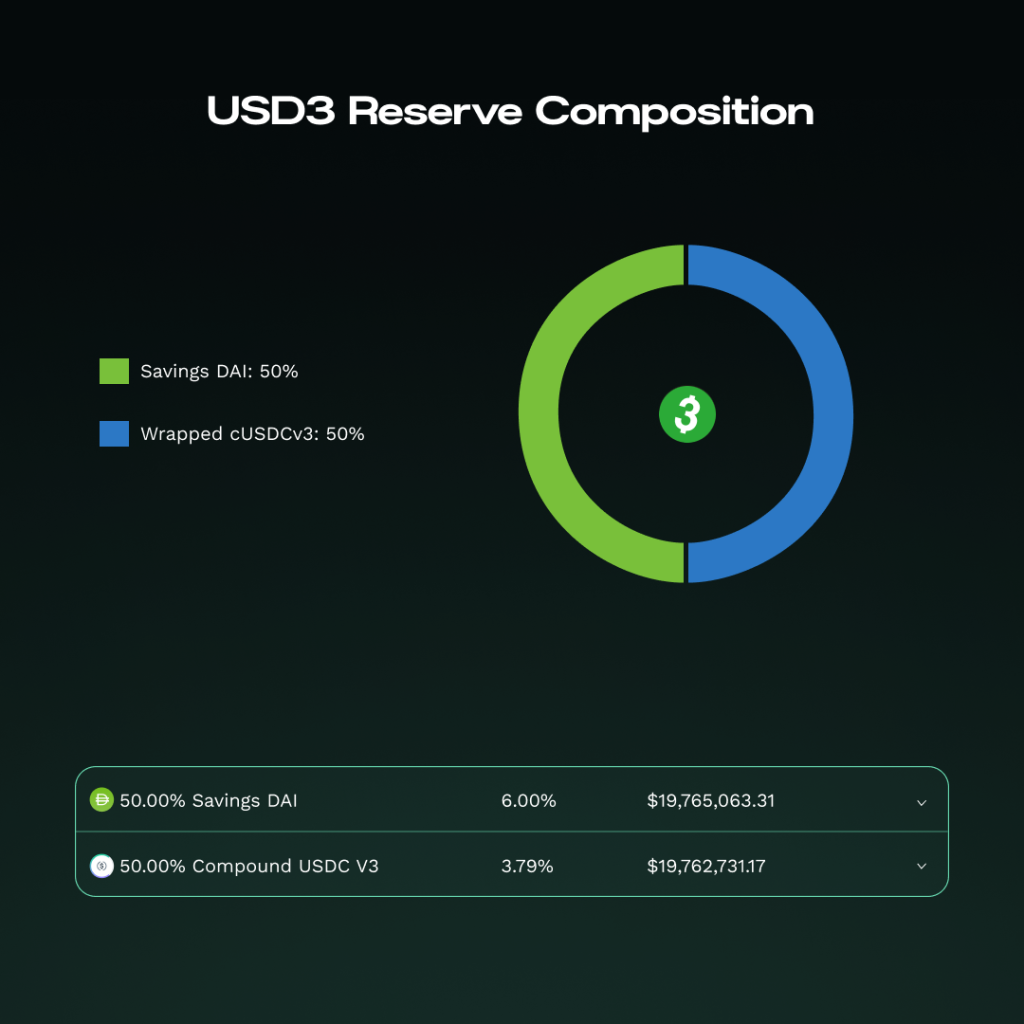

USD3

USD3, also known as the Web 3 Dollar, is a more recent addition to the Reserve Protocol ecosystem. Launched with the goal of becoming the native currency for Web3, USD3 is backed by a basket of highly-rated stablecoins, including sDAI and Compound’s V3 USDC. This collateral composition aims to provide a balance between stability and yield generation, with USD3 targeting yields of up to 10% APY.

USD3’s governance structure allocates 85% of generated revenue to USD3 holders, 12% to RSR stakers, and 3% to a treasury for growth initiatives. This model incentivizes both holding and staking, potentially attracting a broad user base. USD3 also emphasizes transparency and security, with on-chain proof of reserves and overcollateralization provided by staked RSR. As a newer entrant in the Reserve Protocol ecosystem, USD3 aims to position itself as a compelling option for DeFi users, DAOs, and others seeking a stable, yield-generating asset in the Web3 space.

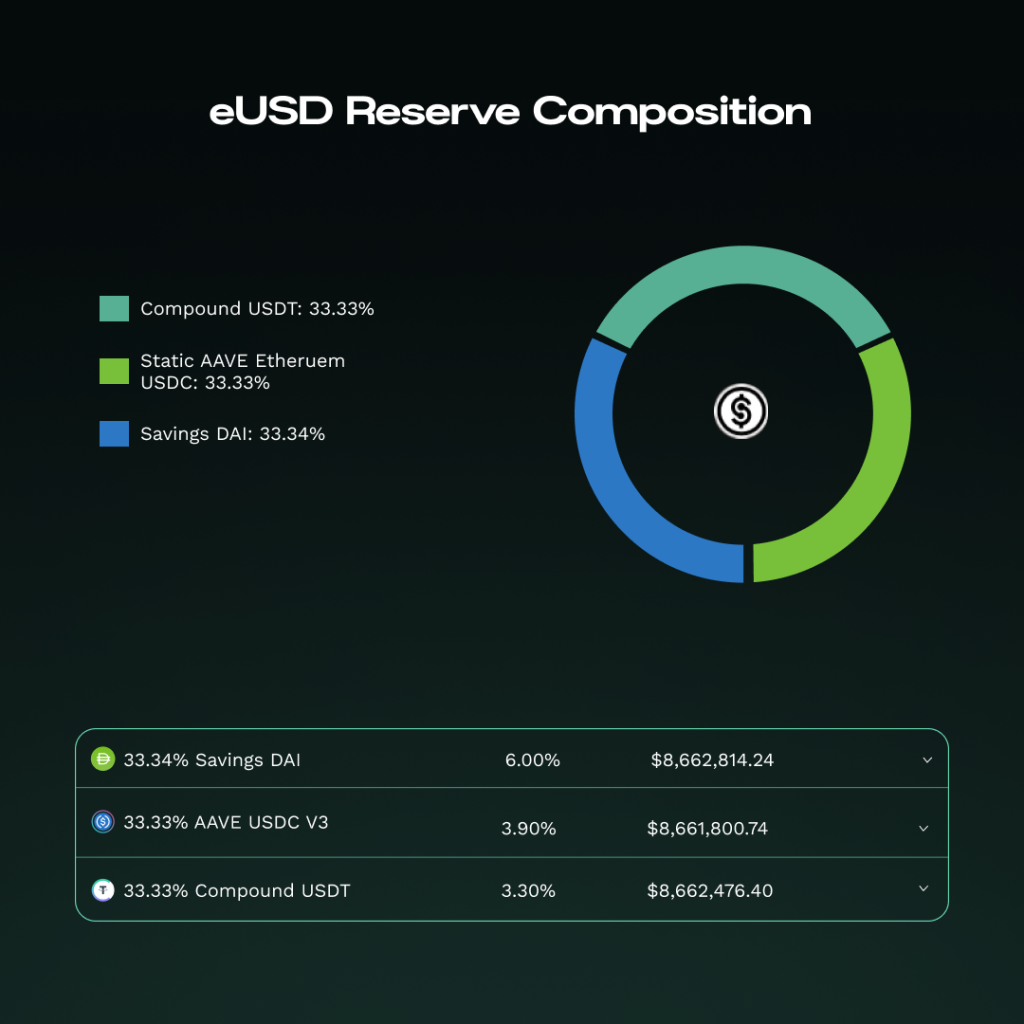

eUSD

Token: eUSD

Supply: $27,498,534

Yield: 4.18%

Network(s): Ethereum

eUSD (Electronic Dollar) is one of the flagship stablecoins created on the Reserve Protocol. Launched in February 2023, eUSD is designed to be a fully collateralized, US dollar-pegged stablecoin. Its collateral basket consists of yield-bearing stablecoins, including Aave’s USDC and USDT deposits (saUSDC and saUSDT) and Compound’s USDC and USDT deposits (cUSDC and cUSDT), each making up 25% of the basket. This composition allows eUSD to generate yield for its holders while maintaining stability.

One of eUSD’s unique features is its integration with MobileCoin, a privacy-focused blockchain. This integration allows eUSD to function as a private digital dollar on the MobileCoin network, with a permissioned bridge facilitating transfers between Ethereum and MobileCoin. eUSD employs a governance model where eusdRSR (staked RSR) holders can participate in decision-making processes, including adjusting collateral composition and protocol parameters. The stablecoin has demonstrated resilience, successfully navigating challenges such as the USDC depegging event in March 2023.

Gyroscope

Token: GYD

Supply: $23,203,354

Yield: 11.98%

Network(s): Ethereum

Gyroscope is a project developing a novel “all-weather” stablecoin called Gyro Dollar (GYD). They aim to create a fully-backed, decentralized stablecoin that is resilient to various risks in the cryptocurrency ecosystem.

The key innovation behind GYD is its “all-weather” reserve design. Unlike many existing stablecoins that are backed by a single asset or small basket of assets, GYD is backed by a diversified portfolio of crypto assets held in separate “vaults”. This stratified reserve structure is designed to isolate different types of risks – including price, counterparty, regulatory, and technical risks. If one vault or asset fails, it should not impact the entire reserve.

GYD uses an algorithmic pricing mechanism called the Dynamic Stability Mechanism (DSM) to maintain its peg. The DSM autonomously adjusts minting and redemption rates based on market conditions and reserve health. In normal conditions, GYD can be minted or redeemed at close to $1. If the reserve becomes stressed, the DSM can impose redemption fees or limits to prevent bank runs while still allowing orderly exits. This aims to give users confidence that GYD will return to its peg even during crises.

The project continues to evolve and refine its mechanisms in response to real-world market conditions. While the long-term resilience of Gyroscope’s approach will be tested over time, the project has shown a commitment to combining academic research with practical application. By offering a unique all-weather stablecoin design.

Threshold

Token: thUSD

Supply: $202,423,989

Yield: via Stability Pool

Network(s): Ethereum

Threshold is a decentralized network providing cryptographic services and infrastructure for blockchain applications. Founded in 2023 through the merger of NuCypher and Keep Network, Threshold offers solutions like tBTC, a decentralized Bitcoin bridge to Ethereum, and Threshold Access Control for conditional and private data sharing. The network is governed by T token holders who can stake and run nodes to power various cryptographic services.

Threshold USD (thUSD) is a stablecoin soft-pegged to the US dollar, backed by ETH and tBTC as collateral. It operates with a minimum collateral ratio of 110%, allowing users to borrow thUSD against their ETH or tBTC holdings. thUSD is designed as a modified fork of the Liquity protocol, with key differences including multi-collateral support and a Protocol Controlled Value (PCV) model.

The stability of thUSD is maintained through several mechanisms, including the Dynamic Stability Mechanism (DSM) and Concentrated Liquidity Pools (CLPs). The DSM adjusts minting and redemption rates based on market conditions and reserve health, while CLPs provide efficient trading around the target $1 price.

The graph of thUSD’s price stability above indicates that these mechanisms are functioning effectively, despite the project being in its early stages. The data shows that thUSD has maintained a relatively stable price, with the largest observed deviation reaching only 1.014771343. This represents a difference of 14.77 basis points or 1.477% from the target $1 peg. Such a small deviation suggests that Threshold’s approach to maintaining the peg has been successful thus far, though continued monitoring will be necessary to assess long-term stability.

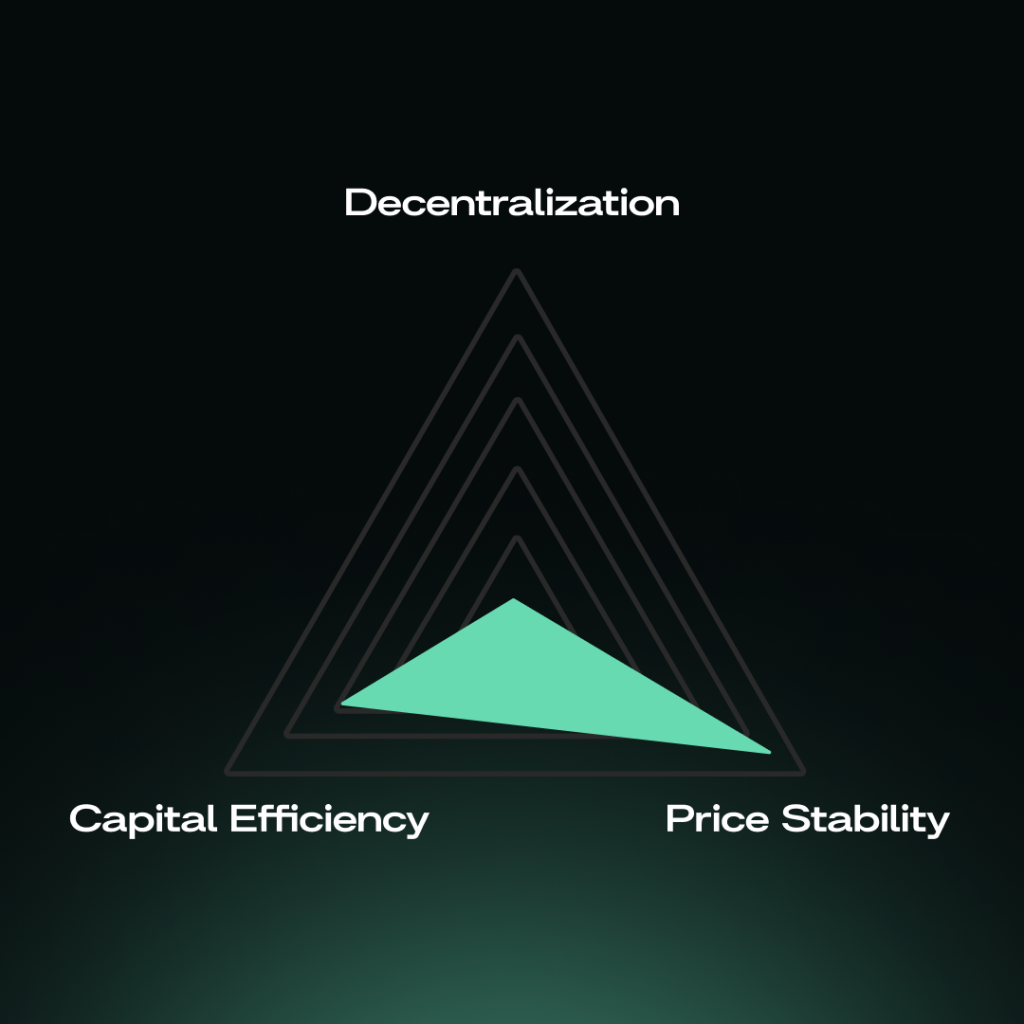

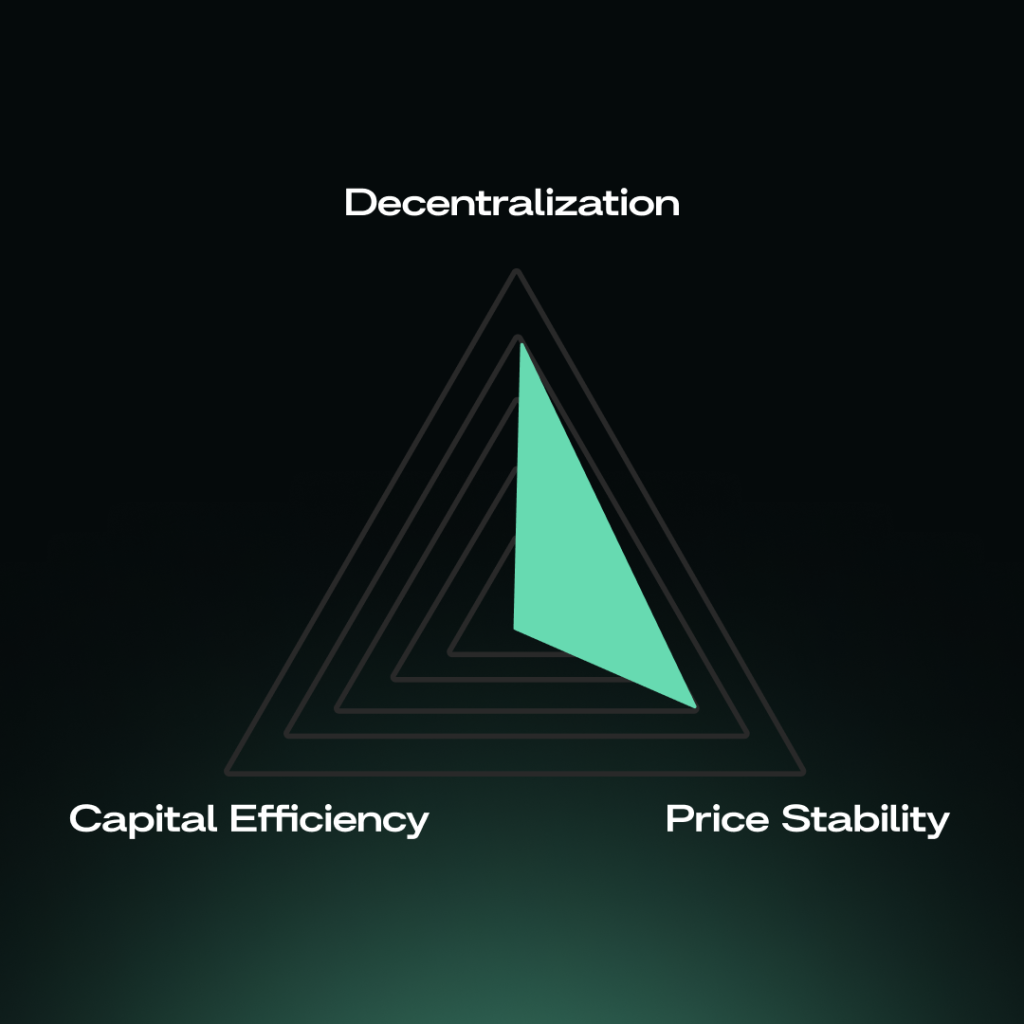

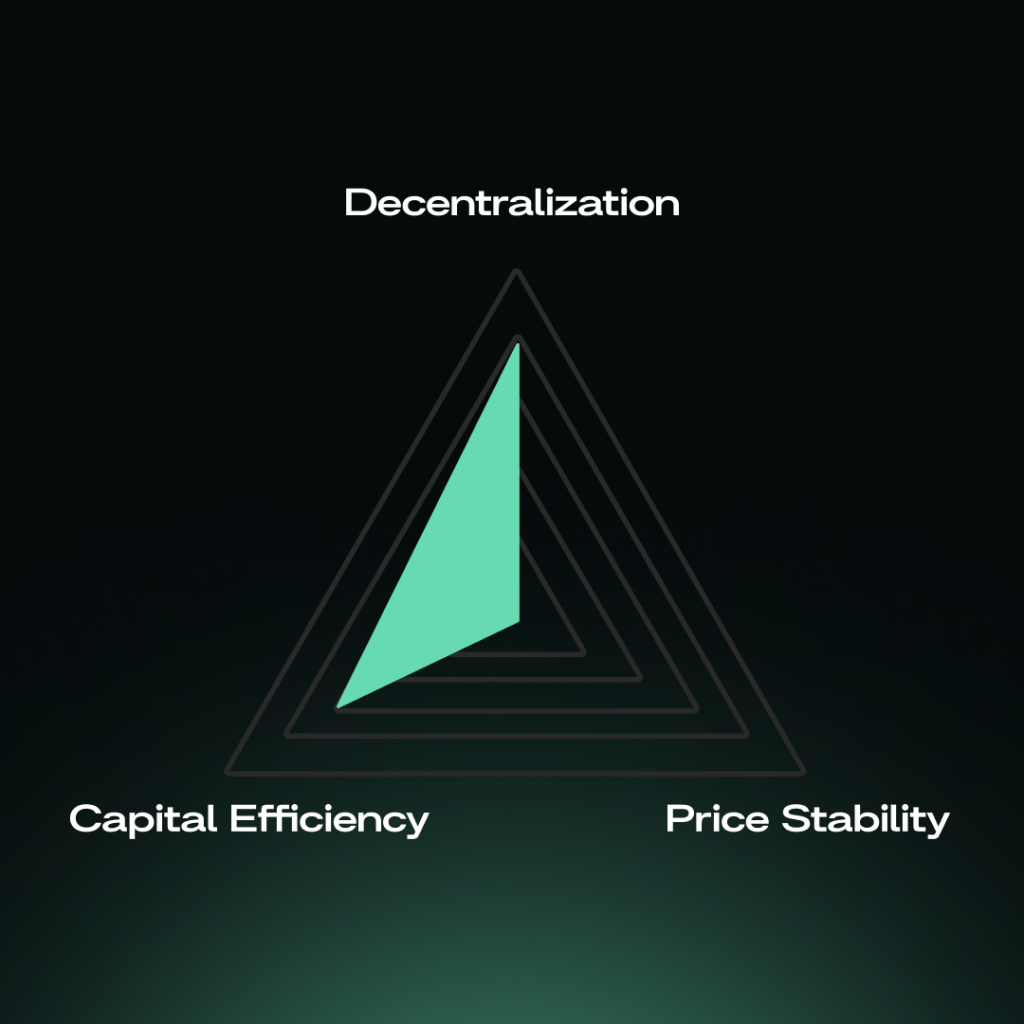

Algorithmic and Hybrid Stablecoins

Algorithmic stablecoins represent an approach to solving the stablecoin trilemma, aiming to achieve stability, decentralization, and capital efficiency simultaneously. Unlike fiat-backed or over-collateralized crypto-backed stablecoins, algorithmic stablecoins employ smart contract-based mechanisms to balance supply and demand, maintaining price stability without traditional collateral. These systems typically operate on a two-token model, with a stablecoin paired with a price-floating token. The protocol ensures that users can always exchange one stablecoin for $1 worth of the floating token, incentivizing arbitrageurs to maintain the peg through market actions. When demand for the stablecoin fluctuates, the protocol adjusts the supply of both tokens to stabilize the price.